In today’s Money Morning…1971 all over again…bitcoin beats gold…how high could bitcoin actually go?…and more…

Our small-cap expert Ryan Clarkson-Ledward wrote last week about the rise of small-cap stocks on the ASX and elsewhere.

As he noted, ‘it’s not just Afterpay’.

There’s a plethora of opportunities in small stocks if you’re looking in the right places.

Companies in energy, MedTech, fintech, EdTech, AI, quantum, and even FoodTech are rising in the ranks.

My take on it is that in a world of exponential growth, you need to be nimble to adapt to ever-faster change.

Lumbering giants with their fat cat executives and reams of middle management are increasingly no match for a forward-thinking entrepreneur with her finger on the pulse.

If I’m right on this, then it partly explains the seeming ‘method behind the madness’ of the Robinhood generation of investors.

Sure, there’s a lot of stupid stuff going on there, but at a deeper level, some of it works because the pace of change and ensuing industry disruption is real too.

But for my money, the biggest opportunity of all is the disruption of money itself.

And time is running out for you to claim your stake.

Let me explain why…

1971 all over again

As my co-editor over at the New Money Investor service, Greg Canavan, noted to subscribers last week:

‘50 years ago, this Sunday (yesterday) marks the anniversary of President Nixon taking the US off the gold standard. That is, foreign central banks could no longer swap US dollars for gold.

‘Within a decade, gold went from US$35 an ounce to a peak of US$850.

‘That’s a return of more than 2,300%.’

1971 was a pivotal moment for gold.

As it left the formal financial system — and was no longer tied directly to money — investors, wary of this untethered fiat system of money, decided gold was a crucial hedge against problems ahead.

For 10 years they bid up the price of gold aggressively, and as Greg noted above, early investors made a motza.

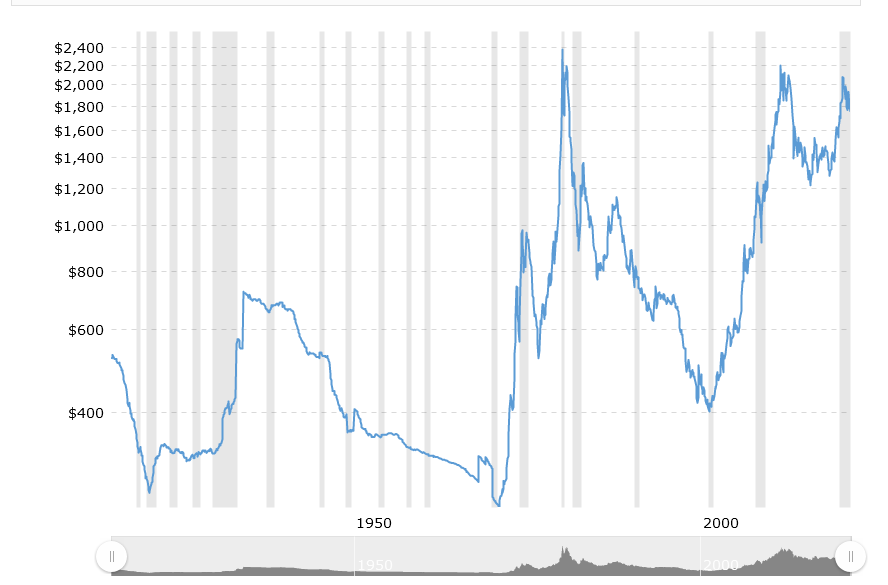

Check it out here:

|

|

|

Source: Macro Trends |

As you can see, the price of gold took off like a rocket ship in 1971 and went almost vertical.

Though, as you can also see, it fell back down to Earth with a thud since and despite a post-2000 run higher, is still lower than its 1980 peak today.

Why?

Well, the masters of money eventually wrestled back control of gold.

How?

As Greg explained to subscribers:

‘In the ensuing decades, a huge paper market for gold emerged. The London bullion market and the New York futures market offered investors (speculators) “exposure” to gold. Central banks “leased” their gold into the market, creating numerous claims on a single ounce of gold.’

Basically, the market for gold became a fake market driven by — and tied to — the fiat system.

This is a $118 trillion mirage of complex products created by unelected, unaccountable bureaucrats who wield power over money and markets.

Unfortunately, as a bulwark against fiat malpractice, gold has failed.

Like so many falsified financial products, there’s no accurate ‘price signal’ in gold for investors to use or to keep bankers honest.

And it’s why, despite the immense amount of money printing since the 2008 GFC, the price of gold has barely budged.

The golden years for gold were the 1970s, not today.

But there is one asset class whose golden years are still ahead of it…

Bitcoin beats gold

I’ll cut to the chase…I’m talking about Bitcoin [BTC].

So what can Bitcoin do that gold can’t?

Crucially, it’s a decentralised network.

But at the same time, it’s very easy for anyone to check what’s happening under the hood.

Despite the naysayers claiming only criminals use it, the fact is the Bitcoin blockchain is very transparent.

Which means we know exactly how much BTC there is at any one time and where (what Bitcoin addresses to be exact) it is held at.

Why is this better than gold?

Well, it makes it very hard for the financial wizards to create multiple products that cross-collaterise financial products on top of it like happens in the gold market.

They can’t game the system.

As the golden years of gold will tell you, this is crucial to maintain value.

Today bitcoin has a market cap of just US$869 billion.

Gold, on the other hand, is a US$11.1 trillion asset class according to some estimates (though, it’s harder to be as exact as you can with bitcoin).

So bitcoin needs a 12X move just to catch up with gold.

But remember this is a technology, a network, not just a static asset…

How high could bitcoin actually go?

In my opinion, a 12X return is the base case for bitcoin.

It has features of decentralisation and transparency that gold can’t match, so as ‘fiat insurance’ it should be just as valuable (ignoring other use cases for gold for brevity).

Then there’s the fact this is a technology platform, much like the internet.

It’ll derive more value as things are built on top of it.

Twitter CEO Jack Dorsey (whose other company Square incidentally bought Afterpay last week) is one company already doing this.

He tweeted recently he was ‘focused on building an open developer platform with the sole goal of making it easy to create non-custodial, permissionless, and decentralized financial services.’

And he added this would be built on the Bitcoin blockchain because:

‘What really drove my thinking and drives my passion behind it is, if the internet has a chance to get a native currency, what would that be? To me, it’s bitcoin because of those principles, because of its resilience.

‘It reminds me of the early internet.’

Imagine in 1994 you could buy a piece of ‘the internet’ and accrue value as Apple, Amazon, Tesla, and many more dotcom stocks rose up the market indices?

This is the opportunity in front of you today.

It’s a collision point between a fiat system in freefall and a technology whose time has come.

What would that be worth 10 years from now?

Who can say for sure?

But my take is the golden years for Bitcoin are coming fast…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.