Core Lithium [ASX:CXO], one of 2022’s top-performing stocks, received environmental approval for its flagship lithium project on Tuesday.

Enjoying sustained interest in the lithium theme, rising 350% in the last 12 months.

That said, the lithium junior has cooled off recently and is down 20% in the last month:

Source: Tradingview.com

CXO Achieves Environmental Approval

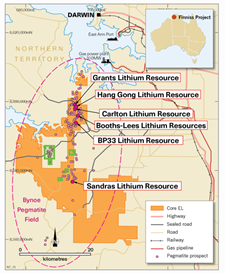

This morning, Core Lithium publicly announced that its BP33 Underground Mine has received environmental approval from the Northern Territory’s Minister for Environment.

With approval under its belt, the company can now put forth a request for assessment — in the form of a Mining Management Plan (MMP) — to the Department of Industry, Tourism and Trade.

A mining authorisation for BP33 is anticipated by the middle of next year.

CXO now has two mines approved for its Finniss Lithium Project, with the Grants deposit having already commenced mining in 2021.

The company expects the Finniss Project to be shipping ore by the end of 2022.

Managing Director Stephen Biggins said:

‘The grant of environmental approval for the BP33 Underground Mine is another exciting milestone achieved by Core in the development of the Finniss Lithium Project. BP33 is a higher-grade orebody than Grants with recent deep drilling supporting the interpretation that BP33 mineralisation is improving with depth.’

The Northern Territory’s Minister for Environment, Eva Lawler, added:

‘The Territory Labor Government’s reformed environment protection legislation commenced in 2020, providing Territorians with an improved environmental regulatory regime.

‘This Environmental Approval follows a thorough assessment of potentially significant environmental impacts by the NT EPA — it is the second to be granted under the EP Act, and the first for a mine.

‘We will continue to work with Core Lithium on this project to ensure the best outcomes.

Source: Core Lithium

CXO share price outlook

With environmental approval for CXO’s BP33 Underground Mine and future assessments in the works, the company appears to be forging ahead.

Back in March, CXO entered an agreement with Tesla for 110,000 tonnes of Li2O spodumene from the Finniss Project for the next four years.

This is certainly a boost for Core’s long-term prospects and helps derisk its Finniss Project.

Now, lithium isn’t the sole EV battery input.

Other materials are just as important in getting EVs off and running — materials like copper, nickel, cobalt, and graphite.

As lithium continues to dominate attention, our Money Morning experts believe now is the time to look for a smarter way to play the EV boom.

They believe a potential answer lies with lithium’s ‘little brother’?

Click here to find out more about ‘The NEXT Lithium?’.

Regards,

Kiryll Prakapenka,

For Money Morning