‘Everybody’s bullish on gold.’

Analyst Mark Cudmore on Bloomberg this morning.

‘All roads lead to inflation’, says celeb investor Paul Tudor Jones.

PTJ may be right. We think he is. At least, over the long run. But many are the twists, turns, blind alleys and washed-out bridges along the way.

Ultimately, almost all major governments are spending too much money. We know where that road leads. Politically, they can’t control spending. And financially, they can’t control the value of the dollar. As they borrow, print and spend more and more of them…dollars will go down that long, winding road to peso status.

In the venerable tradition of tyrants and jackasses everywhere, politicians will debauch their own currencies in order to keep the wheels turning and the cash flowing. Dollars, pounds, euros, yen…all will go down compared to real things, including gold.

The talking heads on Bloomberg are already counting their profits. They think gold is an ‘investment’. They talk about the ‘gold trade’ and hope to make money by buying and selling, in and out, in a timely manner.

And right now, with the Fed cutting rates… the economy still growing… and an election coming up, they see higher gold prices. Three thousand dollars an ounce is the number that dances on their screens and in their dreams. Benzinga:

‘Gold Could Reach $3,000 By 2025, Bank Of America Analyst Says: “Ultimate Perceived Safe Haven”

‘Gold remains “the ultimate perceived safe haven asset” in today’s macroeconomic environment, according to Bank of America’s commodity analyst Michael Widmer, amid rising concerns over U.S. fiscal policies and their potential impact on Treasury yields. Widmer explained that a key driver behind this surge is the rising inflation expectations paired with the Federal Reserve’s policy shifts.’

Sooner or later investors are likely to catch ‘gold fever’. Then, they will trade gold mining companies like they traded dotcoms in 1999, cryptos in 2020, and AI stocks in 2024. Sitting in their parents’ basements, young traders will fill the internet with reasons to ‘get in now’ or be left behind forever.

Elon Musk will leave puzzling messages about it. And hustlers will quickly learn the lingo of gold mining…and speak to rapt audiences of the fortunes they will make by applying their AI secrets to gold mines that never produce a single ounce of the metal.

But we are not there yet. For now, the bigger danger is not a bubble in the gold market, but a bubble in US debt. As we’ve seen, an embezzler must have someone to embezzle… and the vast middle-class public is inflation’s intended victim.

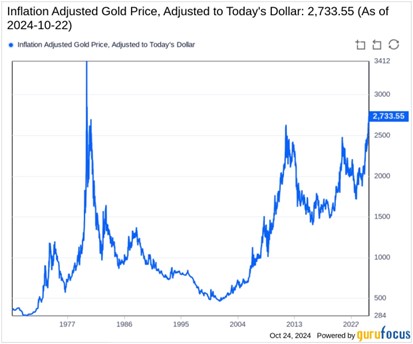

Will gold protect us? So far, it has…

| |

| The all-time high for the inflation adjusted gold price is $3,411/ounce, set in 1980. |

The US government no longer operates on a gold standard. But we do. We use it to protect us from crashes, inflation, and major bear markets. We also measure our real wealth in gold terms.

We do not, however, use it as a means of exchange. Nor do we speculate on gold going ‘to the moon.’

Gold, in its physical state, doesn’t lend itself to casual transactions. And a gold-backed digital currency, so far, has not caught on.

What’s more, when a ship goes down, people don’t like to give up their life preservers. And in a financial crisis, people don’t want to trade their gold for a tuna sandwich. That’s Gresham’s Law; bad money drives good money out of circulation. People don’t spend gold; they hoard it.

The authors of the Fed study that we mentioned yesterday see gold as less of a threat to their inflation policies than Bitcoin… suggesting that there may be less need to ban it or tax it. Gold is no longer a ‘monetary metal.’ In their minds, it is just another dead asset, like tin or baseball cards.

But the feds banned private ownership of gold back in 1933. And if gold ever offered the common people a way to dodge inflation, they could do it again. And they would say they are ‘protecting investors’ against a bubble in the gold market.

But that is too remote to worry about. For now, we hold gold to protect against the Big Loss in stocks, bonds, and the dollar. And if gold itself ever might cause a Big Loss – either because it has gone to the moon…or to Ft. Knox…we count on our Dow-Gold signal to get us out in time.

Tomorrow… what if we’ve missed the plot completely?

Regards,

|

Bill Bonner,

For Fat Tail Daily