I shuffled into the office during the week as I need to clean out my desk.

Man, the stuff I’ve kept.

See, I’m in the bad habit of printing off deep articles or research papers I know I’ll want to read one day. Then I take them home and shove them in my ‘research’ box. Because of my insane schedule, it means I really only start sifting through my research box in the Christmas period.

I think printing papers off to take home and read reveals my age…

But that box is a like Christmas present for data geeks. And I found out my desk was full of papers over the years that never quite made it home.

A mix of papers without context reflected my interests over the years. Stuff on the Turkish lira crisis, foreign funding of Aussie banks, and history of Athenian coin mintage to name a few.

As I shoved them into my bag to take home, I thought of all the wonderful things I’ve read about in the past decade…

RBA won’t raise rates until you make more money

Sure, my swan song could be about bullion, liberty, big government, bureaucratic spending, unstable monetary policy, a double down on understanding consumption data, trade data, mining movements, secret sources, geopolitical tensions coupled with critical minerals, or watching fiat currencies and their impending day of reckoning…

Out of that Mary Poppins bag of papers…out of all the topics in all the world I could choose from, I’m going to poke holes in something the Reserve Bank of Australia said during the week.

The reason? The lack of central banker understanding surrounding wage growth has me wondering where they sit on the Laws of Human Stupidity chart.

See, our central bank boffins got together Tuesday earlier in the week and made some decisions about where interests would or wouldn’t go this month. I wrote on Thursday that these monthly meetings are largely dull affairs these days.

In fact, I’d say that many of their press announcements are darn near a cut and paste from the month before.

Let me show you what I mean.

You can bet an overpriced Aussie house that the RBA will write they are ‘monitoring’ international markets with an ‘eye’ on the bond markets in the US. Followed by comments on how they are ‘tracking’ global trade while looking for ways to ‘support’ the Aussie economy.

Our fearless bankers will then tell us they are carefully ‘watching’ Aussie property prices but have ‘concerns’ about inflation failing to move higher.

At the end of this abuse of the English language, is a reassuring statement they will adjust policy as ‘conditions’ change.

However, the only adjustment you can expect going forward is lower rates and more quantitative easing.

This month’s meeting though, the RBA came out an emphasised their biggest concern is the lack of wage growth. And that nothing will cause them to raise rates until people start earning more.

Of course, this isn’t the first time our central banking mates have expressed concern about wages. It’s just that now it’s another scapegoat as to why rates won’t go up any time soon…

Bedtime stories for central bankers

Today’s problem is not a new one.

Our central banking mates have commented regularly since 2017 that wage growth in Australia is not ideal.

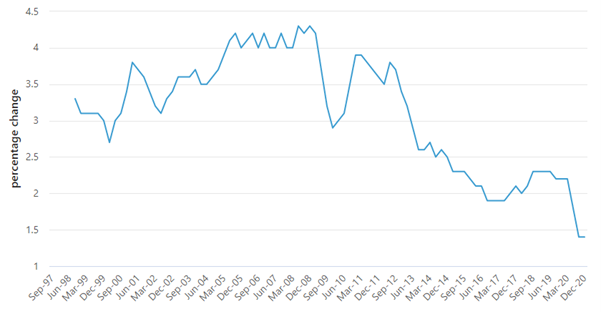

The thing is, since the RBA first started talking about it, things have gotten even worse. Check this out:

Australia’s Wage Price Index

|

|

| Source: Australian Bureau of Statistics |

Wages in Australia have been in a slippery dip down since the financial crisis of 2008. It’s not a problem unique to Australia, though we are the worst affected in the Western world.

The lack of wage growth has seen the RBA author white papers and start conferences trying to get to the bottom of it.

Aside from the oddness that was 2020, employment data and job growth was reasonably consistent. Yet as I’ve pointed out over the years, the official unemployment statistics don’t reflect reality.

The metrics of how the ABS measures unemployment is just one reason ‘tight’ labour conditions won’t see wages move materially higher.

The other reason is the structural shift in employment in Australia.

Over the years the blame has been laid on decreasing union membership. Though the impact of this was mostly felt long before 2017. Another one that gets the blame is not enough enterprise bargaining agreements (EBA). However back in 2018, Business Insider pointed out there is a correlation between EBAs and the overall wage growth falling.

There are two main contributors that stifle wage growth and there’s a chance the RBA won’t be able to do a darn thing about it.

Local automation and increasing product efficiencies are two theories that explain why wage growth is stagnant. Offshoring traditional entry level office jobs to Asian countries where the labour costs are significantly lower has also contributed.

Offshoring is part of the overall theory about the monopolisation certain corporations have on the labour market. All of which has the double whammy effect on pushing wages down.

This beefy 346-page Wage Crisis thesis hints that large corporations who employ large chunks of Aussies are inadvertently setting the labour rate because of the sheer heft of people on the books.

The top five largest employers in Australia — Wesfarmers Ltd [ASX:WES], Woolworths Ltd [ASX:WOW], Commonwealth Bank of Australia [ASX:CBA], BHP Group Ltd [ASX:BHP], and National Australia Bank Ltd [ASX:NAB] — have a combined 530,000 employees, which equates to 4.3% of the Aussie workforce.

They unintentionally set the cost of labour in Australia.

Compounding all of this, is the public pay rise freeze. As much as I don’t like it, private wage growth lags public wage growth.

Another thing hindering wage growth, is that incentives as opposed to higher salaries are on the table. Perks like gym memberships, gifts, and bonuses are on the table over an hourly increase.

The reality is that a mishmash of these factors is compressing Aussie wages and leading to wage stagnation across Australia in general.

The point of my musings today, is the RBA stated earlier in the week without wage growth they will keep the cash rate low until inflation is ‘sustainably’ in the 2–3% zone.

A lucky few may get a pay rise. The majority can expect perks.

But the fundamentals keeping a lid on wage growth are out of the RBA’s control.

I better go buy a suit

Early one October morning in 2009 I was at the doorstep of Port Phillip Publishing. With a giant latte in hand, I side-stepped the homeless man sleeping on the century-old stoop, pushed open the heavy door, and tottered up the stairs.

I’d left the world of derivatives — the very ones that copped the blame for the financial crisis — for the world of investment writing.

There was my empty desk with a chair still in its box, that my new manager insisted I assemble…in the nicest suit I owned. Realising everyone was in t-shirts and dodgy-looking jeans, I rocked up the next day in a pair of Levis and gave the suit away.

I had only planned to stay a couple of years…but when you are surrounded by some of the strongest contrarian minds in Australia, it’s hard to leave.

The most incredible minds have filled these pages and the responsibility of following in their footsteps and heading up The Daily Reckoning Australia was never lost on me.

Nor was the utter privilege to be allowed into your inbox each week and share my market musings. Thank you for allowing me to do what is possibly the coolest job for a stock market nerd.

Nonetheless, my tenure with Fat Tail Media has come to an end as of today. An opportunity to move further into the gold space came my way and I just couldn’t say no.

Thanks for being with me on this ride, it’s been wild.

That’s it from me, I better go buy a suit.

Over ‘n’ out my friends,

|

Shae Russell,

For the final time, Editor of The Daily Reckoning Australia

PS: If you want to stay in stay in touch, you can follow me on either on LinkedIn or Twitter @shaearussell.

Comments