Pizza-selling corporation Domino’s Pizza Enterprises [ASX:DMP] released a trading update describing expectations and cost initiatives for the near future.

The pizza group says it will be targeting a $55 million improvement in annualised underlying performance after shaking up its operational focus.

Interestingly, the fast food enterprise also reported that while its sales had increased in the second half of the financial year, it expects them to fall below expectations for the full year as it moves towards the path of cost savings, efficiency, and a stronger growth trajectory.

DMP shares plunged 9% by mid-morning.

A DMP share was worth $42 each, and the group is still down 33% in the full year of trade:

Source: tradingview.com

Dominos reshuffles operations, closes stores and saves costs

Earlier this morning, Australia’s iconic pizza company Domino’s released a new strategy that it hopes will allow it to save on material near-term cost savings, improve its efficiency, and develop a stronger foundation for growth.

Domino’s reported sales increased in the second half of the financial year by 0.2%, but it expects a drop below expectations for the remainder of FY23.

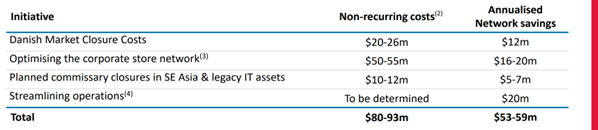

DMP’s general cost savings plan outlined such strategies as closing its Denmark business, closing commissary stores in Southeast Asia, and optimising its corporate store network with an acceleration to franchising and another closing of 65–70 underperforming corporate-owned stores.

The pizza group will also be looking into streamlining its core operations to increase its operational efficiencies.

Altogether the group expects the combined savings to improve its FY24 earnings before interest and tax by around $25–30 million and expects this number to increase over the next two years as initiatives continue to take effect.

A third of the savings should be going back into the stores, with reinvestment into the franchise network.

Dominos anticipates non-recurring costs of approximately $80–93 million but that the initiatives will provide annualised savings of $53–59 million.

In streamlining operations, the group expects ongoing savings of around $20 million in earnings before interest and tax from the 2025 fiscal year.

Group CEO and Managing Director Don Meij commented:

‘Any inefficiency is a burden on the system as a whole; streamlining our business allows our franchisees to focus on delivering the best possible customer experience, growing sales and profitability, and expanding their business.

‘The decisions of today will immediately deliver a stronger business and improve efficiencies for the long-term. Domino’s Pizza Enterprises has a long-term plan, including building out the sizeable opportunity we have in Europe and the Asia-Pacific to more than double our business.

‘This is the right time for us to redesign for future growth; we are taking deliberate action to bring more focus to our business, removing distractions and maximising the benefits of our global reach and scale.’

Domnino’s has been trending low in the share market since its profits took a considerable nosedive in late February.

Time will tell if the group’s store closures and cost-savings strategies will bring it back on top.

Source: DMP

Tik-Stocks and the mania of 2024

Did you know that previous no-name and inconspicuous small-cap Stemcell United [ASX:SCU] catapulted 8,284% in two days on a medicinal cannabis venture?

It wasn’t so insignificant then, and it happened so suddenly.

Cann Group [ASX:CAN] also jumped 30 cents to $4 in a manner of months on another viral explosion.

If you know where the next burst of mania is going to be, you can really take advantage of the hype.

This is why our experts bring you Tik-Stocks, a sort of cousin to ‘meme stocks’ — you know, those stocks that go through the roof based on social media coverage.

These stocks can become overvalued in the blink of an eye. This means you need to time them right.

Intrigued? Click here for more.

Regards,

Mahlia Stewart,

For Money Morning