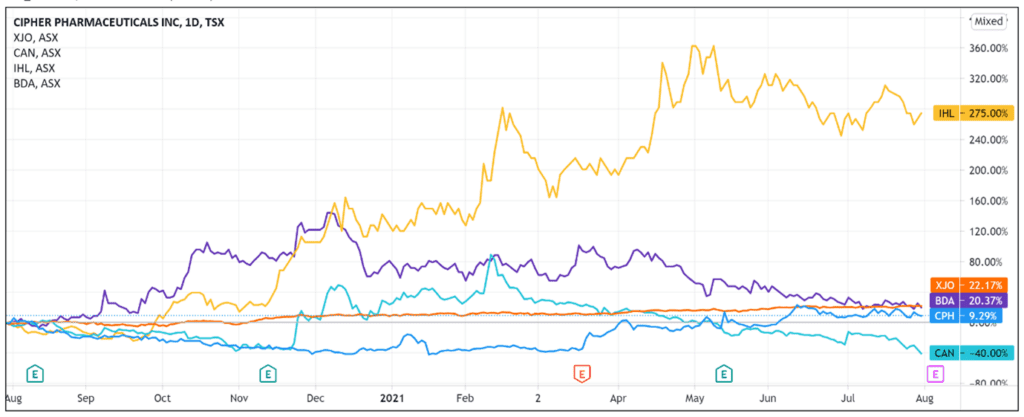

The Creso Pharma Ltd [ASX:CPH] share price is up 9% after the release of its June quarter results.

CPH shares were trading for 12 cents at time of writing.

Creso said the quarter marked the second consecutive quarter of record revenue growth as the pot stock also entered a definitive agreement to merge with Red Light Holland to create HighBrid Lab.

Creso’s busy quarter

The pot stock packed plenty of developments this quarter.

For one, Creso finalised its US OTC dual listing. In the process, it gained exposure to ‘deeper capital market and greater levels of liquidity.’

But the biggest development was CPH and Red Light Holland entering a definitive agreement to merge and create HighBrid Lab, a ‘leading cannabinoid and psychedelics company.’

Red Light Holland is an Ontario-based firm producing magic truffles to the recreational market in the Netherlands.

Under the scheme, Red Light will acquire all issued fully paid ordinary CPH shares and all the issued listed options in exchange for the issue of common shares of Red Light.

Creso shareholders are set to receive 0.395 of a Red Light Holland share for each fully paid ordinary share of Creso.

Creso said that under the scheme, former CPH shareholders would own about 57.4% of the pro forma issued and outstanding shares in Red Light.

Creso’s Non-Executive Chairman Adam Blumenthal said the merger offered numerous synergies that can have an immediate impact:

‘Red Light’s CSE-listed vehicle will allow the Combined Company to enter the lucrative US market and we anticipate that product sales through our recreational cannabis and CBD subsidiaries will scale up significantly in the short term, underpinning early cash generation and provide additional financial flexibility across the business.’

CPH grows revenue…and operating losses

The June quarter saw Creso generate revenue of $1,633,000, an 18% increase on the previous period — $1,385,000.

The result marked the second consecutive quarter of ‘record revenue growth.’

The latest quarter’s revenue also grew 451% compared to 2020’s corresponding quarter, when Creso registered $311,00 in customer receipts.

However, while the company’s revenue grew, so did its operating losses.

Creso ended the June quarter with a net cash loss from operating activities totalling $6.94 million.

This was up from net cash operating loss of $6.35 million in the March quarter.

Year to date (six months), CPH is sitting on a net cash loss from operating activities in excess of $13 million.

The operating losses reduced Creso’s cash and cash equivalents from $18.57 million at the start of the quarter to $13.56 million at the end of it.

Pot stocks can be volatile, but the wider cannabis and psychedelic trend is one worth following.

If you’re looking for more insights into the sector and pot stocks in particular, then check out our latest free report, which discusses three pot stocks worth looking at right now.

Get your free copy here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here