1) It helps not to be a lazy bum when it comes to investing. You sleep better.

There’s no better example right now than the commentary around the release of the Reserve Bank’s ‘Financial Stability Review’.

This is a document the central bank releases twice a year.

It came out last week.

The mainstream media latched on to a potential scenario where a 2% rise in mortgage rates could cut house prices 15%. Cue the scary headlines and fretting.

I call that clickbait!

What makes me say that? If you read the document, as I did this morning, it paints a very secure picture for the housing market.

You get the complete opposite impression!

Here’s some statistics that don’t make for juicy headlines. Data suggests:

- Loans in negative equity are just 0.25%.

- Only 5% of loans have a loan-to-value ratio greater than 75%.

- Median buffer mortgage prepayments are 21 months for variable rate borrowers.

- 40% of loans are on fixed rates (double the number in 2020) at historically extremely low rates.

- Total credit growth continues to rise.

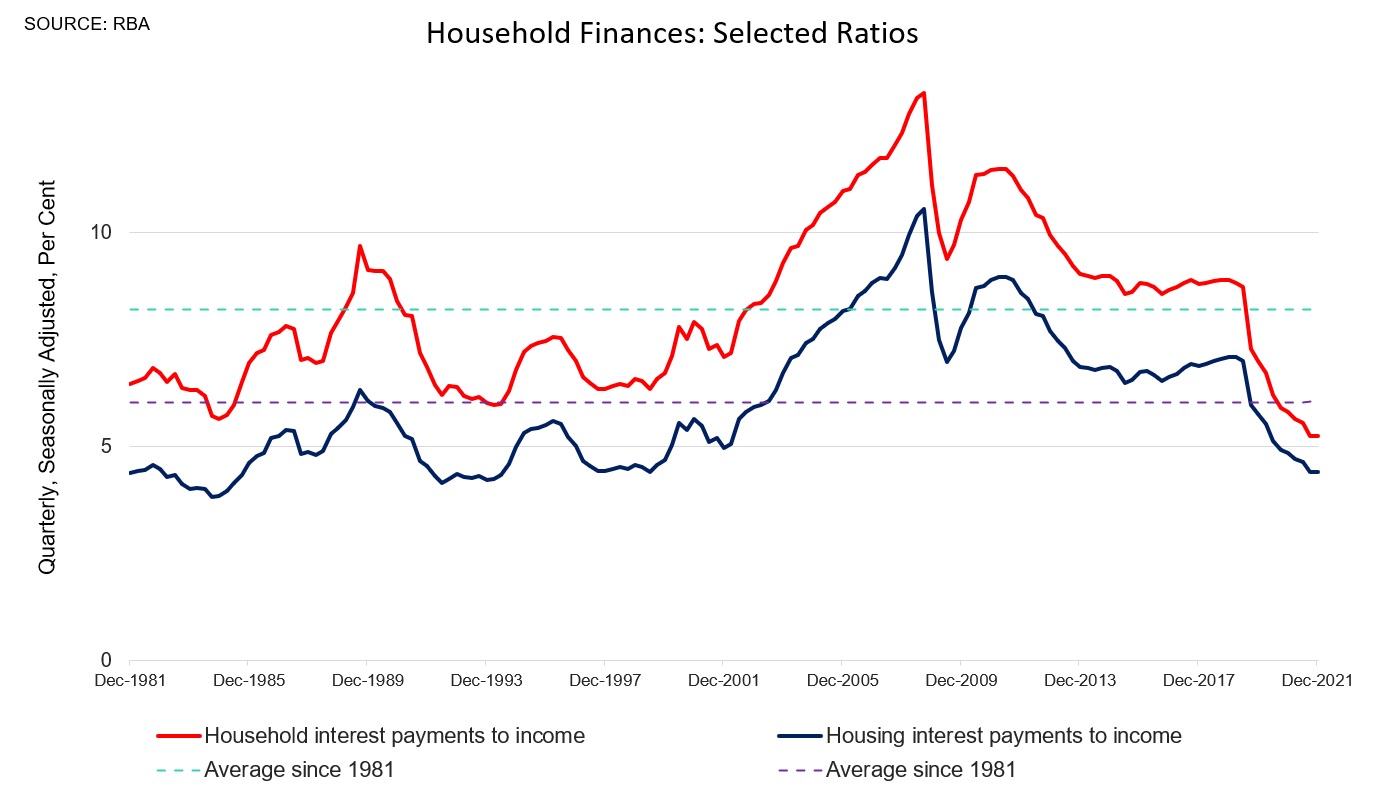

Oh, and household interest payments, as of now, are at a record low:

|

|

|

Source: Twitter |

None of the above looks very scary to me.

Add in increasing immigration and low unemployment, plus big government deficits, and I’m not losing sleep about the housing market.

Personally, I see lots of opportunity in the stock market around this. Property stocks have been hit in the last 12 months, on exactly these fears.

That sets the stage for a rally if I’m right about these fears being overly discounted into stock prices.

My next issue is going to contain three recommendations to take advantage of this.

Stay tuned for more!

2) There is always something nagging at the back of your mind when it comes to the financial markets.

Right now, most of the commentary is around the Ukraine war, inflation, and the market pricing in a 2% rise in rates from the US central bank, the Fed.

The current COVID calamity in China might be slipping by a little too much, to my mind, at least.

What’s the story?

China has a ‘zero-COVID’ policy. That means any outbreak results in staggering restrictions on huge numbers of people.

Shanghai is the hot zone right now. That’s 25–26 million people! Some are said to be running low on food.

I saw one suggestion that China’s food system is highly time-sensitive, with poor cold chain management.

If ports and trucks can’t clear from either a) workers hit by the virus or b) the lockdowns, there could be panic and unrest as people go hungry or are worried enough to do something drastic about it.

The Financial Times says COVID cases could hit 250,000 a day if the Omicron outbreak tracks Hong Kong’s events.

Meanwhile, President Xi is trying to juice everything to ensure his third term is approved without a hitch later in the year. He’s latched his authority to this policy.

Compounding this issue is that China’s vaccines don’t appear to be as effective as the Western ones, and millions of elderly Chinese aren’t vaccinated at all.

Where this goes is anyone’s guess, but some blowback to Australia could be on the cards if Chinese weakness drags down commodity prices.

With everybody trying to cash in on roaring lithium, iron ore, oil, and coal, there can’t be too many bears left in their caves.

Or am I being too paranoid?

Such is the madness the world of finance can take you to. How to cope with it?

Let the market decide. There’s no need to act before.

Until commodity stocks reverse powerfully in some way, we have to assume the market is comfortable with the risks presenting in China.

But the situation bears careful watching.

3) ‘Does the election matter for the stock market, Cal?’

My brother asked me that yesterday.

I don’t think so.

It’s been said by others, but I think the following is true: there’s no economic difference between the two major parties.

There was an opportunity when the Liberals won last time. That was a surprise…and it took up mortgage brokers, for example, that the royal commission previously toasted.

The Liberals kept the same financial system (negative gearing, franking credits, commissions) in place. The market liked that…and so did voters, obviously.

I don’t see an equivalent opportunity this time…just Australia’s ongoing political mediocrity.

All the best,

|

Callum Newman,

Editor, The Daily Reckoning Australia