Shares of Melbourne-based biotechnology company Dimerix Ltd [ASX:DXB] have gained 9% today, to trade at 32 cents at the time of writing.

The DXB share price rose on the back of encouraging results that will support further development of a new drug to treat chronic obstructive pulmonary disease (COPD).

Source: Optuma

What’s happening at Dimerix?

In partnership with the University of Western Australia, Dimerix have been focusing their efforts on COPD through an Australian Government Innovation grant.

With COPD being the fourth leading cause of death worldwide, studies in this area are hugely important.

To treat this issue, Dimerix is in the developmental stages of a new drug, DMX-700.

The new drug has been shown to inhibit signalling of key receptors associated with COPD.

The company is hoping DMX-700 opens up a fast-growing market for the company.

Key organisations such as the National Institutes of Health (NIH), and globally by the World Health Organisation (WHO) and the Centers for Disease Control and Prevention (CDC), all have flagged the need for COPD treatments.

The global COPD treatment market was valued at US$14 billion in 2017 and is projected to increase at a compound annual growth rate of 4.9% to 2026.

Where to from here for Dimerix?

One of the leading causes of COPD is smoking and with the estimated one billion smokers around the globe, if DMX-700 gets to market good things could be in store for DXB.

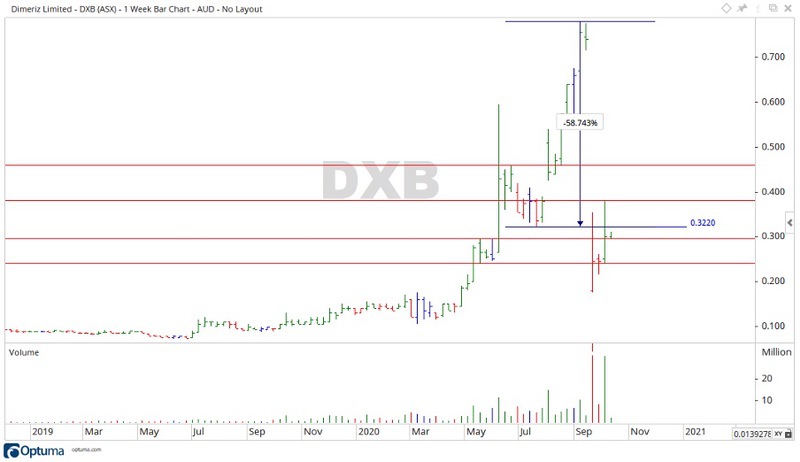

In the shorter term, the DXB share price took a steep fall recently but is starting to show signs of recovery.

Source: Optuma

From the peak in early September, the DXB share price fell over 58% to where it sits at the time of writing.

With the price moving up over the last two weeks on increased volume, if this continues then the levels of 38.1 and 45.9 cents may become the focus.

On the downside if the price were to retrace, then the levels of 29.6 and 24 cents may be enough to halt a further fall.

Regards,

Carl Wittkopp,

For Money Morning

PS: Looking for more exciting small-caps? Download our free report on these four potential post-lockdown stars.