Has Australia’s day of reckoning come?

We’ve dodged a recession for the past 29 years.

It’s been something politicians have loved to brag about.

A reason foreign investors have thrown cash our way.

Our recession-free run has meant we’ve continued to pay stupid amounts for houses, gym memberships, and buy coffees with absurd orders like strong, decaf cappuccino with no foam, no chocolate, half almond milk, half full cream, with a shot of caramel with two equals warm, but not cold (true order by the way).

We might not feel rich, but this economic good fortune has created our lavish lifestyle today.

All because we have no idea what hard times look like.

Well guess what?

We’re all about to find out…

Trump tweets and markets rally

The markets are rallying again today.

Why? Trump tweeted something about Saudi Arabia and Russia agreeing to cut oil production.

That’s it, bad news over! Markets boom.

After such life-altering events, it’s understandable that people are looking for hope that things will return to normal soon. Of course, we have no idea what soon is. Australian federal and state governments have been pretty light on giving people a time frame of when these closures end.

And after a 30%-plus decline in a major index, people are chomping at the bit to get their hands on stocks before others work out there’s bargains to be had. Although it could be a case of revenge trading too. Folks are so desperate to recoup their losses they’ll trade into anything that looks like a rally.

Helping this buy the dip train of thought is the Coalition throwing money at the problem.

A little bit of unemployed benefit here. A let’s prop up struggling businesses there.

The Reserve Bank of Australia is buying bonds as other countries dump them.

The powers that be are stepping in! Surely this will sooth investors’ nerves…

It’s about now, we need to remember the Aussie economy is no simple thing.

Although the complexity of it is what has helped us avoid recessions for almost three decades.

A relaxation of banking laws in the mid-1990s let us take advantage of negative gearing in the last few years of the Hawke government.

The Aussie construction boom that kicked in 2001, coincided with China’s rise as an economic powerhouse…at least that’s what we called it then.

By 2008 our good fortunes once again rested on China’s willingness to buy our minerals and stick them into their cities, with little regard to their future use.

These developments enabled our service sector to bloom and personal debt to balloon. And damn didn’t we enjoy the good times.

Surely if markets are rebounding, normal isn’t too far away, right?

Buying the dip won’t work this time

Buying the dip?

You’re not alone.

You may be bored stuck inside. Working part-time from home because your hours were cut. Just watched your super balance take a big hit over March.

After you’ve taken your dog/cat/lizard/bird (I’ve seen some weird things lately) out for a walk, and bought groceries for the week, what else are you meant to do?

It makes sense that many people are turning to the stock market looking for a bargain. Surely if the government is pumping money into the economy, that will have an inflationary effect? Stocks will go up, so you may as well jump on the train and buy anything that shows promise.

The thing is, those with the buy the dip mentality clearly don’t understand the systemic issues being masked by tweets and headlines.

Sure, some stocks are doing very well right now. Select Aussie gold producers are seeing their stock prices rise because of the difference between the Aussie dollar gold price and the US dollar gold price.

A handful of biotech and medical supply stocks are zooming up too.

But these are individual plays.

Aussie banks are mulling over what to do about a dividend. Harvey Norman has said they won’t pay one at all. So has Flight Centre.

Before you rush in, let’s get some perspective on what’s still to come.

The onslaught of headlines did make it hard to pause and try to put the pieces together while markets tanked day after day.

Along with counting bodies and the billions the government is throwing at us, there are some big picture things to take note of in the economy.

The question for investors is, which domino will fall next?

Which industry goes next?

Stocks bouncing on news ignores that some sectors of the Aussie economy have been spared from shutdown measures.

Plenty of noise has been made about the one million or so Aussies that work in retail. And the other million or so that work in the services sector of the economy. Think your personal trainers, baristas, life coaches, interior stylists, chefs, music therapists, psychologists…you get the drift.

However, there are two pockets we need to watch.

The first is construction.

To date — the commercial construction sector I should add — has largely avoided any forced closures. And from what I hear, it’s pretty lax about enforcing the ‘social distancing’ rules as well.

Now construction is critical to the Aussie economy. It accounts for about 10% of gross domestic product. To boot, it’s being considered an essential service. Hence why it’s avoided any closure. But the sceptic in me believes that has more to do with the overbearing unions and vested financial interests.

Another one investors need to watch for is what’s happening in mining.

To date miners and unions are working together (a rarity no doubt) to keep this sector open. Fly in fly out (FIFO) workers have been banned in Queensland and Western Australia. That is, you can only work on these mining sites out here if you are based in the state.

The Queensland government could possibly take it one step further, and ban FIFO workers based in Brisbane to fly up north to remote Queensland mine projects.

So why do these two sectors matter?

The construction sector is simply a numbers game. There’s over a million people directly or indirectly employed here. Shut down this highly-paid sector, and watch the economy sink faster than someone who pissed off a mob boss.

Mining on the other hand, is about perception.

Rocks and ore contribute roughly the same to Aussie GDP as construction.

Unlike construction, mining only employs about a quarter of a million people around the country. So it’s not as big a deal as either retail or construction…

…yet the health of the mining sector in Australia is critical to how international investors see us.

Whether we like it or not, the rest of the world views us as a commodity-based economy. Shut down mines across the board, the you wipe out the Aussie dollar. Stocks tank as well.

I’d wager the federal government chose to sacrifice the services sector of the economy, rather than let these two dominoes fall…

Don’t let that optimism suck you in

If you see either mining or construction close up, then hang on to your hats while the Aussie market dives.

Then again, remember that these are the local problems.

International markets are seeing liquidity seize up. There’s about US$32 trillion in corporate bonds in Asia looking pretty shaky. And China’s manufacturing data says it’s roaring back to life, but they have no customers to sell it to.

The markets may be rallying on the back of a tweet. But don’t let that optimism suck you in. All is not right with the local and global economy.

We are six weeks into the most destructive sell-off of our time. The market will still be there tomorrow. Your capital may not be if you move too soon.

I’ll dive into the international problems next week. For now, it’s over to Vern Gowdie from one of our sister publications. He’s the only person I know that called the market crash back in January. And he lays out a compelling case below on how the government stimulus isn’t going to make everything better…

Read on for more.

|

Until next time, |

|

Shae Russell, |

Practicing What’s Preached

Vern Gowdie, Editor, The Gowdie Letter

‘Not bearish? Yeah Vern and I’m Santa Claus.’

The doubters are still doubting. That big end of the telescope remains firmly pressed against their eye.

In case you missed the relevance of these opening remarks, please read yesterday’s article titled ‘How Do You See Me?’

My investment philosophy — gleaned from more than 30 years in the rough and tumble of this business — is very simple ‘winning by not losing’.

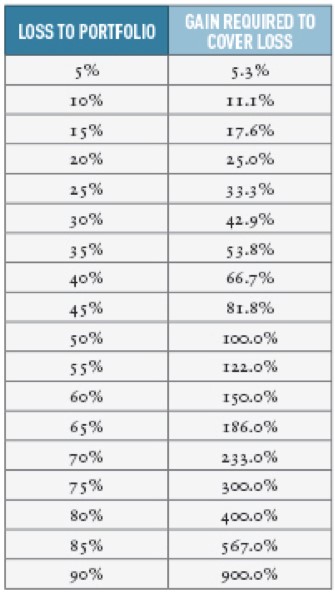

This table — from the soon to be available ‘How to arrange your wealth now for a Post-COVID 19 World’ — spells out the mathematics on ‘gains required’ to cover ‘losses incurred’.

|

|

|

Source: Port Phillip Publishing |

The greater the loss, the steeper the road is to recovery.

The Aussie market — at present — is down around 30%. Making up that lost ground requires a gain of…42.9%.

Here’s a quick back of the envelope exercise. Long-term growth rate from the market is around 6% per annum. Breakeven time frame…seven years. Not good, but not devastating either, assuming that’s the extent of the market loses.

But, what if — ultimately — the market loses 65% or 80%? How many years/decades will it take to rack up gains of 186% to 400%? Do the maths…it’s a devastating prospect.

And then you ask, will investors live long enough to see recovery?

[conversion type=”in_post”]

Winning by not losing is about avoiding (the majority of) the downside and participating in (the majority of) the upside.

Who doesn’t want that? Traders try to practice that every day. But I’m not a trader, never have been. Never will be. My approach is about long-term wealth creation.

That’s what most people want. However, their actions of ‘buying high and selling low’ run counter to that aim.

While the ‘winning by not losing’ theory is simple, the practice does require a level of research, mathematics, gut feeling, and a truckload of patience.

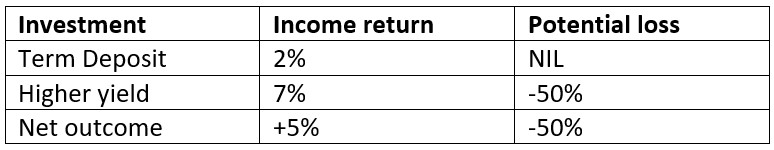

When evaluating the risk versus reward of an investment, the benchmark is the risk-free return (the interest rate paid on a government-guaranteed deposit).

Here’s an example of how this works when markets are in bullish (overvalued) mode:

|

|

In this instance, you ask yourself is it worth risking half my money for a 5% return?

The answer? Hell no.

Therefore, the money stays in the bank, waiting for an equation that offers a more favourable outcome, far more upside and much less downside.

Individual shares are not my thing. Too much work for me. My investing world is focused on major asset classes, indices (ASX 200 and S&P 500); REIT ETFs; bond ETFs; currencies; gold; term deposits.

A lot of water can pass under the bridge before these markets present a favourable risk versus reward outcome.

So you wait (and you wait some more), which is where the patience comes in. That’s the theory.

Now, here’s how this model has been put into practice. In recent months, The Gowdie Letter has attracted a number of new readers.

The 2 March 2020 issue addressed the ‘permabear’ myth and provided insight into the rationale behind some of my recent (well, recent in my context of investing time frames) recommendations/investments.

Here’s an edited extract from the issue…

AUD versus US

Remember the good old days of the mining boom when one Aussie dollar bought US$1.10?

On trips to the US, you didn’t mind paying the ‘tip and tax’ back then.

In the midst of our strengthening currency, economists were tipping US$1.20.

People tend to extrapolate the trend.

In November 2012 (prior to me joining Port Phillip Publishing), we transferred a sizeable sum of Aussie dollars into USD…our average buy-in was around US$1.05.

My reasoning for buying USD was again based on, risk versus reward.

For us to lose 50% in value, the Aussie dollar would have to go to USD$2.10.

The RBA would never let that happen.

The more probable scenario was for the Aussie dollar to fall back towards the median range of US75 cents orin the event of another global economic crisis, possibly into the sub-US50 cent range.

Downside was minimal…maybe 5% to 10% if we went to US$1.10 to $1.20.

But, my guess was this would only be temporary.

Whereas, the upside was at least 30%-plus and possibly, over 100%.

It was the very, very low risk versus much higher return equation, that convinced me to put a considerable amount of money into this investment.

Our investment in US cash — with interest payments — has returned around 70% (now it’s more than 80%) over the past seven (and a bit) years.

Was this a bullish or bearish investment selection? Neither. It just fitted our low risk versus high reward criteria.

GOLD

From 2010 to its peak in September 2011, gold (in US dollars) was unstoppable.

The arc-like price movement was a result of the hysteria over the prospect of hyperinflation.

Central banks were going to create another Weimar Republic or turn us into Zimbabwe.

Buy Gold. And people did.

|

|

|

Source: Trading View |

I questioned the hyperinflation hyperbole.

Why? This is not what happened in Japan…after almost two decades of stimulus.

My publicly stated view was (and still is) we were more likely to see deflation.

And the CPI numbers show us we’ve been far closer to deflation than hyperinflation.

I wasn’t anti-gold, just anti the rationale that was pushing the price higher.

So I didn’t buy during a manic run.

The crosshairs on the above chart have been deliberately aligned with the US gold price in early August 2015.

At that stage, gold was down over 40% from its September 2011 peak.

That looked reasonable to me.

After four years, the heat was out of the market.

The risk versus reward equation — while not as good as the US versus AUD — warranted a ‘dip the toe in the water’ exposure to gold.

In the August 2015 edition of Gowdie Family Wealth (a previous newsletter), I recommended a 5% exposure to the GOLD Exchange Traded Fund…a fund that reflects one tenth of an ounce in Aussie dollars.

|

|

|

Source: Market Index |

The buy-in price was around $141.

The current price is $236 (now $245), a gain of 67% [now 74%] over a 4.5-year period.

The combination of a rising USD gold price and a falling Aussie dollar has turbocharged the GOLD return over the past 12 months.

All the talk at present is about buying gold as a hedge against COVID-09. The contrarian in me, is looking to do the opposite. I get nervous when the crowd starts prefacing recommendations with ‘you can’t go wrong buying’. Yes, you can.

AUD versus GBP

Markets don’t like surprises and the Brexit vote to ‘leave’ in June 2016, was definitely a surprise.

Talk of economic Armageddon saw the Great Britain Pound (GBP) get hammered.

That’s the kind of market that gets my attention. One that’s been moved away from historical levels by emotional reactions.

The 14 October 2016 edition of The Gowdie Letter recommended an exposure to GBP.

Here’s an edited snippet…

There are a couple of ways to gain exposure to the GBP.

Firstly, buy the physical currency.

Secondly, invest in the BetaShares British Pound ETF [ASX:POU].

Here’s a link to the BetaShares site.

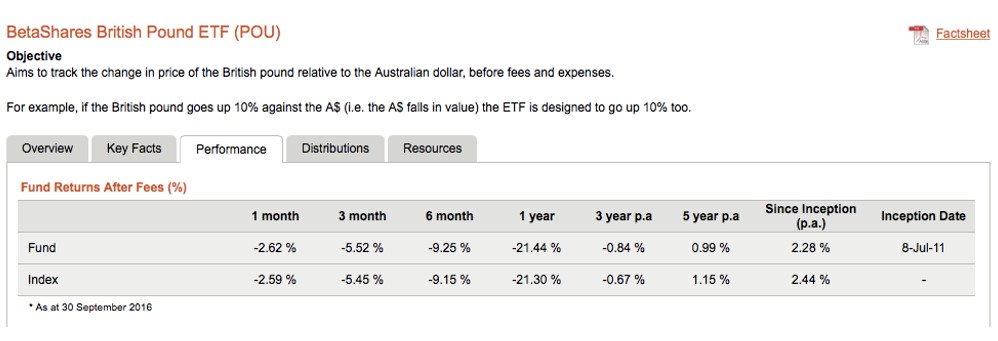

Check out the top of the performance table:

|

|

|

Source: BetaShares |

In the last 12 months, the fund has lost 21.4%.

Over a five-year period, it’s struggled to make 1% per annum.

These are great numbers.

One of the criteria for value investing — low risk/high reward — is to buy quality assets that are unloved.

At present, the British pound is not all that popular.

While the GBP has had a tough time of late, it could get worse…especially if a forecast recession does materialise.

Due to the potential for the pound to lose even more ground against the Australian dollar, the recommendation is to dollar-cost average our way to the 10% exposure.

Our strategy — starting this week — is to move 2% per month for the next five months.

If you do not have a British bank account, you can dollar-cost average your investment via the BetaShares British Pound ETF [ASX:POU].

Please note, this investment could take two or more years to realise a decent return.

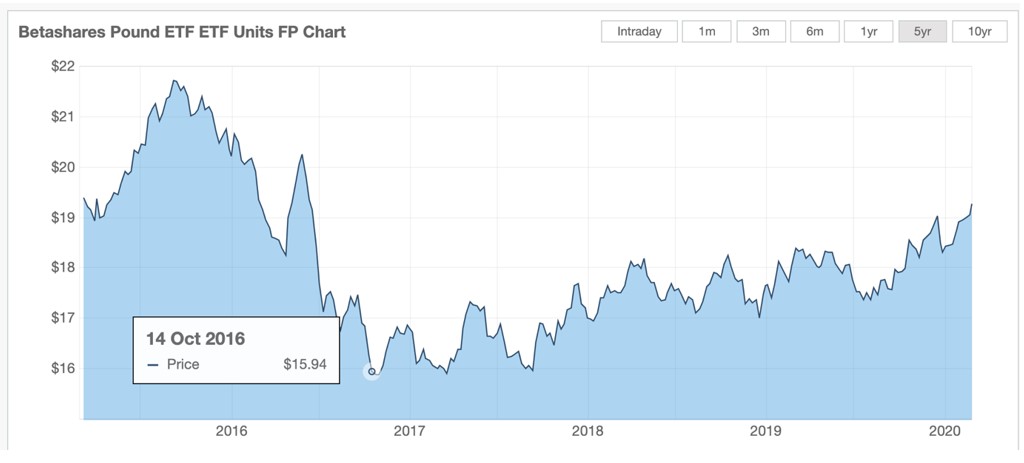

Our initial buy-in was around $16.

Which, as it turned out, was pretty much the lowest point on the chart. That was ‘more a*se than class’. You can never, ever pick the bottom or top.

|

|

|

Source: Market Index |

The current POU price is around $19.27 [now $19.96]…a gain of 20% [now 25%] over the past 3.5 years.

Not brilliant, but better than the cash rate.

Back again.

Hopefully that extract has given you a better understanding of how the winning by not losing approach works.

You have to question popular thinking. You make an educated guess on the upside versus downside. You make proportionate allocations depending on the risk versus reward equation…in the case of the USD investment, the equation was so compelling our allocation was almost 20%. Then…you wait for the trend to play out.

While share markets, of late, have been falling like a stone, these currency investments (and gold in AUD terms is partly a currency play) have been RISING in value.

In due course, if share markets go where I think they’re going, we’ll be doing the same risk versus reward calculations for the major indices.

However, markets are not even close to warranting the numbers being done…yet.

Why do I say that?

Here’s just one of the many valuation metrics that form part of my research.

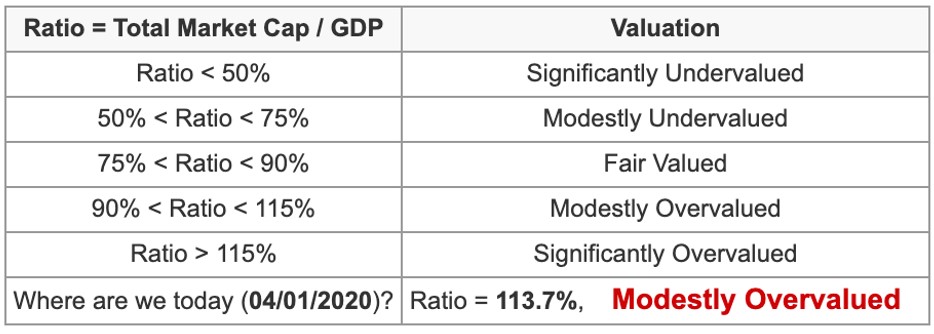

The Total Market Capitalisation (TMC)/GDP or sometimes referred to as the Buffett Indicator.

In 2001, Warren Buffett said in a Fortune magazine interview, ‘it [TMC/GDP] is probably the best single measure of where valuations stand at any given moment.’

The latest reading is 113.70.

|

|

|

Source: Guru Focus |

According to the valuation table, this reading is at the high end of the MODESTLY OVERVALUED range.

|

|

|

Source: Guru Focus |

That is NOT what I’d term as a ‘low-risk’ proposition.

Look at where the TMC/GDP ratio fell to in 2001/02 and 2009, under 75% and touching on 50%, the MODESTLY UNDERVALUED range.

And, if you go back to the early 1980s, the ratio was well into the SIGNIFICANTLY UNDERVALUED range. When that ratio starts to head much further south, then we get interested.

In the interim, I’m going to practice what I preach, and…wait.

Regards,

Vern Gowdie,

Editor, The Gowdie Letter