Explorer of advanced uranium and mineral projects, the Mulga Rock, Alligator River Project and Tumas, Deep Yellow [ASX:DYL] today was providing a combined update for all three.

The Tumas project in Namibia, boasting annual production of around 3 million pounds, has begun a two-phase reverse circulation resource drilling program to expand the resource base.

Air core drilling also began at Mulga Rock, a project with an annual production potential of 3.5 million pounds. Assay results are expected from the 2022 Angularli resource drilling, expected to influence the mineral resource estimate (MRE) for Q2.

Investors in DYL were voting the miner’s share price down by more than 10% to 57 cents a share by the early afternoon.

DYL has slid 45% in value over the course of the year and is down 51% in its sector:

Source: tradginview.com

Deep Yellow updates on three projects

On Wednesday, the uranium explorer released an update covering three main projects; Tumas in Namibia, the Mulga Rock project in Western Australia, and its Alligator River in the Northern Territory.

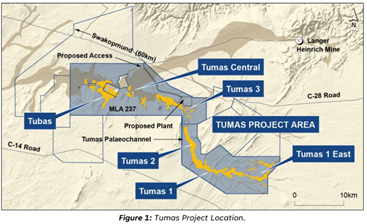

Tumas

The group said that its flagship Tumas project remains its main focus. With its DFS completed in January, the next step was to submit the Environmental Impact Assessment — which was due today. Lastly, an Environmental Clearance Certificate will be issued early in the second half.

Across February and March, DYL completed 16 HQ-diameter diamond drill holes across the Tumas 3 deposit for 800kg of solid core samples. These will be used for optimisation work and metallurgical studies.

In March, the group began a resource drilling program at the western end of Tumas 3 to explore an extension and connect with the Tubas mineral resource. The program includes 340 RC drill holes totalling 9,500m and is divided into 2 phases.

An updated MRE for the Tumas Project can be expected in late Q3 2023, and an increase to the resource base is also expected, as well as extending the mine life beyond 30 years.

Mulga Rock

WA-based Mulga Rock has shown significant value uplift potential, thanks to the recovery of critical minerals located in existing resource shells, in addition to uranium.

The group has identified potential for copper, nickel, cobalt, zinc, and rare earths that are highly advantageous to EV batteries and renewable energy developments.

A 63-hole, 4,099m geo-metallurgical air core drill program has sampled materials and determined ore variability, with results expected back shortly.

Another 810-hole, 50,000m air-core drilling program has begun to better define reserves and upgrade the resource base. This process will run until mid-Q3 2023 and should feed into an MRE update.

Alligator River

Late in 2022, DYL completed 1,116 chemical assays associated with the extensional drilling program on the Angularli deposit, with results expected soon.

These results will also feed into the basis for an updated MRE, which is to be announced mid-Q2 2023.

DYL says it will review all data and develop a comprehensive exploration model which will aid in finding further discoveries in uranium and enable the group to update its medium and long-term objectives for investigations.

Source: DYL

Australia set to profit from the drilling boom

The wider energy industry is making massive bull market-like gains in the face of recession, interest rates and wider market sentiment.

It’s almost like an alternate universe, the universe of booming drillers.

More of these booms are marked to happen for every single metal that can be found on the period table.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Yes, it’s very possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning