CSL [ASX:CSL] released an investor briefing presentation on Monday, providing further detail on its Vifor acquisition, along with a business and strategy update.

CSL believes its recent US$11.7 billion acquisition of iron deficiency business Vifor will accelerate the company’s growth by bulking up its product pipeline, even if questions over ‘IP cliffs’ remain.

CSL shares traded flat on Monday and are down 7% year to date.

Source: tradingview.com

CSL’s 2022 briefing

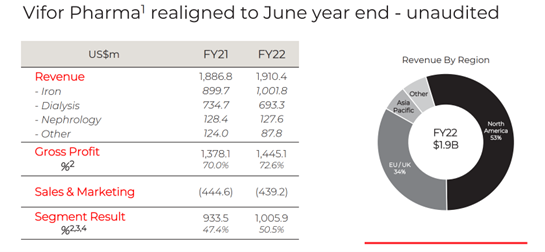

CSL said its Vifor segment offers exciting growth potential, with CLS Vifor expected to provide ‘low to mid-teens NPATA per share accretion in the mid-term.’

Why?

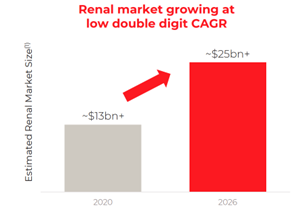

CSL said Vifor’s focus on iron deficiencies opens a big untapped market.

CSL said diseases for iron deficiency offer ‘untapped potential in patient blood management, heart failure, women’s health and fatigue.’

Incorporating the Vifor acquisition, CLS released a new FY23 outlook:

- Revenue growth is now expected to be around 29% at constant currency.

- NPATA is expected to grow between 13–18% to $2.7 billion and $2.8 billion at constant currency.

Source: CSL

CSL chief executive Paul Perreault offered his thoughts:

‘There is a lot more to this business than just viewing it as an earnings erosion story following loss of exclusivity.

‘Operationally there is a lot of complexity to what Vifor Pharma actually does. Iron is actually harder [than plasma] and when I say harder, it’s hard as a rock. Many of you know iron ore in this country, and it does start with iron ore. It is a very difficult process… it’s not that other people can’t make it, but it is complicated.

‘There are enormous opportunities to grow the iron franchise – to drive new indications, expand into new geographies and improve access.’

CSL also gave an update on its chronic kidney disease (CKD) segment, in which it works to develop treatments surrounding a condition that is ‘a leading cause of mortality and morbidity around the world.’

CSL reported an annual growth rate of 8% in cases of CKD.

Source: CSL

CSL also reported that it remains a market leader in the low-iron markets, taking 29% of overall global market share by Q1 2022 and snatching US$1 billion in market sales since 2019.

CSL also reported that, for its dialysis segment, it sees a ‘promising update in the US’ off the back of a large number of patients not having their medical needs met, with moderate to severe symptoms occurring in 40% of patients.

US policies are also being fast-tracked to improve access to treatment.

Five inflation-busting stocks

Few are immune to inflationary pressures. The malaise is widespread.

Households and businesses all over are feeling the pinch.

But some businesses are better placed to deal with inflation than others.

In fact, some stocks might even be ‘inflation busters’ in the current environment.

Our team has recently put together a research report on our five top dividend stocks.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia