The Creso Pharma Ltd [ASX:CPH] came out of a trading halt to announce its acquisition target Halucenex has upped its psilocybin inventory.

The medicinal cannabis company thinks the increased psilocybin supply can expedite clinical trials and R&D programmes.

While rising 2.7% in early trade, the CPH share price has retraced since, down 2.6% at the time of writing.

Despite the market’s flat response to the announcement, the Creso Pharma share price [ASX:CPH] is still up 160% over the last 12 months, although the stock is trading sideways year-to-date.

Halucenex boosts pharmaceutical-grade psilocybin supply

Creso announced today that its target acquisition company Halucenex Life Science has almost doubled its synthetic psilocybin supply.

Halucenex secured an additional 10g, increasing its inventory to 22.3g.

For reference, Halucenex’s Canadian peer Numinus is an integrated mental health company developing products for ‘psychedelic-assisted psychotherapy.’

Numinus received new amendments under Canada’s Controlled Drugs and Substances Act in March 2021, allowing it to increase the amount of psilocybin produced to 750 grams.

Nevertheless, Creso reported that Halucenex’s growing inventory makes Halucenex ‘one of the largest holders of single batch GMP grade synthetic psilocybin in Canada.’

Why is the Halucenex update important?

As Halucenex Founder and CEO Bill Fleming explained:

‘There is strong competition and a bottleneck in the current psilocybin supply chain, so to nearly double our inventory is a significant value accretive event, which significantly derisks clinical trial timelines.

‘Securing additional inventory also highlights the strength of our relationship with Canada’s only synthetic psilocybin manufacturer.’

Creso noted that the additional supply gives the company ‘considerable optionality’ regarding its proposed clinical trials and R&D initiatives scheduled for Q321.

One benefit from a larger psilocybin inventory is the capacity to increase the total number of clinical trial participants in Halucenex’s pending phase II trial.

It also ensures participants in future phase II and III trials receive the same GMP psilocybin batch for tracking and traceability purposes.

Creso also believes Halucenex can use the additional psilocybin to ‘integrate other beneficial compounds including those in Creso Pharma’s current product range,’ creating custom solutions for new drug development.

Creso anticipates that the bolstered inventory presents opportunities that may ‘considerably broaden the total addressable market’ for CPH and Halucenex.

ASX and global pot stocks: the big picture

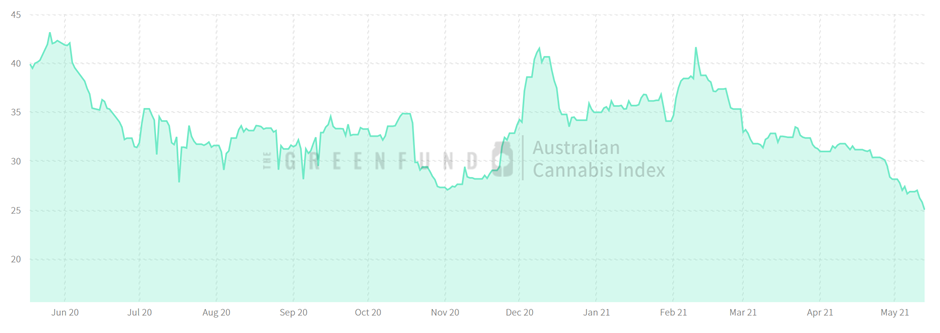

Green Fund’s Australian Cannabis Index represents the overall publicly traded market for Australia’s cannabis sector — depicts a somewhat volatile 12 months for ASX pot stocks.

Source: Green Fund

Source: Green Fund

The Aussie index, which has Creso as a constituent stock, is down 37% over the last 12 months.

However, New Cannabis Ventures’ Global Cannabis Stock Index is up over the same period.

The Global Cannabis Index gained 115% since May 2020.

Source: New Cannabis Ventures

Source: New Cannabis Ventures

But, as readers can see from the chart, the global index is off its January 2021 peak by 40% and currently facing a downward trend.

Creso outlook

Both Creso and Halucenex believe today’s announcement strengthens their position in a competitive sector.

Creso’s update highlighted a ‘bottleneck in supply of synthetic psilocybin’, arguing the additional 10g of the substance grants it a ‘significant competitive advantage.’

However, after coming out of a trading halt following the release of today’s announcement, Creso was met with a lukewarm reception.

Did investors expect the announcement to pack a bigger punch when they first heard Creso was entering a trading halt?

Certainly, Halucenex securing more supply of a critical ingredient is positive for CPH.

But investors may have been seeking more important news.

It could also be the case that the market didn’t place as much importance on the benefits of growing a psilocybin stockpile as Creso did.

After all, while inputs are essential, the Creso and Halucenex branded outputs will most contribute to its earnings.

And in that regard, today’s announcement wasn’t particularly concrete.

For instance, while the additional 10g allows Halucenex to boost its clinical trial participant numbers, it does not in itself expedite or secure the clinical trial’s success.

Creso also flagged that the more extensive psilocybin inventory can help Halucenex ‘integrate other beneficial compounds’, including those in CPH’s current product range.

But Creso didn’t elaborate on what these beneficial compounds could be, only noting that research into them will begin following receipt of a Controlled Drugs and Substances Dealer’s License from Health Canada.

Today’s movement of CPH shares may reflect a market that has largely priced in Halucenex’s position in Canada’s psilocybin supply chain.

If you would like further insights into the evolving regulatory picture regarding cannabis, as well as a discussion of three different ASX-listed cannabis companies, then be sure to check out this free report.

Regards,

Lachlann Tierney,

For Money Morning