In today’s Money Morning…our energy sector was the standout…get out of the crowd…a simple strategy to put in place today…and more…

‘You make most of your money in a bear market; you just don’t realise it at the time.’

-Shelby Davis

After seven gloomy weeks on the trot, markets finally gave us a glimmer of hope last week.

It was a sea of green!

In the US, the moves were particularly juicy.

The Dow Jones Industrial Average of blue-chip companies closed 5.1% higher. The broader S&P 500 was up 5.9%. And the tech-focused Nasdaq Index rose a healthy 6.7%.

Back home, the ASX 200 of the top 200 companies by value in Australia rose a more modest 0.5% for the week.

Our energy sector was the standout, adding 2.3% as oil prices remained high.

This was good news for stocks like Woodside Petroleum [ASX:WPL], Santos [ASX:STO], and Beach Energy [ASX:BPT], which all finished higher.

Interestingly, the red-hot US dollar — a safe-haven trade of late — closed lower for the second week in a row, suggesting investors might be starting to find some courage.

And according to Reuters, macro worries are starting to wane:

‘…traders pared expectations for U.S. Federal Reserve interest rate hikes and as improving inflation and consumer spending data eased recession fears.’

So is that it then?

Can we forget all the doom and gloom?

Is now the time to buy the dip?

Or…

Is this just your typical bear market dead cat bounce before further falls?

We’ll no doubt hear from both sides over the coming weeks.

But the fact is, if you’re a long-term investor, it’s definitely time to start getting interested.

And shortly, I’ll give you one simple move you can do right now to take advantage of the volatility.

Let me explain…

Get out of the crowd

The finance industry makes a big deal of examining the day-to-day gyrations in markets.

We’re guilty of it, too, sometimes.

Every tick, every chart, and every economic statistic is poured over endlessly by analysts, commentators, traders, and investors.

All in the hunt for a slight edge to work out how the next 3–6 months will play out.

But in investing terms, this is what’s known as a crowded trade.

Crowded trades are not where you want to put your money.

The fact is, it’s hard to make money investing in the same spots everyone else is looking at too.

But the media industry is designed around the concept of ‘breaking news’, and the financial press is no different.

No one cares about one or two years out from now.

But in my opinion, that ‘two years out’ point is where you have an investing edge over the market.

You just need to lift your gaze.

To be clear, this isn’t some kind of revolutionary insight.

Investing great Warren Buffett frequently comments on the benefits of being a long-term investor, once noting:

‘The stock market is a device for transferring money from the impatient to the patient.’

This is not to say you shouldn’t tune in at all to daily events.

Things can and do change, and sometimes those changes are important.

But those moments are rarer than you think.

Funnily enough, predicting the future in broad terms is often a lot easier than trying to predict the next tick of a price chart.

So forget trying to time the market.

Instead, focus your energy on finding areas that are just going to keep growing and growing.

A simple strategy to put in place today

According to legendary fund manager Peter Lynch, your greatest stock research tools are your eyes and ears.

He was very proud that many of his best stock ideas were discovered while walking through the shops or chatting to friends.

My experience is similar.

For example, a relative of mine is getting a knee replacement today, and he told me that the surgeon utilises a robot to help with the operation.

It’s something I’d never have thought about.

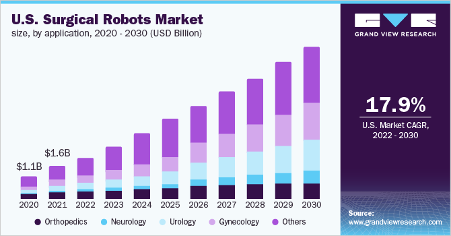

And that little chat led me to discover that the surgical robot market is set to grow at a stunning 17.9% per annum from 2022 through 2030 in the US alone.

|

|

|

Source: Grandview Research |

As an investor that hunts exponential trends, this certainly seemed an industry worth looking into further.

After all, with an ageing population, the demand for such services is likely to grow.

My point is, the next big investing idea might be staring you in the face.

If you find an area that you really like the look of, then there’s no point waiting for the ‘best’ moment to buy.

Sure, if you’ve some charting nous, use it.

But in times like this, when markets are volatile, a simple strategy is to just dollar cost average into your best ideas over the next six months or so.

This approach is one I use myself as it gives me the discipline to build a position no matter the markets.

If you choose your targets wisely, two or three years later, you often find yourself in the right sectors well before the herd.

This may seem easy, but I guarantee that 99% of ordinary investors don’t think like this.

Which is why it’s still such a lucrative approach.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also the Editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.