Shares have been soaring for uranium developer Deep Yellow [ASX:DYL] after the company issued an update pertaining to its Tumas Project in Namibia, which the company says has returned both strong and positive results in its recent DFS (Definitive Feasibility Study).

Deep Yellow was riling up its shareholders on what it called highly positive results for its world-class uranium project, expecting to produce up to 3.6 Mlb UO (uranium) per annum and 1.15 Mlb VO (vanadium by-product) over 22.25 years of mine life.

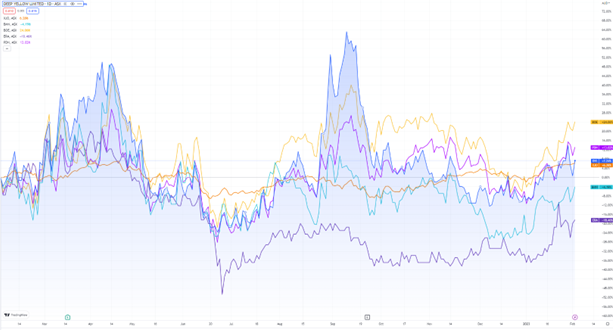

By rising more than 7% in share price today, DYL has shot up more than 17% in the first month of the year and sits at an 8% gain from February 2022–23.

Even so, the uranium producer is tracking below its industry average by 16.5%.

By comparison, Boss Energy [ASX:BOE], DYL’s big-name uranium-producing competitor has moved up 24% in the past full year and, though up on the wider market by 18%, is relatively flat in industry trade.

Source: TradingView

Deep Yellow praises positive DFS for Tumas Project

The uranium explorer has compared the Pre-Feasibility Study (PFS) that took place in 2021 with the latest results passed in the recently executed DFS, excited for an increase in production capacity at the Tumas Project plant from 3Mlbpa UO to 3.6Mlbpa UO — that’s a 20% increase.

There was also an 11% increase in throughput from 3.75Mtpa to 4.15Mtpa.

However, with growing speed and capacity, Deep Yellow highlighted that there’s also the 26% increase in initial capital to be aware of — mostly thanks to inflation-centric effects and carry-on effects of the pandemic over the past two- and a-bit years.

Production at the rate of 3.6Mlb a year, with the present understanding of resource reserves, is expected to ride the course of 10 years and means that overall LOM (length of mine) life has reduced from more than 25 years to closer to 22 years.

The company also hopes that additional resources will help to boost the mine’s life to around 30 years.

The company said that on a cost per annual pound basis, initial construction capital has been upped to US$103/lb in comparison with the previous US$98/lb, as reported in the PFS — which is an increase of 5%.

Initial estimated capital costs have been set for US$48 million, and $48 million is set aside in pre-production costs.

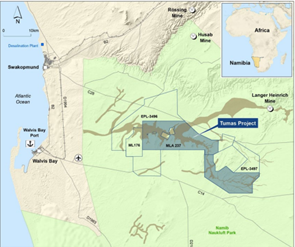

Source: DYL

Uranium in Namibia and DYL next steps

Deep Yellow says that its Tumas Project involves very low technical risk, using open cut trick and shovel mining and conventional processes for beneficiation, leaching, and resources recovery in both uranium and vanadium.

The company pointed out that the region of Namibia is said to be an established uranium jurisdiction and so provides plenty of potential and lower exploration and excavation resources needed to access and mine product.

DYL will now shift its focus to more detailed front-end engineering and designs, project financing, and offtake arrangements before reaching a final investment decision in H1 2024.

At present, the uranium price is assumed at US$65/lb, and vanadium price at US$7/lb.

The net present value of the project after tax has been assessed at $341 million, and the internal rate of return is sitting at 19.2%, ungeared.

Australia’s boom in commodities, and how to capitalise

Our in-house resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’…a boom where Australia and its stocks stand to benefit.

The next big mining boom is predicted to happen in the next few years, the question is, are you ready for it?

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia