Core Lithium’s [ASX:CXO] share price experienced a rocky start to the week, as aggressive shorting of the ASX was the prelude to the share price plummeting 16% to 73 cents in morning trade.

The lithium miner’s stock took a hit following the release of its fourth-quarter update, which revealed a mixed bag of results and subdued guidance for FY24 and FY25.

The update disappointed investors who have been selling off Core Lithium shares. The company’s share price is now down 60% from its all-time high of $1.86 per share in November 2022.

Let’s explore what’s behind the fall in guidance and if there’s an opportunity for investors.

Source: TradingView

Production down amid early mine hiccups

The Core Lithium share price crashed 16% today following the release of the company’s Q4 update, which revealed the company’s lower-than-expected production and cost guidance for FY24 and FY25.

Despite the disappointing outlook, the company posted quarterly spodumene production of 14,685 tonnes — up from 3,589t in Q3.

This contributed to 18,274 tonnes for FY23 at a C1 unit cost of $902 per tonne for the quarter.

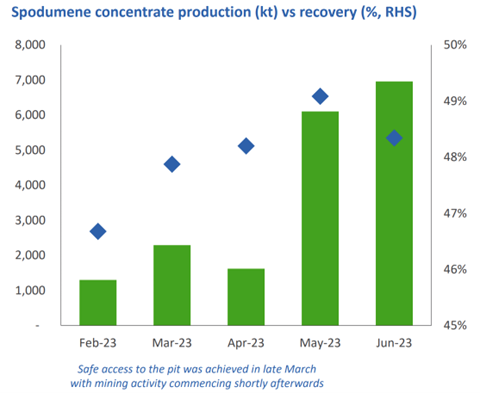

A significant investor concern in the update was spodumene’s low concentration quality and recovery rates.

Source: Core Lithium

CXO shrugged off the lower recovery rates despite being well below test work predictions.

Commentary in the release said it was not uncommon at the start-up phase to see lower recoveries and pointed to peers in the lithium space who demonstrated ramp-up of recovery after initial low rates.

Poor weather in April also played a significant role in production and quality — something the company said it would address in a $11 million investment to improve water management.

For 2024, Core Lithium is guiding for spodumene production of 80,000–90,000 tonnes.

This is lower than estimates due mainly to lower recoveries, mine plan adjustments, and mining rates.

The company expects its C1 costs to increase to AU$1,165–1,250 per tonne as waste stripping costs associated with the Grants open pit continue to sting.

In FY25, Core Lithium expects its monthly mining and processing rates to be above FY24 levels, but its overall production is expected to be below FY24.

That’s approximately 50% lower than Macquarie Equities’ expectations for FY25 production.

This is due to a three-month gap in ore supply from the mine and processing plant capacity constraints.

Core Lithium’s CEO, Gareth Manderson, acknowledged the shortcomings and tried to reassure investors, saying:

‘Production forecasts are lower than what was anticipated in the July 2021 Definitive Feasibility Study and cost expectations are higher.

‘Following this review, we are working through a suite of improvement projects to drive Finniss operating performance to deliver higher mining rates, improve lithia recoveries and commercialise the fines products.’

Despite all these issues, the company managed to ship 5,423 tonnes of spodumene concentrate, generating cash receipts of $114 million for the quarter.

The mine also managed an uptime of 14 weeks, which was on target with their campaign.

So, are these the growing pains of an early mining operation or signs of trouble ahead?

Outlook for Core Lithium

There’s a lot of bad news to digest in today’s update. Shareholders’ optimism has been dashed severely by production woes and costs.

These issues are highlighted when compared to similar-sized projects.

Many lithium companies strive for economies of scale by drilling a large deposit and building a single long-life mine.

It seems that Core Lithium’s strategy of operating a series of smaller satellite mines around a central mill has run into the first obvious issue of rising costs.

Each smaller mine increases the maintenance cost and creates headaches in estimating output.

Both of these problems have struck at once and will hurt CXO.

Compounding those issues is the complex outlook for lithium prices and market dynamics.

Most analysts agree that lithium demand is set to grow along with the EV market and wider battery usage.

This demand and 2022 prices spurred huge investment globally, which could see supply catch up faster than some investors expect.

Source: McKinsey & Company

For now, subdued commodity prices and huge 2022 inventories pushed Lithium prices down in the first half of the year.

Prices have recovered since May but have trended sideways since June as more news of a sluggish recovery of the Chinese economy — the primary market for lithium.

Further muddying the waters is the labour issues facing the region.

We have seen massive growth in investment, but it’s becoming clearer that labour will be the bottleneck in the foreseeable future.

As the lithium industry evolves, Core Lithium must navigate these challenges and deliver on its commitments to regain market confidence and drive growth in production.

However, until real improvements come, the company’s shares will likely remain under pressure, maintaining its position as one of the most shorted stocks on the Australian share market.

Lithium’s future price is going to be hard to predict.

But another metal sits under the radar and is poised to be the next big story as it runs dry.

The Red Drought and what to do

Stopping climate change will require trillions and a global supply of critical minerals — one special metal from this range is copper.

S&P Global Market Intelligence projected in 2022 that annual global copper demand will nearly double from 25 million to roughly 50 million tonnes by 2035.

This means we will need a lot of red metal, and more exploration will be required to restock supplies.

So far, we are way behind the curve.

If you subscribe to Fat Tail Commodities, you will have access to resources expert James Cooper’s most recent insider report on the subject.

James will give you instant tips on stock picks for the copper industry.

He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Click here to learn more about making money from the red draught.

Regards,

Fat Tail Commodities

Comments