The Australian financial sector has had a turbulent past couple of years to say the least.

In particular, the Big Four banks have been put through the wringer. And it’s played into the hands of the Wisr share price, at least until the pandemic leads to aggressive de-risking.

We’ve seen small- and mid-cap companies that were up significantly sold off for no apparent reason other than the need for taking money off the table amid a dash for cash.

With the weakening of the banks’ grip on the Australian consumer thanks to the Hayne Royal Commission, a younger generation of financial institutions have begun taking the place of traditional banks.

The Big Four banks have noticed too.

Australia and New Zealand Banking Group Ltd [ASX:ANZ] got rid of its wealth management arm, Commonwealth Bank of Australia [ASX:CBA] sold its life insurance business, and National Bank of Australia Ltd [ASX:NAB] moved on from its funds business.

Aussie fintechs have shown just what is at stake if you get your product right — take a look at the success Afterpay Touch Group Ltd [ASX:APT] has had.

Cue Wizr Ltd [ASX:WZR].

WZR is another Aussie fintech start-up who specialises in personal loans.

The neo-lender packages itself as a smartphone-enabled, automated, personalised, low-interest lender.

Launching back in 2015 after a rebrand, the neo-lender’s share price saw massive growth as it targeted the banks’ personal loan business.

Specifically, it was out for the millennial demographic.

In 2019, the WZR share price (blue) rocketed up nearly 460%, beating out the APT share price (red) who only put up a modest 174% return.

Source: Trading View

Even with the current market crash, WZR has still posted a one-year return of ~85% and is up 25.93% at time of writing.

Interested in protecting or even potentially growing your portfolio during the current market crash?

We have a two-pronged strategy that aims to help you benefit as the ‘corona crisis’ worsens.

Click here to claim your copy today.

If you can’t pay rent, you can’t pay a loan

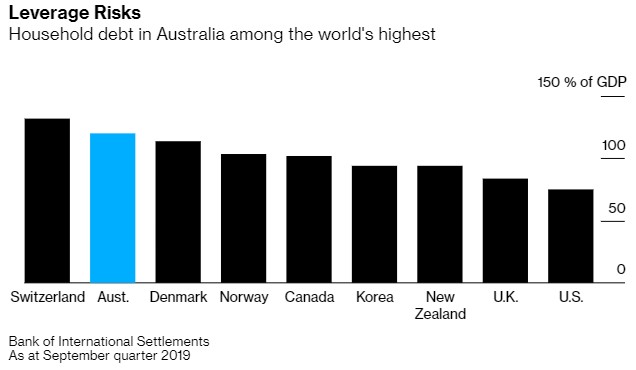

Australian households are the second most indebted in the world.

Source: Bloomberg

With our unemployment rate expected to swell to around 10%, this could mean a perfect storm is brewing for loan defaults and bad debts.

And despite various balance sheet metrics, it’s hard to spin this in a positive light for any lender, let alone Wisr.

A lot of people cannot even pay rent right now, so how can they manage to pay off their car loan?

WZR’s share price has risen today after the company announced it has surpassed $200 million in loan originations.

But with the RBA warning of a ‘very large economic contraction’, you can reasonably expect to say goodbye to a lot of disposable income.

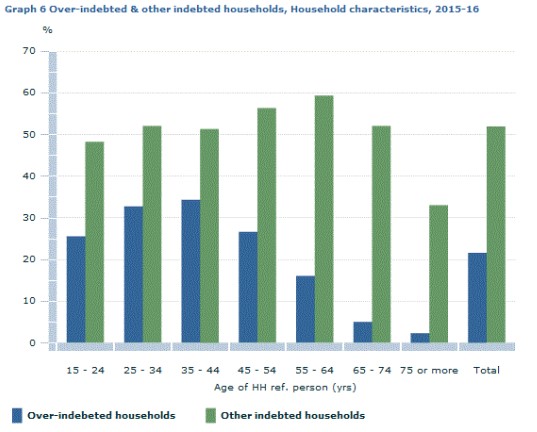

Younger households are the most over-indebted in the country.

Now that part-time and casual work has dried up thanks to the coronavirus, young Australians could be some of the most affected.

Source: RBA

Around 42% of Wisr’s customers are under the age of 35.

I fear we could be witnessing a car crash in slow motion, so to speak.

Don’t believe me?

Just look back to what happened to RAMS and other secondary lenders in the GFC of 2008 — they nearly went bust.

It could be the case that once we really begin to see the carnage to personal finances in the coming months, then investors will finally react.

So yes, Wisr’s numbers were strong in my eyes today, but beware of the demographic risks down the track.

Regards,

Lachlann Tierney,

For Money Morning