Belief is a powerful thing.

In some ancient civilisations, parents believed sacrificing their children to the gods was the ultimate offering.

Absolutely crazy, right? But that’s what belief systems make people do…conjure up mythical values that do not exist.

Another thing about these absurd belief systems is, it always seems to be the little guy who’s the one making the sacrifice. Did the high priest ever offer up his children? Not on your nelly.

Anyone who dared challenge the sanity (or more to the point, insanity) of these beliefs more than likely met the same fate…skewered on the altar.

Devote members of the crypto cult were none too happy about my tilt last week at their beloved bitCON.

Figuratively speaking, they wanted this Luddite blasphemer, ‘hung, drawn and quartered’.

Love it. Keep it coming.

Why?

Well, when your position is supported only by ridicule, abuse and blind belief…you got nothing.

It’s so reminiscent of the dotcom era. A time when they conjured up all these hocus pocus reasons as to why a sh*t sandwich was really and truly fillet steak on rye bread.

Other than some plucked out of the air figure, what is Bitcoin’s [BTC] value? Where is the asset backing? What’s its commercial use? Can someone develop a better piece of code that’ll make bitcoin obsolete? Will it be around for thousands of years like gold has been and will continue to be?

Nothing of any real substance comes from the crypto cult believers other than belief. The cult talks about there being an intrinsic value due to the cost to mine a coin…whoop-de-doo.

There’s a conga line of bankrupt property developers who’ll tell you the same sorry story ‘why did the receiver sell it for less than what it cost to develop?’.

Because that’s how markets work sunshine. They ain’t fair and in the longer run, they ain’t stupid either.

Sooner or later, someone starts giggling at the butt naked offering that’s been prancing around in all its supposed finery.

In the 17 March 2021 issue of The Rum Rebellion titled ‘BitCON Is Funnier than an Irish Joke’, I wrote (emphasis added):

‘The latest line of reasoning as to why Bitcoin is worth X thousands of US dollars is…because of what it costs (in electricity usage) to “mine” new coins.

‘To quote from tradeblock.com…

“Using our above assumptions and the current network hash rate of (~113,000,000 TH/s) and the number of bitcoin mined per block (~12.73, which includes transaction fees), the gross cost to mine one bitcoin at current levels with current device types would be US$6,851.

“Our breakeven price estimate of US$6,851 is in line with similar break evens calculated in other reports: Cost to breakeven US$8,000 (11/11/19); Cost to breakeven US$7,600-3,600 (12/5/19).”

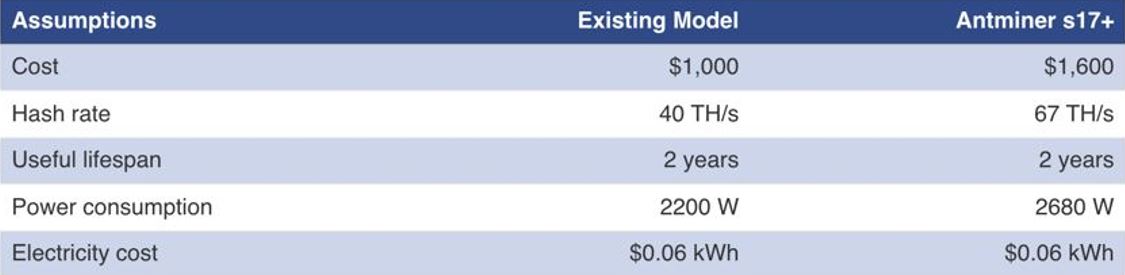

‘These are the assumptions used to calculate the “mining” cost…

|

|

| Source: tradeblock.com |

‘I wonder if the environmentally conscious millennials who are buying bitcoin realise how much additional CO2 their responsible for creating?’

Bitcoin’s dirty little secret was exposed in a recent Bank of America report titled ‘Bitcoin’s dirty little secret’.

This is an extract from the 19 March 2021 Citywire article on the BoA report (emphasis added):

‘Our analysis shows that bitcoin’s annual energy consumption now rivals that of some small developed countries like the Netherlands and Czech Republic.

‘With increasing bitcoin prices, the carbon footprint of bitcoin may rise further into the future…

‘The report added that buying one bitcoin has a carbon footprint equivalent to 60 internal combustion engine cars driven for a year.’

Not the best of environmental credentials.

Where’s the outrage from the climate change cult on this one? Not a peep. Could it be they hold dual cult memberships?

Perhaps Greta Thunberg and co should be made aware of this from the Bank of America report identified this (emphasis added):

‘Bank of America also assessed bitcoin’s ESG [environment, social and governance] credentials. It said that the cryptocurrency has a mixed record on social and governance records, and a bad one on the environment, as it is designed to increase in complexity with demand, which results in increasing energy consumption.’

With institutions bending over backwards these days to be the ‘the wokest of woke’, surely, bitcoin’s rather large carbon footprint would exclude it from institutional portfolios?

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Not so.

This is from the February 2021 issue of The Gowdie Letter:

‘And I noticed this the other day on Yahoo! Lifestyle…

|

|

| Source: Yahoo! Lifestyle |

‘To quote from the 22 January 2021 article:

“BlackRock, Wall Street’s biggest money manager, is opening the door to investing in bitcoin futures in a potential boost for the controversial cryptocurrency.

“Securities filings from the investment giant show at least two BlackRock funds may buy bitcoin, a digital currency which has seen wild swings since being introduced over a decade ago.”

‘How does that align with the company’s ESG (environmental, social and governance) policy?

‘These are extracts from the Blackrock CEO’s 2021 newsletter regarding its commitment to the environment…

“2020 was a historic year of climate change commitments by corporations, governments, and investors alike. These commitments are centered on achieving ‘net zero’ — that is, building an economy that emits no more carbon dioxide than it removes from the atmosphere by 2050, the scientifically-established threshold necessary to keep global warming well below 2ºC.”

‘AND

|

|

| Source: Blackrock |

‘Companies won’t invest in coal miners, but are happy to support the activities of bitcoin miners?

‘Interesting.’

And Blackrock isn’t the only insto looking to cash in on the demand for all things crypto (emphasis added)…

‘Fidelity Investments is preparing to launch its own bitcoin exchange-traded fund as the investment giant works to cement its clout in the market for digital assets and virtual currency.’

CNBC, 24 March 2021

This takes me back to the dotcom boom.

Towards the peak, fund managers, in a frantic fee-driven desire to meet the demand from tech cult members, rushed anything dotcom related to the market.

After the bubble burst, the tech funds were quietly taken to the industry’s product graveyard…their names to never be mentioned again.

The Bank of America report also touched on another aspect of the cult-like nature of bitcoin (emphasis added):

‘Extreme volatility and lack of liquidity in bitcoin is contributed to by its high concentration of ownership, which also makes it hard for it to become adopted as a mainstream currency in the future…

‘As a reference point, we note that about 95% of total bitcoin is owned by the top 2.4% of addresses with the largest balances.

‘In our view, the fact that such a small percentage of bitcoin accounts hold most of the BTC in circulation makes this instrument impractical as a payments mechanism or even as an investment vehicle.’

Bitcoin’s high priests are playing the masses like a fiddle.

Controlling supply and whipping up demand with a brilliantly orchestrated PR campaign…appealing to inherent distrust people have of all things government.

As I wrote in The Gowdie Advisory on 26 November 2020 (emphasis added):

‘My views on cryptos are well known.

‘I don’t get it.

‘Someone develops a blockchain computer code that becomes a store of wealth.

‘How is that possible? For me, I can only explain it away as nothing more than a cultish-like belief. People believe it is so, therefore it becomes accepted wisdom.

‘The question I’ve been mulling over is this…“Are the majority with the least, being played by the minority with the most?”

‘This is from Bloomberg on 19 November 2020 (emphasis added):

“The fact remains that there’s nothing widespread about Bitcoin ownership.

“A few large holders commonly referred to as whales continue to own most Bitcoin. About 2% of the anonymous ownership accounts that can be tracked on the cryptocurrency’s blockchain control 95% of the digital asset, according to researcher Flipside Crypto.”

“Could the 2% be manipulating the price to send the ‘rats and mice’ into a frenzy? Forgive me for being a little sceptical.”

I’m looking forward to this week’s emails…full of intoning, chanting and vitriol, but absent any hard data to support the price of bitcoin being the equivalent of a very healthy deposit for a home.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.