How do you protect yourself from the next big crash?

It’s the $64,000 question.

Falling and then rebounding cryptos has held sway in the financial media recently.

Meanwhile, the ‘old game’ plays on…

The old economy in the US churns out greater numbers. Vaccinations are injecting investors with invincibility, inoculating them against fear. Stock market fans point and laugh at crypto investors’ recent change in fortune and buy more stocks.

According to The New York Times, if you held a diversified portfolio of stock funds since March 2021, you’d have seen a return of 80% plus dividends.

You could have made over 900% holding the crypto Cardano. And that’s including the big recent sell-off. But that’s just silly business, the stock diehards say. An 80% return for ‘trad-fi’ investors is the respectable number we should all be focusing on…

After all, stocks aren’t like cryptos.

They just keep going up and up, right?

Right?

People have been so occupied with cryptos they forget that stock market numbers like that are not normal either. They are very far from normal.

What is Happening in the Stock Market?

That’s one of the riddles we set out to answer in a free event we’re holding next Wednesday. It’s an event you’ll want to sit in on…

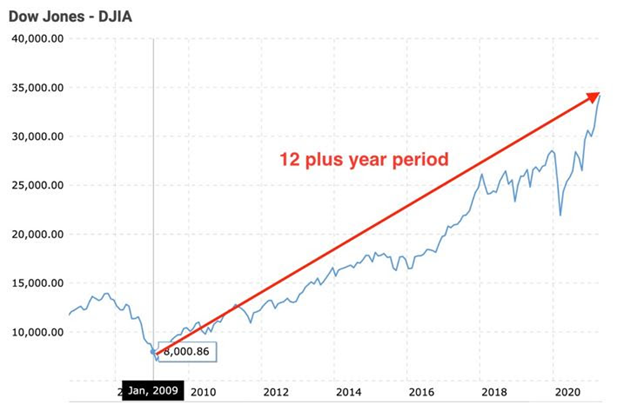

Take a look at this:

|

|

|

Source: McKinsey |

The Western world has sunk astronomical amounts of money into quantitative easing to fight the effects of COVID-19.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

This money has gone into many asset markets. But primarily the stock markets. Jonathan Ruffer, a prominent London money manager, reckons the end is nigh:

‘I take it pretty much for granted that the 40-year bull market is ending, and that it will be replaced by hard investment times.’

‘A huge collapse is coming,’ warns friend of The Rum Rebellion, market prognosticator Harry Dent. He adds, ‘This thing will be hell,’ it could be ‘the biggest crash ever,’ and the start of ‘the next big economic downturn.’

When does Dent see this coming?

By the end of June, he reckons.

The Rum Rebellion’s Vern Gowdie is a bit more reluctant to put a month or even a quarter or year down for ‘the big one’.

But he’s been warning for some time about the abnormality of the stock market…and the abnormal way it’s being goosed.

Printing money to make people feel like they have more money.

It doesn’t make a lot of sense when you put it like that, does it?

But today, pointing that out is a brave position.

When everything from stocks to cryptos to NFTs to collectibles to property is in a boom, it’s not fashionable to mention that it’s all based on sand. And that groupthink may be at play.

And to be fair, Vern has been predicting a great reckoning in the old broken finance game for years.

But a doomsayer is wrong…until he is right…

The old game is cracked beyond repair. And these cracks first started showing back in 2009, says Vern, courtesy of the US Federal Reserve’s intervention in artificially inflating the US, and thereby global markets.

The result is the gap between value and return has never been wider.

|

|

|

Source: Macrotrends |

Says Vern…

‘Investors — like they did in the 1920s — are buying into the idea this is a permanent plateau from which returns of 10–12% per annum will be consistently delivered.

‘Since 2014, the value line has been warning the US market — over a 12-year period — will likely deliver (at best) 0–2% per annum.

‘The most recent 12-year forecast — from Jan 2021 to Dec 2032 — is for MINUS 4% per annum.

‘Investors have been seduced by this market…and I can’t blame them. When something good like this goes on for so long, you want some of it in your life.

‘It’s only natural.

‘Fighting the temptation is hard…real hard.

‘Mathematically it is not possible for these past returns to be repeated.

‘Share prices are a function of Earnings Per Share (EPS) multiplied by a Price/Earnings ratio.

‘EPS have been goosed up by share buybacks and accounting trickery. The PE ratio has already expanded well beyond historic norms.’

Vern goes on to compare the current state of the stock market to the recently deceased Bernie Madoff’s Ponzi scheme…

‘Maths don’t add up…TICK. The longer the period of outperformance, the more likely it is people believe it’s true…TICK. Identifying the “con” early can be an exercise in frustration…TICK.

‘The Fed is doing its utmost to pump this market full of fillers to give it a youthful, seductive appearance. But in the cold light of day, it’s far from being an attractive proposition.

‘Those who are tempted into the warm embrace of this market will, in due course, experience the coldest of cold shoulders.

‘Heartache awaits.

‘Something no one is expecting — least of all the Fed — will expose this seducer for the cad it really is.’

Let’s say you agree the market is due a Madoff-like comeuppance.

And that the financial system as we know it is broken.

What do you do?

There’s a growing school of thought that when the old horse starts to look dodgy…

You back a NEW horse

And I’m not talking about cryptocurrencies…

Or gold…

I’m talking about perhaps the single-smartest thing you could do right now to soften any blow a new global financial crisis may have on your wealth in 2021…2022…or 2023.

All common sense tells you the old system is running on bought time.

But what few realise is something new is emerging from the shadows.

It won’t replace the old game. Not overnight, at least.

But it’s in the process of disrupting it in ways few people can comprehend.

You’re not hearing much about it.

All the bandwidth is being taken up by roaring stocks. Or the mainstreaming of cryptocurrencies.

You’re also not hearing about this ‘new game’ because, put simply, there are so many vested interests in maintaining the status quo that these topics are just not being discussed in polite circles.

Next Wednesday, in a free event six months in the making, we aim to change that.

At the core, we’re in a stage where we now have two systems operating in tandem.

The new, young, still-working-itself-out, free market, decentralised system that’s evolving. And the centralised one. Tied to the old world. Totally dependent on central authorities propping it up.

What we’re going to try and do is chart a smart path for your wealth between these two conflicting systems.

To see exactly what I mean in a bit more colour, watch this invitation event trailer now…

Regards,

|

James Woodburn,

Group Publisher, The Daily Reckoning Australia

PS: Australia’s Great COVID Recession — Learn which investments to accumulate and which ones to avoid in order to give you the best chance of preserving your wealth during the recession. Click here to learn more.