Australia’s self-proclaimed ‘newest lithium miner’ Core Lithium [ASX:CXO] was up more than 2% Monday afternoon after the company broadcast that one of its deposits yielded outstanding results in the quarter.

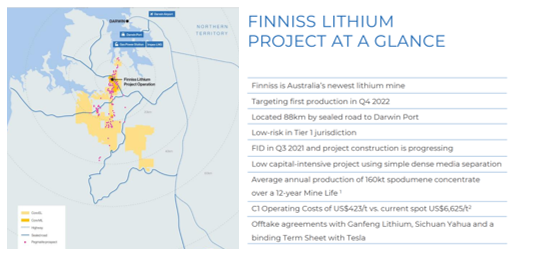

The lithium developer also published a presentation detailing Finnis Lithium Project updates, targets, and overall business strategies.

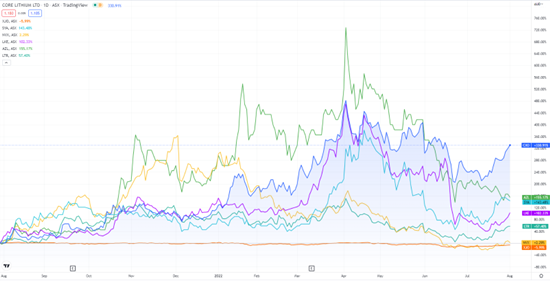

Core Lithium has risen 12% in the last week and is up 100% for trading year-to-date.

Lithium mining peer Arizona Lithium has crashed 10% in the week and month, after hitting all-time highs three months ago.

While Sayona has moved in a more modest parallel to Arizona, it’s up 7% this week and 28% in the last month:

www.TradingView.com

Core lithium: outstanding BP33 drilling results

Core Lithium had positive results to share on Monday morning for its BP33 high-grade lithium drilling at its Finniss Lithium Project near Darwin, which began in May.

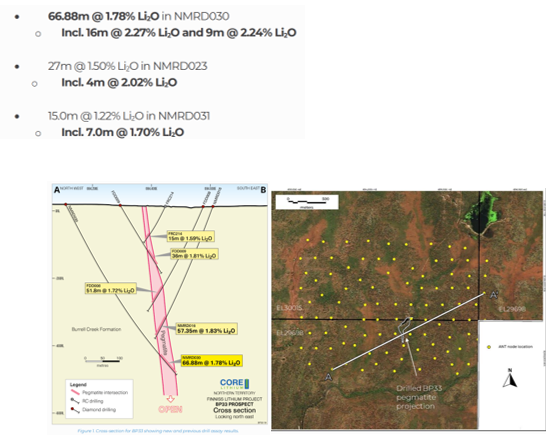

The lithium miner reported the following highlights having now received assay results:

- ‘World-class high-grade lithium found at 66.88m1 at 1.78% Li2O:

o 16m @ 2.27% Li2O; and

o 9m @ 2.24% Li2O

- ‘Multiple drill intersections below southern BP33 pegmatite with the orebody open at depth

- ‘Spodumene bearing pegmatite extends at depth to the south with indications that thickness and grade improve with depth

- ‘Intersections outside of the current Mineral Resource at BP33 expected to deliver substantial orebody extensions

- ‘Trial Geophysical (ANT) survey at BP33 successfully images pegmatite to 500m depth’

Core reported that five more diamond holes with varying thickness have been mineralising as pegmatites at intersections at the southern BP33 site, 420 metres below the surface.

The properties for these spodumene discoveries are below:

Source: CXO

Core’s Chairman Greg English commented on the results:

‘The BP33 orebody appears to be getting better at depth with 66.88m @ 1.78 Li2O, an outstanding result. We are in the middle of our largest ever drill campaign and these latest results more than justify our decision to expand our exploration efforts.

‘BP33 south is open at depth with the Ambient Noise Tomography (“ANT”) survey identifying additional targets at the deposit. The timing of these outstanding results could not have been better, with the final mining approval for BP33 expected in the coming weeks.

‘These new world-class lithium drilling results reflect the confidence Core has in delivering significant resource growth from Finniss that will add to our life of mine and our capacity to materially increase lithium production from northern Australia in the future to keep up with rapidly growing global demand.’

The ANT Geophysical Trial was a survey commissioned by Core to test BP33 pegmatite detection techniques.

It’s now been proven that Finniss’ geophysical identifying techniques are successful.

Core said:

‘The now proven ability to detect subsurface pegmatites at considerable depths (at least 500m) will be a major boost for future exploration. ANT technology is a cost-effective method of informing drilling targets.’

Source: CXO

The race is on

It’s full steam ahead for lithium companies pushing for efficient strategies and supply offtake deals as the lithium-ion battery market ramps up.

On average, Core says it has invested $1.8 million for each year of Finniss’ life in the current plan.

Core has now secured customers in Gardeng Lithium, Yahua, and Tesla to date — all that’s left is to get the product on the move.

The electric vehicle (EV) market is rapidly expanding, boosted further by government initiatives and funding programs supporting production across the globe.

Joe Biden has been publicly campaigning a production boost in the US, Australia has been tightening strategies as it pursues China’s monopoly, and the EU is also chasing its own targets by 2035, desperate to sort its ongoing energy crisis.

But our energy expert, Selva Freigedo, says the global transition to EVs means the industry faces a supply crunch, sending battery materials into a new type of frenzy.

If you’d like to know more, and ensure you’re prepared for the inevitable, we suggest checking out Selva’s report for free here.