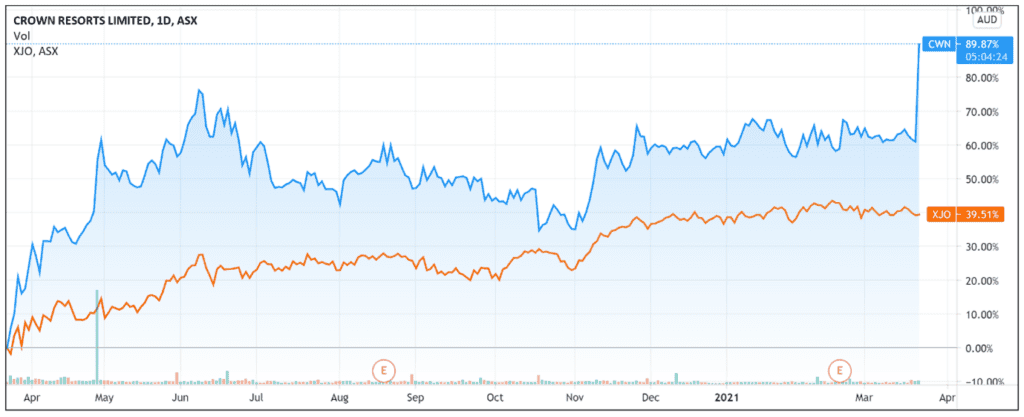

The Crown Resorts Ltd’s [ASX:CWN] share price is up more than 18% in early trade after confirming an $8 billion offer from Blackstone.

This morning, Crown confirmed Blackstone’s bid after the Australian Financial Review first reported the existence of the offer on Sunday night.

Today’s ASX announcement by Crown revealed that it received an unsolicited, non-binding and indicative proposal from a company acting on behalf of Blackstone and its affiliates.

Blackstone offered to acquire all shares in Crown via a scheme of arrangement at an indicative price of $11.85 per share.

For reference, the Crown share price closed at $9.86 per share last Friday.

The company noted that Blackstone’s indicative price would be reduced by the value of any dividends or distributions declared or paid by Crown.

The news sent the company’s share price soaring.

At 11:00am, the Crown share price is up 18.4%, trading at $11.675 per share, 1.5% down from Blackstone’s indicative share price offer.

This represents Crown’s best share price performance since February last year.

Blackstone’s $8 billion bid for Crown

Blackstone is a global investment firm investing capital on behalf of pension funds, large institutions, and individuals.

The private equity group already has a 9.99% shareholding in Crown, acquired from Melco Resorts for $8.15 per share last April.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

The proposal is subject to several conditions.

Apart from due diligence and debt finance arrangement requirements, the success of the bid rests on a unanimous recommendation from Crown’s board and a commitment from all Crown directors to vote in favour of the proposal.

Right now, the Crown board is yet to form a view ‘on the merits of the Proposal.’

The company stated it would initiate the assessment of Blackstone’s bid, which will involve engaging with relevant stakeholders including regulators.

Blackstone must also receive regulatory confirmation that a Blackstone-owned Crown is ‘considered a suitable person to continue to own and operate the Sydney, Melbourne & Perth licences.’

Will the Crown bid succeed?

As the Australian Financial Review pointed out, Blackstone’s offer follows an unsuccessful $10 billion proposal from Las Vegas casino operator Wynn Resorts two years ago.

The buyout collapsed after Wynn Resorts abruptly ended talks with Crown in April 2019.

Reports at the time suggested that the casino operator did not appreciate its confidential discussions being made public.

So an offer alone is not a guarantee the buyout will go ahead.

Crown itself noted in today’s ASX announcement that ‘there is no certainty that the Proposal will result in a transaction.’

Crown advised its shareholders that they ‘do not need to take any action in relation to the Proposal at this stage.’

Additionally, Blackstone’s offer comes just as Crown is facing royal commissions in Victoria — which starts on Wednesday — and Western Australia concerning Crown’s suitability to hold its Victorian and Western Australia casino licences.

Blackstone would no doubt be aware of this and their proposal suggests they anticipate the royal commissions will not be calamitous.

However, there will always be uncertainty over what the commissions will find. If royal commission findings can be largely anticipated, there’d be hardly any need for royal commissions.

That said, Blackstone may well leverage Crown’s impending regulatory headaches by positioning itself as someone who can represent a fresh start for Crown in the eyes of federal and state regulatory authorities.

As Reuters reported, Blackstone recently acquired the Bellagio resort in Las Vegas for $4.25 billion. The company also owns another casino resort in Las Vegas as well as Spanish gaming hall operator Cirsa.

With Crown’s board still needing to assess Blackstone’s proposal and with an upcoming royal commission sure to keep Crown in the news, we could see Crown shares move either up or down quickly.

At the end of the day, knowing how to trade during volatile periods for stocks could give you an advantage.

If you want to gain some extra knowledge, then check out our trading veteran Murray Dawes’ free report here. He reveals his unique strategy that may improve your probability of success while limiting your downside risk.

Regards,

Lachlann Tierney

For Money Morning