‘Overvalued’ equities, a rally driven by trading kiddies, and an avalanche of cheap money.

Or so they say, anyway.

Many in the market are running around like headless chickens because it’s hard to make sense of the chaos.

New cases of coronavirus — market up!

US–China trade war back on — market up!

Unprecedented civil unrest in the US — you guessed it, market still up!

This may change soon of course, but many are now wishing they bought the rally.

Are we on the verge of a lengthy bout of sideways trading though?

One of the most successful hedge funds ever seem to think so…

In a note to clients on 16 June, analysts at Ray Dalio’s Bridgewater Associates warned of a ‘lost decade’ for equity investors as profit margins get squeezed by the pandemic.

The note from the analysts continued:

‘Globalisation, perhaps the largest driver of developed world profitability over the past few decades, has already peaked.’

And:

‘Now the US-China conflict and global pandemic are further accelerating moves by multinationals to reshore and duplicate supply chains, with a focus on reliability as opposed to just cost optimisation.’

Bridgewater is the most successful hedge fund according to LCH Investments.

The business churned out a staggering US$58.5 billion for its clients since its inception in 1975.

They also suffered a 15% drop in assets under management (AUM) between March and April after some heavy losses.

But what’s in the secret sauce that delivers these kinds of returns, or more recently, a lack thereof?

How trading robots work…

In Tuesday’s Money Morning, my colleague Ryan Dinse discussed the phenomenon of the ‘Robinhood rally’.

The key claim from his piece was that online share-trading platform, Robinhood, shares customers’ order flow information with third parties.

These are funds that have high-frequency trading algorithms which are constantly trying to learn how to make money.

So, in effect, a really successful individual trader can make big waves in the market, without even knowing.

I’ve heard stories about successful sports gamblers being banned from betting platforms because they keep winning.

You can be sure the gambling companies are using the data from these punters to better hone their bookmaking, so they don’t get stung in the future.

What’s happening with share market platforms is a bit different.

Instead of banning the successful punter, you on sell/share that information with an entity that has access to significantly more capital.

These are the wolves.

But who are the sheep?

Turns out, it could be a combination of quantitative traders at hedge funds and the sea of new retail investors.

As Damien Klassen writes in MacroBusiness, this is the method used:

- You see assets going up then you buy them

- Assets stop going up then you sell them

‘It is a surprisingly effective strategy over time. It usually makes a little bit of money most of the time, and then loses a lot of money in very short order. Over the cycle, it usually wins.

‘There are a lot of quantitative traders out there following momentum strategies under a range of names and guises. A lot of hedge funds have this strategy. Commodity Trading Advisors (CTAs) do as well. Many quant funds or smart beta ETFs also follow this strategy.

‘Numerous retail traders also follow a similar strategy. Technical analysis is (usually) just a flavour of momentum trading.’

You can read his full article here, by the way.

What the big funds are doing and thinking…

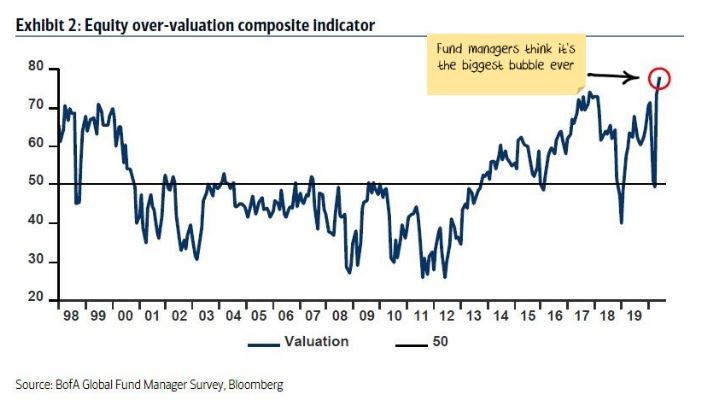

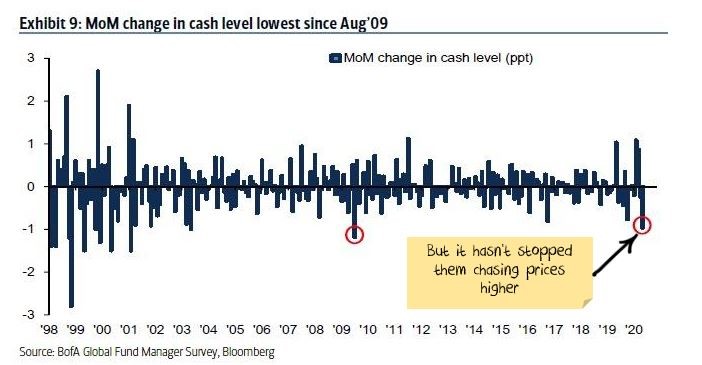

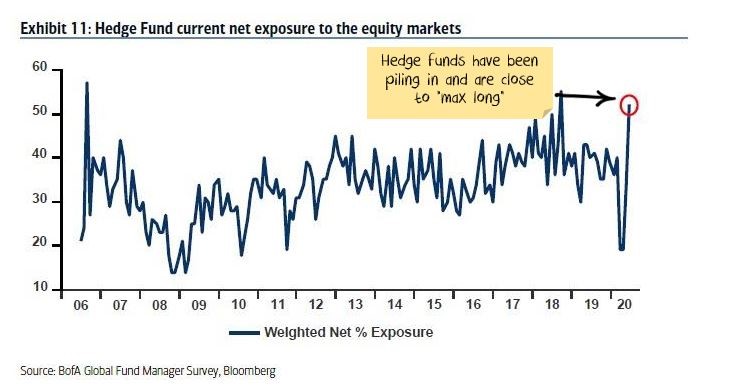

What follows are some of Klassen’s annotated charts from the June 2020 Bank of America Global Fund Manager Survey report.

This report ‘canvasses the views of approximately 200 institutional, mutual and hedge fund managers around the world.’

It shows some very conflicting trends amongst fund managers.

What follows are three of the most interesting charts I’ve come across since this rally started.

|

|

|

Source: MacroBusiness |

|

|

|

Source: MacroBusiness |

|

|

|

Source: MacroBusiness |

Taken together, you can see the immense cognitive dissonance amongst fund managers.

This is a term from psychology, where your beliefs and actions conflict.

As you can see, fund managers think everything is overpriced, are chasing higher prices, and are plunging cash into equities.

How do you beat the herd?

It could be as simple as time.

I’ll explain.

If you have a longer investment horizon — i.e. the time you expect to hold a stock or portfolio — you have a chance at beating the herd.

This means you are an investor, not a trader.

The funds and the technical retail traders are trying to grind out a steady return over a smaller time frame.

They are aiming for certainty or near certainty at the expense of sound reasoning, as the charts above show.

But if you can stick it out for a few years with a stock that has great prospects and big trends driving the flow of money into its industry — well, you just might latch onto the next FAANG-style stock.

Even in a sideways market or bear market.

This is the methodology behind our Exponential Stock Investor service.

You can learn all about it, right here.

Regards,

Lachlann Tierney,

For Money Weekend

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.