At time of writing, the share price of Creso Pharma Ltd [ASX:CPH] is up more than 6%, trading at 24 cents.

You can see the CPH share price bouncing off a level below before pushing higher again:

Source: tradingview.com

Creso Pharma has inked a deal for a minimum order of $2.48 million.

Highlights from today’s CPH announcement

Here are the key bits from today’s announcement out of CPH:

‘▪ Creso enters into Distribution Agreement with Route2 Pharm Pvt Ltd in Pakistan, for the exclusive distribution of Creso Pharma’s products into Pakistan and Philippines, as well as non-exclusive distribution into other potential target markets (‘Agreement’)

‘ ▪ Agreement contemplates combined minimum order quantities for the first contractual year of up to CHF1.71 million (AUD$2.48 million1) across CannaQix 10, Cannaqix 50 and CannaDOL product lines, pro-rata subject to timing of product registrations.

‘ ▪ Agreement follows a landmark decision by the Government of Pakistan allowing Pakistan to enter the billion-dollar Cannabidiol (CBD) market2

‘ ▪ Pakistan has a population of over 216 Million people and a wide range of unmet needs that can be addressed by a targeted portfolio of products’

$2.58 million doesn’t sound like much against a current market cap of more than $200 million at time of writing.

But it shows to investors that the company is getting some long-awaited traction.

Here’s how I think the future will play out for CPH…

Outlook for CPH share price

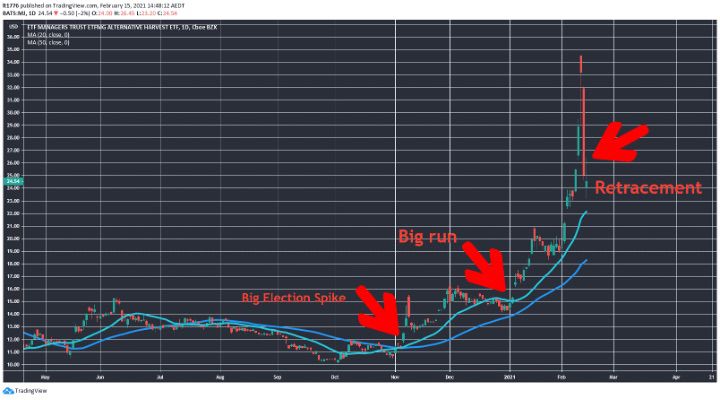

For a quick pulse check on the global cannabis market, you can look at the ETFMG Alternative Harvest ETF [MJ]:

Source: tradingview.com

Post-US election it went flying up.

The regulatory environment over there looks to be softening.

It also looks to be halting the slide as well.

This bodes well for the future outlook for the CPH share price.

If you are looking to learn more about the ASX-listed pot stock mini-sector, be sure to check out this free report.

It’s a great bit of research on the potential of three pot stocks and the various risks involved in investing in these companies.

Regards,

Lachlann Tierney

For Money Morning