It’s a Bitcoin [BTC] and crypto bloodbath! Prices are still under pressure. Bitcoin is US$34,398 and Ethereum [ETH] US$2,101. They are down 24% and 40% over the last week respectively.

Welcome to crypto! Just when everyone gets crazy bullish, along comes the steam train. I’ve seen this go around more than once.

What does it all mean? The answer is probably nothing.

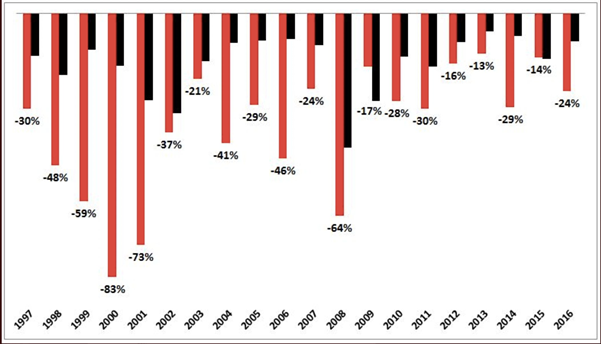

By way of example, let me show you the following chart:

|

|

|

Source: Twitter |

What are you looking at? It’s the drawdowns over the journey for Amazon.com Inc [NASDAQ:AMZN] stock since it listed over 20 years ago.

Do you know anyone that bought the stock and held on the whole way? I only know one guy: Jeff Bezos!

He now happens to be the second-richest dude on the planet. Or maybe he’s number one again. I haven’t checked since Telsa’s stock got the wobbles a bit.

Either way, Bezos hitched his wagon to Amazon in 1995 and is still there.

You have to think of crypto in the same way, in my opinion, if you’re going to get involved.

You either invest in and hang on for dear life, or don’t go near it.

The world in between is where you get chopped to pieces. Trying to time this beast is about as sane as corralling a Spanish bull with a spear point already in its back.

But I thought you’d like to hear from our crypto specialist, Mr Ryan Dinse:

He tells us:

‘By playing the long game, you don’t need to be hasty here.

‘You can start to put more money in with plans to put more in if it falls further. Or you can just dollar cost average in no matter what on a regular basis…

‘I’m of the firm opinion crypto is here to stay. It’s just how long it’ll take to upend the existing financial system that is unknown.

‘Lastly, the final way you manage risk is by deciding how much of your overall portfolio you’re willing to risk in this space…

‘The beauty is, the upside is so great over the long term, even a small holding could make life-changing money over the years to come.’

The history of crypto so far says the big dips in bitcoin, and cryptos in general, are buying opportunities. To get ongoing coverage of the ‘new money’ transition, go here for Ryan’s latest service.

I told you last week that the framework that guides my long-term economic and financial forecasting is the real estate cycle. The twin drivers of this are land values and bank credit.

It makes keeping tabs on the health of the financial system much easier because you can do away with most of the peripheral data like GDP growth and wage rates and blah blah.

We got a nice check in on the American housing market thanks to the recent issue of The Economist. Check it out:

‘During the pandemic America’s housing market has behaved oddly. Prices have increased rapidly, even as the economy fell off a cliff, defying predictions.

‘In contrast with the last recession, few people have defaulted on their mortgages. A less-noticed trend is that the home-ownership rate has jumped…

‘Long-term demographic change is another important factor behind America’s rising home-ownership rate. Millennials, on average, are less likely to be home-owners than their parents were at the same age.

‘Blame that in part on high levels of student debt, which make other sorts of borrowing difficult. Nonetheless the millennial generation is entering its prime home-buying period (the median age of a first-time home-buyer is 34). After falling prior to 2012, the share of 30-somethings in the overall American population is now rising.’

US housing is absolutely booming right now. Home builders are going gangbusters and US banks are loosening their credit policies to let more people in.

This is not a trend I started following last week. I’ve been writing on it in the Daily Reckoning since 2013.

All this is perfectly in accord with the real estate cycle that we discuss over at Cycles, Trends & Forecasts. You should be signed up if you aren’t already. You’re flying blind without it.

What does the cycle call for now? ‘Lavish government spending’ is one thing.

The Australian government is moving to form here.

The supposed fiscally conservative Liberal party has thrown their economic policy behind big debts and big deficits.

We can debate the merits of this all day. All you and I need to know is that there are two major risks that have crashed asset markets regularly over the decades: a rise in interest rates or slashed government spending.

Both are not the case in Australia currently. You can now sleep a little easier (unless you’re leveraged in the crypto market 😊).

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.