I’ve been a broken record lately, writing about mergers and acquisitions, especially among copper stocks.

Yet, if there’s an investment theme screaming opportunity… You need to know about it!

And I’ve tried to make that crystal clear over the last several months.

So, here we are again…

Earlier this week, Indonesian-owned Mach Metals lobbed a $393 million takeover offer on the small South Australian developer Rex Minerals [ASX:RXM].

Rex’s flagship project is the IOCG copper-gold Hillside deposit on the York Peninsula in SA.

Both parties did well to keep this offer under wraps… Rex traded within a narrow 25-27 cent range over the last four weeks.

But when the announcement was released Monday morning, RXM’s opening share price exploded to 44 cents, just shy of Mach’s proposed 47-cent-per-share offer.

That’s an instant 60-plus percentage gain… a nice way to start the week for Rex shareholders!

Kudos to my colleagues Brian Chu and Murray Dawes, whose readers held Rex Minerals in their respective portfolios.

But what’s the bigger picture here?

As long-term readers know, copper stocks’ sudden return to favour has been fueled by a lack of supply.

For too long, the world’s largest miners have shelved exploration ambitions… Repulsed by the enormous capital commitment involved in finding and developing new mines.

But an aversion to growth can only have one outcome… Falling supply.

This story has taken years to unfold. It’s rooted in the overexuberant investment phase of the last mining boom, which lasted from 2003 to 2012.

In the following years, mining executives received a walloping from shareholders who questioned their ability to read the market.

You see, at the peak of the last boom, many of the world’s largest miners succumbed to buy-out fever.

A war of outbidding other miners to grab hold of juniors that were suddenly in hot demand.

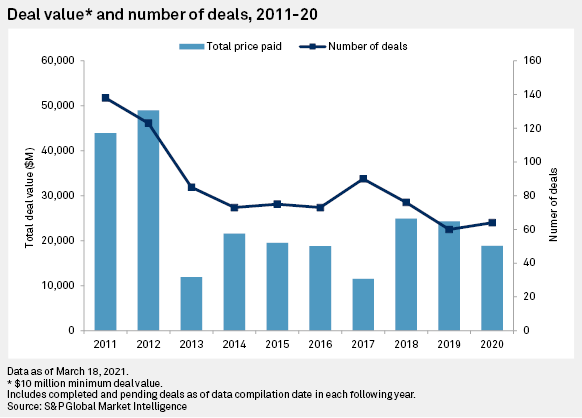

As the graphic below shows, total deals (and their overall value) peaked in 2011/12, the very top of the last commodity bull market.

| |

| Source: S&P Global Market Intelligence |

Heads rolled… CEOs from Rio Tinto to Barrick Gold were given the boot.

And that nightmare looms large over mining executives today.

It’s a key reason mining firms have failed to invest in new projects over the last decade.

Yet, M&A activity is starting to tick up…deals like Rex Minerals and BHP’s recent attempt on Anglo America clearly show momentum is beginning to build.

Yet, a pick-up in M&A will not address the supply problem; it simply transfers ownership from one copper stock to another.

Capital starvation can only last so long; eventually, something must break

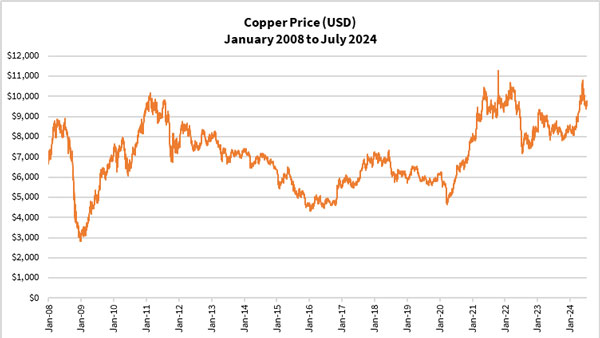

Copper prices tested all-time highs last May (see below), and I suspect we’ll see a re-testing of those highs soon.

| |

| Source: Refinitiv Eikon |

How high can copper go? We can only guess. However, any tick higher from these levels could trigger a chain reaction that would fuel more M&A activity.

Right now, mining firms have two options:

Either acquire new projects and leverage their exposure to the coming boom, OR…

…make meaningful investments in exploration and grow organically.

In my mind, the former is much more likely. That means more junior copper stocks could be on the acquisition hit list.

But back to Rex Minerals, what else is this recent bid telling us?

Rex…from ugly duckling to market darling

Almost ten years to this day, the outlook for Rex shareholders was depressing.

It was early August 2014… Copper prices were deteriorating rapidly.

Rex Minerals’ chief, Mark Parry, had just handed in his resignation.

It stemmed from a disappointing feasibility study demonstrating that the project was unviable in its proposed form.

The company’s share price capitulated for the remainder of that year, falling almost 80% to the end of 2014.

To make matters worse, the Hillside project falls on prime cropping land and is just a stone’s throw from a popular holiday destination on the coast. This sparked furious resistance from the community.

But 10 years is a long time in mining…the copper outlook is rapidly bouncing back after a depressed decade.

Former ugly ducklings who for years looked as if they were too low-grade to warrant development are now becoming the new market darlings.

This is what a lack of investment in new supply looks like. And this is how the mining cycle turns.

Marginal projects are re-emerging as viable solutions (or the only solution) to address future supply shortfalls.

The copper market landscape is rapidly changing.

A project that was once overlooked 10 years ago is now gaining favour.

So, are there more projects lying around waiting for a cashed-up company to inject new life into them?

That’s what I’m uncovering for my paid Diggers and Drillers readers.

If you’re interested in finding out more, click here!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments