Creso Pharma Ltd [ASX:CPH] hired a North American cannabis executive to expand its US business after New York State legislates recreational cannabis.

In a bid to gain a foothold in the US, Creso today announced it hired John Griese as its Director of US Business Development.

The appointment follows the state of New York passing legislation to legalise, tax, and regulate recreational cannabis in the state.

Although Creso’s update was seemingly positive, investors reacted by sending CPH shares down 4.7% at noon.

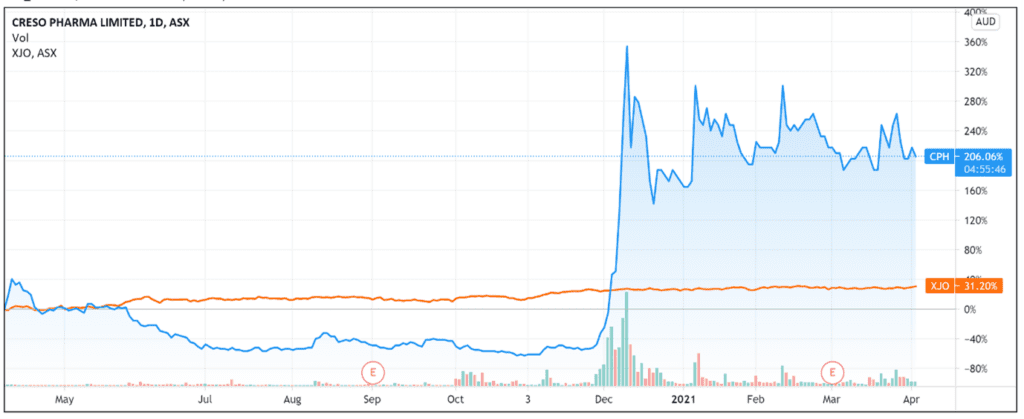

While the CPH share price is down 6% over the last week, the stock is still up 12% YTD and up 230% over the last 12 months.

Source: Tradingview.com

Source: Tradingview.com

Creso hires cannabis executive

Creso announced today that its appointment of John Griese follows the ‘global trend towards cannabis legalisation as well as recent legislation in New York State legalising recreational marijuana.’

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Creso described Mr Griese as a senior leader with nearly 30 years of executive level experience in sales, consumer package goods (CPG), and supply chain management.

Creso noted that Mr Griese also has experience in the cannabis sector, having previous roles with Creso (as its Americas Chief Operating Officer) and Blooms Farms.

Additionally, his most recent role was Chief Operating Officer at Supreme Cannabis Company, which is listed on the Toronto Stock Exchange.

As COO, Mr Griese was involved with product development, commercialisation initiatives, procurement, manufacturing operations, and supply chain management.

In his new role as Director of US Business Development, Mr Griese will ‘pursue revenue generating and value accretive opportunities in the North American market to further establish Creso Pharma’s footprint ahead of the potential legalisation of recreational cannabis.’

New York state legislates recreational cannabis

Last Wednesday, New York Governor Andrew Cuomo signed a bill that will permit recreational sales of marijuana to begin in the state next year.

The New York Times reported that the first sales of legal marijuana may even be more than a year away because officials will first face:

‘The daunting task of writing the complex rules that will control a highly regulated market, from the regulation of wholesalers and dispensaries, to the allocation of cultivating and retail licenses, to the creation of new taxes and a five-member control board that would oversee the industry.’

The legislation would create a new Office of Cannabis Management (OCM), which would be controlled by a Cannabis Control Board.

The OCM would then regulate the sale and distribution of recreational and medicinal cannabis in the state.

Creso stated that following New York’s legalisation of recreational cannabis, Mr Griese will focus on New York, Vermont, and other states to ‘delineate a strategy for Creso Pharma to begin delivering products into the USA.’

Global X Research analyst Pedro Palandrani estimates that New York’s sales should be between US$2.5 and US$2.7 billion in the first year based on Governor Cuomo’s forecast of US$350 million in cannabis tax revenue.

For context, Colorado achieved US$2 billion in total cannabis sales in 2020 after more than five years as a recreational market, according to Colorado’s revenue department.

According to Reuters, news of New York legalising recreational marijuana pushed an ETF tracking US pot producers’ stocks up more than 6%.

Creso share price outlook

While Creso’s management was excited by the announced developments, ‘confident that [Mr Griese] will unlock a number of potential opportunities for the company throughout the US,’ the market’s reaction wasn’t so upbeat, with CPH shares down 4.7%.

Why are investors selling off Creso shares?

It is difficult to say but one reason could be profit taking, with some investors potentially seeing today’s news as a good opportunity to sell their stakes.

Investors may have also been anticipating more concrete developments.

While Creso’s new hire has experience in the North American cannabis industry, his role to ‘pursue revenue generating and value accretive opportunities’ is likely an objective that investors already expected Creso to have.

And while Mr Griese may be highly experienced, investors probably realise that the biggest hurdle for Creso is federal regulation.

As the company itself pointed out, Creso’s ‘ability to export its cannabis products into the USA will remain subject to the federal legalisation of cannabis.’

Competition is also a factor.

Investors may be taking a cautious approach and seeing how Creso fits into a landscape where legalisation of cannabis invites more competition.

For instance, the second largest US pot producer by market value — Green Thumb Industries — reacted to New York’s legislation by stating it will allocate ‘significant dollars’ to the New York market.

What is Creso’s competitive advantage?

Creso believes its established footprint in the Canadian recreational market via its subsidiary Mernova will provide it with a ‘first-mover advantage in the US’ following federal legislation.

Creso noted that it and Mernova successfully navigated Canadian regulations to launch 10 recreational cannabis products across four Canadian provinces.

Mernova operates a fully-licensed 24,000 square foot cultivation and growing facility 219 miles from the US border.

Creso believes this provides the ‘ideal location to service the North American recreational cannabis market’ following federal legislation.

Investors may have been unenthused about Creso’s announcements today, but the months ahead will present a clearer picture of where Creso stands in the shifting cannabis sector.

If you would like further insights into the evolving regulatory picture regarding cannabis, as well as discussion of three different ASX-listed cannabis companies, then be sure to check out this free report.

Regards,

Lachlann Tierney,

For Money Morning