Shares in Coronado Global Resources [ASX:CRN] fell 4.6% to $1.85 apiece today after the coal producer revised down its full-year production guidance.

Due to disruptions at its QLD Curragh mine and Buchanan mine in Virginia, US, the company’s production guidance has been lowered from 17 million to 16.3 million tonnes.

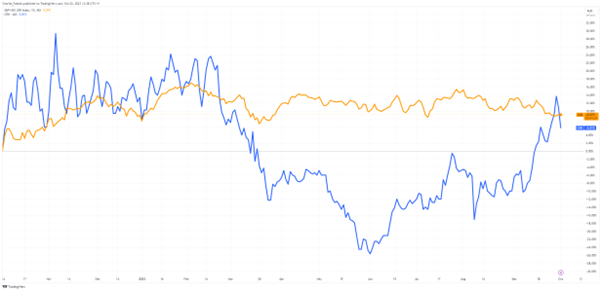

Although the company faced a selloff, it has recently experienced a surge along with other coal and energy producers. This is due to a positive shift in coal and steel markets, which have recovered from their bearish sentiments and low prices in late June.

CRN shares rose by 13.11% in the past month, leading to 6.3% growth over the past 12 months. This was helped by Czech private capital company Sev.en Global Investments acquiring a 51% stake in the mining company from fellow private firm Energy & Minerals Group (EMG).

Unfortunately, CRN is no stranger to lowered production guidance and disappointment, so what will the latest news mean for the stock moving forward?

Source: TradingView

Coronado updates guidance for final quarter

Coronado’s announcement today also provided details on some mine site difficulties.

Mining activities at the Buchanan mine were temporarily affected by geological conditions in the coal seam during the September quarter, slowing production rates and impacting yield.

At its QLD mine in Curragh, management revealed that one of the draglines experienced a mechanical failure in the propel unit.

Repairs are already underway and are expected to be completed no later than the end of October. Until then, production from Curragh will be impacted due to the resulting delayed ability to move waste.

Coronado’s FY23 cost-per-tonne forecast has increased to US$97–102 a tonne from a previous range of US$84–87 a tonne, due to the combined impacts of lower volumes and inflation impacts on base costs.

However, the company has said it’s made some capital expenditure efficiencies, with its FY2023 capex guidance revised down to $US220 million from $US240 million.

Executive Chairman Gerry Spindler attempted to remain upbeat about the revision, saying:

‘Notwithstanding these two short-term non-recurring operational challenges, net of the efficiency gains in capital expenditures, we expect this to have a minimal impact on year-end cash on the balance sheet of a maximum $US10million reduction assuming none of the lost production can be recovered.’

The market response today, however, shows investors are understandably concerned.

This is not the first time the company has faced difficulties. With adverse weather conditions affecting late 2022 and early 2023 production in its US mines, the company has faced production challenges that have seen its price-to-earnings multiple remain well below its coal peers and the broader resources sector.

However, the more significant focus may be the approximate $1.6 billion deal to acquire a majority stake by private firm Sev.en.

The firm, led by Czech tycoon Alan Svoboda, has continued its buying spree of Australian coal and power assets that institutional investors have ignored. Now, he is potentially setting his eyes on steel producers.

While the deal still requires regulatory approval, let’s explore its implications.

Outlook for Coronado

The forecasts for Coronado can be simplified into short-term production concerns mixed with potential long-term structural strength.

The production cut is its second such disappointment in the past financial year alone, with significant cuts seen in November 2022. In the face of such challenges, it becomes imperative for CRN to manage its mine risks better and communicate the mitigation steps to investors.

Adverse geological conditions in coal seams are common for miners, but they appear to happen at a higher frequency for Coronado, while the dragline failure in QLD seemed somewhat avoidable.

Coronado’s immediate focus should be on operational efficiency and cost optimisation. The challenges faced at the Curragh mine underscore the importance of predictive maintenance.

Similarly, the Buchanan mine highlights the importance of geological surveys to anticipate and mitigate such frequent disruptions.

Despite these short-term hiccups, the company should be in a stronger long-term position.

The company’s assets still have a long life, with approximately two decades and two billion tonnes of resources split across worldwide projects.

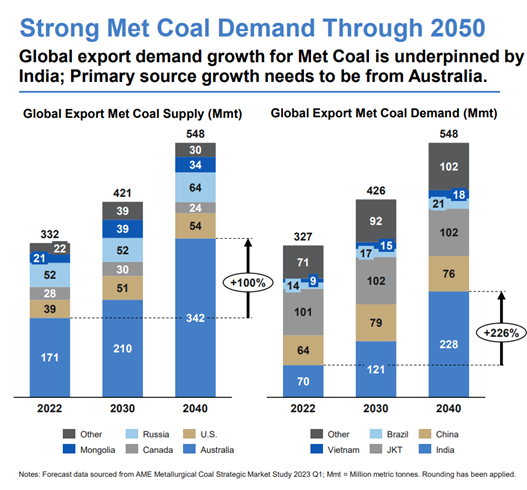

The demand for Met Coal should remain critical for steel production for the foreseeable future, especially as demand from China remains relatively robust and India’s market explodes.

Source: Coronado Half Year Report FY23

Through its diversified approach, the company should weather any adverse regulatory hurdles that may come from government decarbonisation efforts.

The company’s reduced capex guidance is also positive, as it will free up cash for other purposes, such as dividends or share buybacks.

Overall, the impact of Coronado’s revised guidance on investors will depend on the severity of the production disruptions.

Coronado’s current challenges could be overcome by strengthening risk management practices and maintaining transparent communication.

Investors should closely monitor Coronado’s strategic moves under new majority ownership and watch the company’s proactive measures to try and address these cost blowouts and volume drops.

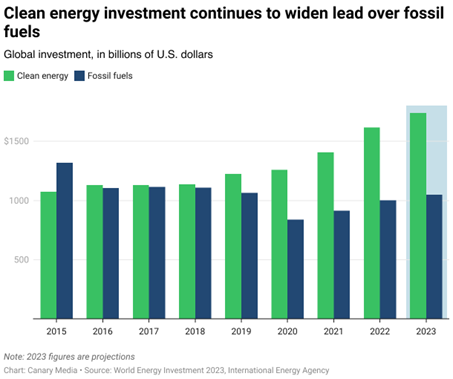

Sev.en’s bet is that they are moving into a sector that still holds strong cashflows as markets underinvest in fossil fuels in the hope of a fast transition to renewables.

The future demand for these resources

Globally, we are seeing governments U-turn on the closure of coal plants, and the renewables rush slow amidst rapidly rising costs.

Few disagree about the shift towards renewable energy, but many disagree on the timeline for a transition that makes economic sense.

Meanwhile, larger investors turn their back on fossil fuels, pushing energy costs up around the world.

Source: IEA

Our Editorial Director Greg Canavan has been looking into the cost and implications of Australia’s energy transition to renewables from a wide-eyed economic perspective.

He thinks he’s found a gap in the market where Australians can follow hedge fund investors and billionaires like Warren Buffett into smart investments before the market realises.

Buffett’s Berkshire Hathaway has seen the writing on the wall and is spending big, including:

- Buying 2.1 million shares of a Houston-based oil producer, one of the largest in the world.

- Increased its stake in Occidental Petroleum to 25%, worth over $13.5 billion.

- Spending $3.3 billion to boost its stake in a LNG export terminal in Maryland.

Warren Buffett is no fool, when the ‘Oracle of Omaha’ makes a move, it’s recommended you listen.

If you want to learn more about how you can position yourself in the coming Net Zero energy environment, and the potential U-turn governments will have to make, then click here.

Regards,

Charlie Ormond

For Fat Tail Commodities

Comments