In today’s Money Morning…is crypto a risk to the global financial system? Or not?…the crypto race is on…latest US inflation numbers are just the beginning for crypto…and more…

It appears so.

As for inflation, that’ll bookend the discussion today.

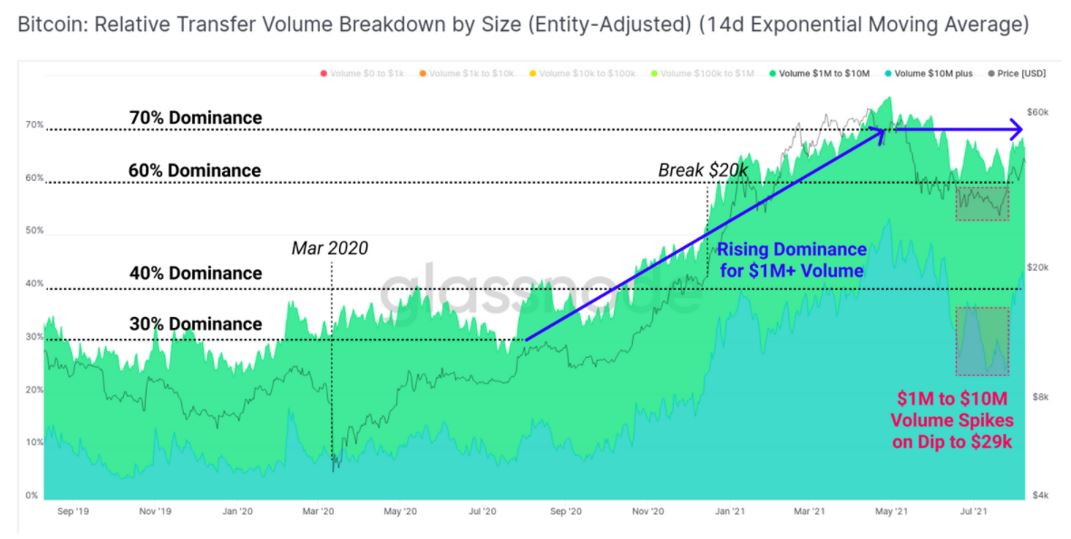

Check out this interesting chart I picked up via Glassnode:

|

|

|

Source: Glassnode |

The crypto analytics organisation explains:

‘The other side of this equation, the chart below demonstrates a structural decline in small size transaction dominance. Transactions of less than $1M in size have declined from 70% to around 30%-40% dominance. These two charts clearly demonstrate a new era of institutional and high net worth capital is flowing through the Bitcoin network since 2020.’

The chart was from the period September 2019 through to July 2021.

The key bit to notice is that bottom right rectangle.

You can see two big spikes in volume for US$10 million transactions.

These are big, big Bitcoin [BTC] buys.

Glassnode continues:

‘Since September 2020, the dominance of these large size transactions has risen from 30%, to 70% of the total value transferred.

‘As the market traded down to the lows of $29k in late July, the $1M to $10M transaction group spiked markedly, increasing dominance by 20%. This week, the dominance of $10M+ volume followed through with a spike of 20% dominance supporting the price rally.

‘Given the lifespan analysis above suggests older coins have been largely dormant of late, this suggests that these large size transactions are more likely to be accumulators than sellers and is again, fairly constructive for price.’

And here’s the chart for BTC during that period corresponding to that rectangle in the bottom right of the chart:

|

|

|

Source: Tradingview.com |

The BTC price was hardly going off.

Which for me means that while many retail investors not playing with US$1–10 million-plus were exiting, big players were buying the dip.

Was it MicroStrategy which is 14.6% owned by fund behemoth BlackRock?

Doesn’t really matter.

The point is the smart money made big moves in the second ‘crypto winter’.

Meaning there could be some credibility, depending on how you look at it, to the following…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Is crypto a risk to the global financial system? Or not?

As per CoinDesk:

‘Crypto assets have grown rapidly from just $16 billion five years ago to about $2.3 trillion today, and thus could pose a systemic risk to the global financial system, the Bank of England said on Wednesday.

‘While $2.3 trillion is small compared to the $250 trillion global financial system, it doesn’t take much to destabilize things. The sub-prime debt market was valued at around $1.2 trillion in 2008, just before the financial crisis, noted the BoE’s Jon Cunliffe, the bank’s deputy governor of financial stability in a speech.

‘“In that case, the knock-on effects of a price collapse in a relatively small market was amplified and reverberated through an un-resilient financial system causing huge and persistent economic damage,” Cunliffe said.

‘Cunliffe said that because the crypto industry is growing rapidly and beginning to connect to the traditional financial system, with the emergence of leveraged players and in a mostly unregulated space, systemic risks, while limited now, could grow very quickly.’

Bigger than the sub-prime debt market, you say?

Must be really bad, Mr Cunliffe.

These types of comments are based on the mentality that crypto will go down and crush institutional investors.

What if crypto goes up and up with further global uptake?

A virtuous loop with second-order effects, feeding into more liquidity available to put into traditional markets?

I wouldn’t rule it out.

The crypto race is on

What I think is going on under the surface, though, is something far bigger, especially given the volume of large transactions I highlighted before.

It’s a sort of race.

Namely, the push for a hyper-regulation of crypto or the ‘regulated out of existence’ outcomes I discussed yesterday are competing against big institutional sentiment.

Check these interesting factoids out, for example.

From the Fidelity Institutional Investor Digital Assets Study (via Bitcoin Magazine):

‘“Across Europe and the U.S., we saw year-over-year growth across nearly every category, including perception and appeal, current exposure, and propensity for future investment,” the report said.

‘Considering all investors surveyed across the globe, 52% of respondents said they invest in bitcoin or cryptocurrency, and 9 in 10 investors find those assets appealing. Notably, 84% of European high-net-worth investors said they are invested in the asset class. The most appealing attribute of bitcoin and cryptocurrency shared by institutions was “high potential upside” for future price appreciation.’

As for negatives or drawbacks for institutional investors:

‘The firm found that 54% of the respondents see price volatility as one of the greatest barriers, while 44% shared a “lack of fundamentals to gauge appropriate value” as the primary concern.’

First of all, I don’t like the word volatility.

It’s a sort of clumsy catch-all term for ‘the price doesn’t move in a straight line up forever like I’m used to with my big bets on FANG stocks.’

As for fundamentals — it’s more so that these institutional investors don’t know how to convert from reading balance sheets to reading charts and checking up on Glassnode data.

In a world where institutions are betting big on BTC, institutions that are comfortable with regulatory requirements and paperwork, it’s possible the risk associated with BTC is going to entirely come from the regulators themselves.

It’s as if financial regulators are saying: BTC is risky because its volatile and we intend to make it more volatile with ham-fisted regulations.

A problem entirely of their own making.

Here’s where I think the next major bull run for crypto starts to kick off…

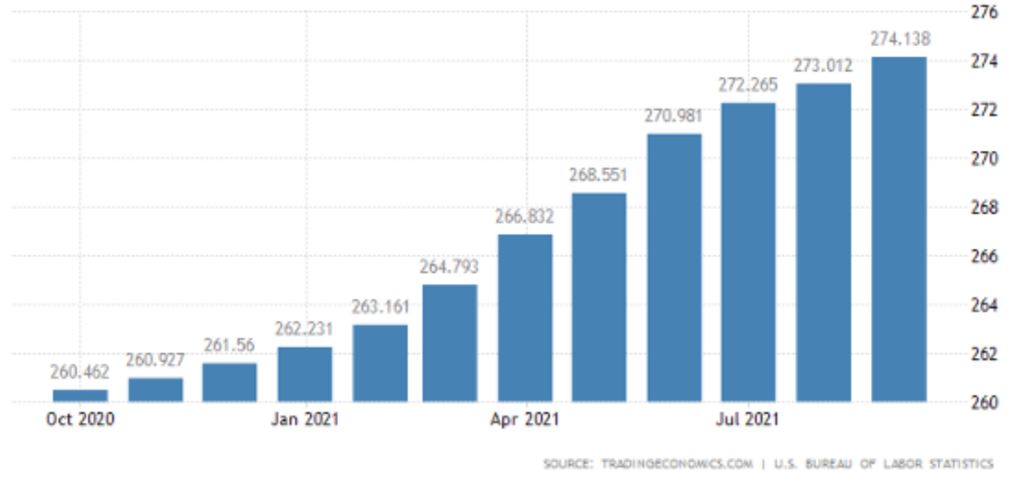

Latest US inflation numbers are just the beginning for crypto

BTC’s inflation-hedge narrative hasn’t changed.

The latest US CPI print came in big at 274.14 points:

|

|

|

Source: Tradingeconomics.com |

Reuters reports:

‘Inflation is no longer “transitory”, said Sung Won Sohn, professor of finance and economics at Loyola Marymount University in Los Angeles. “Supply-chain bottlenecks are getting worse. The logjam is unlikely to ease anytime soon despite the latest intervention by the White House.”

‘The consumer price index rose 0.4% last month after climbing 0.3% in August. Food prices jumped 0.9% after increasing 0.4% in the prior month. The largest rise in food prices since April 2020 was driven by a surge in the cost of meat.

‘Owners’ equivalent rent of primary residence, which is what a homeowner would receive from renting a home, increased 0.4%. That was the biggest gain in five years and followed a 0.3% rise in August. Rent of primary residence shot up 0.5%, the largest advance since May 2001.’

Ah yes, the ‘transitory’ lie with a double dose of supply chain problems as an explanation (smokescreen).

Hmm, I reckon it’s the money printer that really caused inflation.

Inflation was always going to come, and hard money is the play.

That could be gold and gold stocks or BTC and other cryptos (which I believe is a new form of hard money).

Hard money meaning something that isn’t prone to the vagaries of central bank tinkering.

Or worse, central banks completely rewriting the rules of money via CBDCs.

Go on, check out Greg Canavan and Ryan Dinse’s latest issue of New Money Investor.

If anything I’ve said today resonates with you, I trust you’ll find their latest special report an exciting read.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.