What is a stock worth?

What is intrinsic value? And how can an investor calculate it?

An astrophysicist may encounter a celestial object — a meteorite or a comet — and, with effort, determine its mass, speed, trajectory…

The characteristics of this object reveal themselves to the astrophysicist in due course, input after input, calculation after calculation, equation after equation.

But an investor comes across a stock and is stumped.

What tools does he or she have? What calculations lend themselves to accurate assessments?

If we can measure the speed, mass, and trajectory of an object deep in space, surely we can find the true worth of something more mundane (and earthbound) like a stock, right?

The Great Crash leads to a PhD

As the great Peter Bernstein wrote in his classic Capital Ideas, the most influential method for pinning down intrinsic value was published 85 years ago by a precocious maths whizz, John Burr Williams.

Williams’s solution to the riddle of intrinsic value applies not just in the stock market, but to business and economics more widely.

Williams started on Wall Street as an investment analyst during the Roaring Twenties when shares rose to unprecedented highs.

Things were going great.

He had a well-paid job, he got engaged…and then came the Great Crash of 1929.

As the US Federal Reserve retells the story:

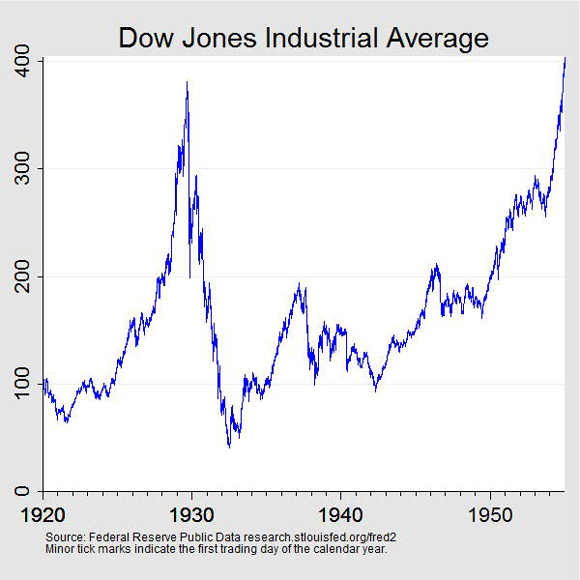

‘The epic boom ended in a cataclysmic bust. On Black Monday, October 28, 1929, the Dow declined nearly 13 percent. On the following day, Black Tuesday, the market dropped nearly 12 percent. By mid-November, the Dow had lost almost half of its value. The slide continued through the summer of 1932, when the Dow closed at 41.22, its lowest value of the twentieth century, 89 percent below its peak. The Dow did not return to its pre-crash heights until November 1954.’

|

|

| Source: Federal Reserve |

The crash was a steep lesson for Williams.

But it also inspired him to question exactly what moves stock prices.

Just before the crash, he was following a high-flying stock — American and Foreign Power — trading on a P/E ratio of more than 100.

Following the Great Crash, American and Foreign Power fell from nearly US$200 a share to US$2.

The stock’s collapse and others like it prompted Williams to take a sabbatical and earn a PhD in economics from Harvard.

His dissertation, The Theory of Investment Value, set forth, for the first time, a rigorous means of establishing intrinsic value.

A hen for her eggs…

Williams approached his thesis by asking why a rational investor would buy shares in the first place.

An easy answer is capital appreciation. Investors buy low to sell high, as the bromide goes.

But that is only a ‘hope’, according to Williams.

For the stock to rise, other investors must bid up its price. But what’s the guarantee the bids will come?

As Bernstein summarised:

‘The investor must consider what return the stock might provide even if other investors never changed their mind about it. And that return can consist of nothing more than all the future cash flows paid by the company to its stockholders, out into the future as far as one can see. These payments will most often be dividends, though they may sometimes be liquidation payments or the proceeds of a takeover. This flow of cash back to the owner of the stock is quite literally a return of the money invested.’

Touching on some of my earlier discussion on earnings, Williams proclaimed it is future dividends, not future earnings, that take priority in establishing value (emphasis added):

‘Most people will object at once to the foregoing formula for stocks by saying that it should use the present worth of future earnings, not future dividends. But should not earnings and dividends both give the same answer under the implicit assumptions of our critics?

‘If earnings not paid out in dividends are all successfully reinvested at compound interest for the benefit of the stockholder, as the critics imply, then these earnings should produce dividends later; if not, then they are money lost. Furthermore, if these reinvested earnings will produce dividends, then our formula will take account of them when it takes account of all future dividends; but if they will not, then our formula will rightly refrain from including them in any discounted annuity of benefits.

‘Earnings are only a means to an end, and the means should not be mistaken for the end. Therefore we must say that a stock derives its value from its dividends, not its earnings. In short, a stock is worth only what you can get out of it.’

Williams then reiterated his point with a cutesy poem:

‘A cow for her milk,

‘A hen for her eggs,

‘And a stock, by heck,

‘For her dividends.

‘An orchard for fruit,

‘Bees for their honey,

‘And stocks, besides,

‘For their dividends.

No Auden, Shakespeare, or Keats…but good enough to get the point across.

Why dividends matter, a brief sketch of research findings

It’s been decades since Williams wrote his groundbreaking dissertation, and countless findings have corroborated his argument.

In 2016, for instance, the prestigious Financial Analysts Journal published a paper evaluating the investment benefits of dividend-paying stocks.

I’ll get straight to the conclusion:

‘In general, focusing on dividend-paying stocks significantly reduces risk, independent of investment style.’

But that’s not all:

‘With the exception of the late 1990s, which witnessed a tech bubble, the performance superiority of the high-dividend portfolio has been remarkably consistent over time. Attribution analysis confirms that choosing high-dividend-yield stocks results in positive returns that are pervasive across sectors and independent of the sector chosen.’

And another thing…

Usually, investors associate dividend stocks with staid mature companies with little to no growth. If someone’s after excitement, they often overlook dividend payers.

But, counterintuitively for some, growth and dividends go well together:

‘In addition to reducing risk, growth investors could receive higher returns by focusing on dividend-paying stocks. It is particularly noteworthy that dividend-paying growth stocks have higher returns than non-dividend payers, because it is often presumed that growth companies have high-return internal investment opportunities and thus dividend payments would detract from investor return. Our findings are consistent with Arnott and Asness (2003), who found that low dividend payouts do not imply higher future earnings growth.’

Six stocks that can grow and pay dividends while doing it

There you have it, dividend-paying growth stocks usually have higher returns than non-dividend payers!

In a happy coincidence, our editorial director, Greg Canavan, just published a report on six growth stocks that pay a healthy dividend.

Greg may not have had the Financial Analysts Journal paper in mind when he set out to find these hybrids, but he found them, nonetheless.

Greg thinks that after two years of the Aussie market treading water, there’s an ‘income/growth sweet spot developing’.

For Greg, you don’t have to chase growth or income.

You can chase both.

And now’s the time.

You can read his new free detailed report — and the six stock ideas — here.

Happy reading!

Regards,

|

Kiryll Prakapenka,

Editor, Money Morning