At time of writing, the Creso Pharma Ltd [ASX:CPH] share price is up 1%, trading at 20.2 cents.

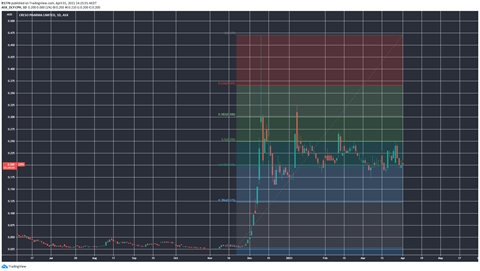

The CPH share price exploded higher in December 2020 on a wave of positive news, and looks to be bouncing off the .618 Fibonacci level in the chart below:

We look at their newest CBD tea product and the outlook for the CPH share price.

Highlights from CPH’s announcement today

Here they are:

‘▪ Creso Pharma launches three new CBD based tea products under established and recognised cannaQIX® brand ▪ New products include: cannaQIX® tea, cannaQIX® NITE tea and cannaQIX® Immunity tea

‘▪ Products are based on a 2nd generation newly developed technology optimising CBD content and taste, and provide Creso Pharma with an opportunity to expand its target consumer base into the mainstream convenience food and beverage market.

‘▪ Launch follows German Federal Court of Justice ruling annulling charges against tea sellers, opening up the German market for food products based on hemp flowers

‘▪ Creso Pharma to sell the tea products to its existing distribution network comprised of over 2,100 points of sale including pharmacies, drugstores and retail chains to consumers in Switzerland, with additional European territories earmarked for near term expansion, including Germany.’

All positive things, particularly the regulatory change in Germany.

There are plenty of ASX-listed pot stocks going after the German market, and Europe more generally.

Germany is not alone; Thailand is liberalising its cannabis infused food and beverage policies, as per Bloomberg coverage.

Regardless of where you stand on the issue, the renaissance for ASX-listed cannabis companies points to the fact that this is big business.

Beyond that, a part of the reason I think CPH is holding a level at the moment is steady positive news flow out of the company.

So often I see companies pullback hard after a big spike because investors exit due to a lack of further progress or information.

Outlook for CPH share price

I think this time around the interest in companies like CPH may have a much more solid fundamental foundation behind it.

As in ASX-listed cannabis companies, despite their inherently speculative nature, may well move more quickly towards profitability than in say 2017 or 2018.

It’s the Gartner hype cycle all over again — and many are emerging from a ‘trough of disillusionment’ as we speak and starting to hold a level after a long-dormant period and a burst.

Future catalysts for upward momentum would be regulatory changes opening up new markets.

It’s hard to see governments around the world reversing course on these changes too — especially considering the potential tax revenue these products and companies could bring in.

The pandemic has squeezed budgets around the world so that’s definitely something to consider.

Beyond that, at some point it may become a case of a saturated market.

We aren’t there yet though I think — and if you want insights into the evolving regulatory picture and three different ASX-listed cannabis companies be sure to check out this particular report.

Large multinational companies may take the plunge on the products squeezing out small players like CPH or opportunistically acquiring them should their share prices sink too low.

These are just some of the risks you should have an eye on when trading volatile stocks like CPH.

To get the full rundown on how to manage risk when trading stocks, be sure to read this report on trading strategy and charts by our chart guru Murray Dawes.

He runs the excellent Pivot Trader service, and you will definitely learn a few valuable points about charting.

I recently sat down for one of his presentations and it opened my eyes on chart analysis.

Definitely worth your time.

Regards,

Lachlann Tierney

For Money Morning

Comments