Seeing the future requires us to open our eyes.

As best we can, we have to try to sort out the real from the unreal.

Being told you can cure a debt problem with more debt, this is not real…it’s in the realms of fantasyland.

Yet, plenty of people have bought (or, more to the point, borrowed) into this carefully orchestrated version of ‘reality’.

The higher markets go, the more blinded people are to what’s really happening…over-valued assets become even more over-valued.

Sight is only ever restored after the inevitable has happened.

Leonardo da Vinci was a man way ahead of his time.

A true visionary.

Among da Vinci’s many inventions were the tank, the helicopter, the flying machine, the parachute, and the self-powered vehicle.

He said…‘Blinding ignorance does mislead us. O! Wretched mortals, open your eyes!’

Blind ignorance is what took the financial world to the abyss in 2008.

And, there were none so blind as those inside the system.

These extracts are from testimony given to the ‘US Financial Crisis Inquiry Commission’, held in April 2010 (emphasis is mine)…

‘I think all of us bear — not just all of us at Citi — failed to see the potential for this serious crisis,’

Robert Rubin, former Clinton Treasury secretary and member of the Citigroup board of directors.

‘In hindsight, it’s very hard to see how these structured products could have been accepted in the way (that) they were accepted,’

Charles Prince, Citi CEO

The subprime time bomb was hiding in plain sight…others saw it as clear as day.

Just because detonation took longer than expected, it didn’t change the reality of the situation…tick, tick, tick…the bomb was still active.

In hindsight, 2008 was only a dress rehearsal.

With foresight, we can outline the case for a much larger disruption to the global economy…one that threatens to unwind much of the growth of recent decades.

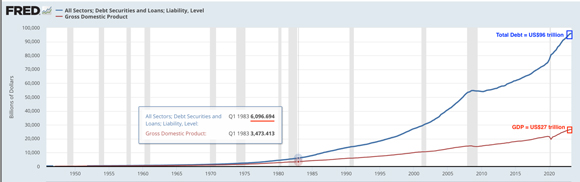

Since the early 1980s, the global economy has grown due to increasing reliance on more and more people going deeper and deeper into debt.

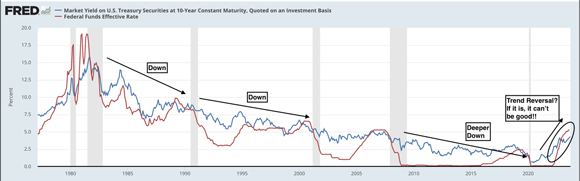

To facilitate this ‘growth’ model, interest rates fell from the high teens down to barely zero (or beyond).

The share market has been a major beneficiary of this ‘growth’…the Dow Jones index increased 37-fold (from 1,000 points to 37,000 points) over the past 40 years.

While this compound effect is now seen as ‘normal’, I can assure you it’s not.

It is completely without precedent.

Which begs the question…

Can Wall Street keep compounding at 9.5% per annum?

This is a question that all pending and current retirees need to ask themselves.

Why?

Because what happens in the US market gets ‘exported’ to the ASX.

Basing your retirement on market returns achieved from a period of extraordinary debt expansion…

|

|

| Source: FRED |

And, interest rate suppression…

|

|

| Source: FRED |

…is, in my opinion, seriously flawed.

What has been, is not necessarily what’s going to be.

Certain conditions create certain outcomes. If those conditions no longer exist, then it brings into question whether the same outcomes can be achieved.

And so it is with investment returns. Which is why every Product Disclosure Statement contains the warning ‘Past performance is no guarantee of future performance.’

The conditions of the past 40 years (continued debt accumulation, substantial interest rate reductions and vast amounts of QE) have been to share and property markets what a tailwind and downhill run are to a cyclist…progress is made at a far greater speed than your natural ability would normally permit.

With ageing populations, heavy debt loads (and, rising debt servicing costs) and geopolitical fractures, there’s a valid argument to suggest that those conditions no longer prevail…or, at least not to the same extent.

Markets may now be facing a steep uphill climb into a fierce headwind.

If that’s the case, it’s going to be tough going in the coming years.

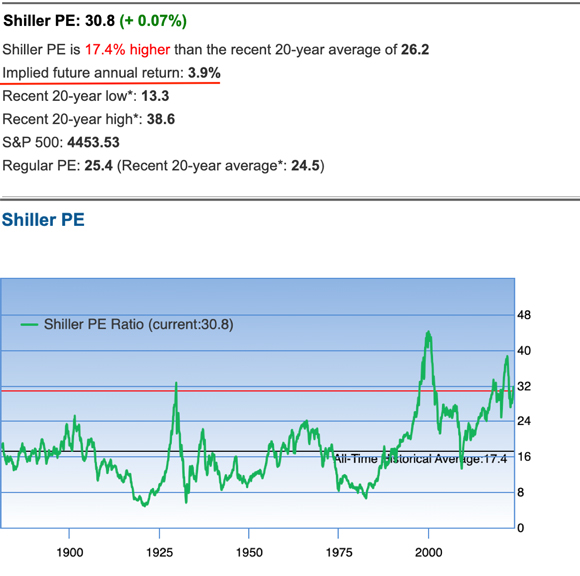

The following chart of the Shiller P/E 10 — with a current reading of 31 times — brings into play a couple of important points of note.

|

|

| Source: guru focus |

Firstly, P/E (the multiple paid on earnings) expansion from seven times (in 1982) to 31 times has been a major contributor to the market’s exceptional period of performance.

A company earning $1 million in 1982 was valued at $7 million, whereas today it is valued at $31 million…without a dollar extra in earnings.

Will the PE10 ratio expand by a further factor of 4.4 (31 divided by 7) to produce the same uplift in value? If it does, the PE10 would need to expand to 136 TIMES!!!!

Not even the heady days of the dotcom era took the PE10 remotely close to this number.

The absence of this multiplier effect on earnings is the stiff headwind markets are running into.

Secondly, history shows the average ‘Implied future (next eight years) annual return’ from the current PE10 level is 3.9% PER ANNUM.

That’s a far cry from the desired 7 per annum (AFTER FEES) retirees are expecting to fund account-based pension payments AND growth.

And remember, that what happens on Wall Street ripples out to the rest of the world.

The other point to note, is getting down to an average annual return on 3.9% per annum is unlikely to be in the. Form of a nice gently sloping decline…more probably, it’ll be a collapse followed by a long path back to recovery. Will retirees be able to hold their nerve during the ‘collapse’ phase? Some will, others won’t.

The US market has (and the operative word is, has) enjoyed the longest bull market in history. The current market is living on borrowed time.

One of the most expensive markets in history is ripe for a spectacular fall…taking the well-laid plans of unsuspecting retirees down with it.

History is firmly against markets repeating the stellar performance of the past anytime soon.

Retirees, with much lower portfolio values, will be forced to tighten the purse strings.

Summary…time to pay the piper

Without the ability of working households to borrow (significantly) more and for retired households to spend more, the economic growth Ponzi scheme collapses.

The real lie we’ve been living will be exposed with a credit crisis of biblical proportions.

The damaged caused by wave after wave of defaults and debt restructuring will be beyond salvation from even the most creative initiatives dreamed up by central bankers.

Why?

Because we have pushed the system to the limit…inflationary pressures are restraining interest rates from going lower (for now); the population base cannot expand sufficiently enough; debt levels are already beyond anything we’ve seen in history and the multiples being paid for assets are at or close to historic highs.

This is a system that’s ripe for a massive fall.

The time is fast approaching when we must pay the piper.

Take whatever defensive action you can to avoid the fate of those who are too blind to see what’s staring them in the face.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia

PS: STREAMING NOW: What you’re not being told about the greatest energy U-turn in history…It’s the polarising video we had to release…and it reveals how the goal of 100% renewable energy in Australia is impossible. Stream NOT ZERO now and you’ll discover that some of the wealthiest investors in the world have spent the last 18 months quietly loading up on fossil fuel stocks. They’ve figured out what’s coming — and now, so can you. WATCH THE VIDEO HERE…