If you’ve been following the finance news over the last few days, you’re no doubt aware of the recent decision by the Oz Minerals’ [ASX:OZL] board to accept BHP Group’s [ASX:BHP] buyout.

Mainstream outlets are hailing this as a fantastic opportunity for Oz shareholders.

But I won’t beat around the bush here…in my mind, the revised bid is woeful.

Just a 13% increase to BHP’s August offer, which was flatly refused by the OZL board.

With Oz Minerals’ sudden backflip, shareholders are more than justified in questioning the OZL decision to unanimously accept this ‘slightly higher’ offer.

Who knows what’s going on in the background here; secret handshakes, promised positions in high places…there seems little incentive for OZL shareholders given the strong outlook for copper over the coming years.

Regardless of any backdoor negotiations that might be taking place, BHP’s actions speak loudly…it has been on a persistent hunt for Oz and looks like it has now won its prize for what could be a bargain pick-up.

But this cleareyed focus on Oz Minerals may also play into some underlying concerns about BHP’s overseas assets, particularly those located in Chile.

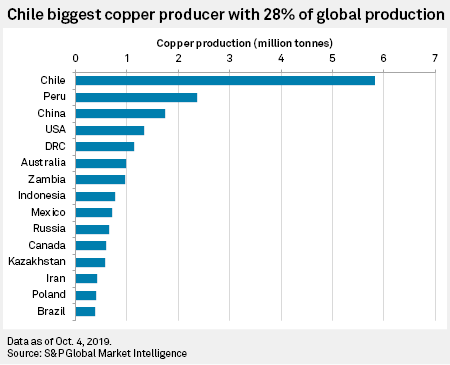

As I wrote in our premium letter The Insider, this South American country is a major global supplier of copper.

In fact, Chile consistently produces close to six million tonnes of copper each year, that’s almost 30% of the world’s entire supply!

No other country comes close to this output, take a look for yourself below:

|

|

| Source: S&P Global Market Intelligence |

This is why, when it comes to understanding copper, you need to know what is going on in Chile.

But recent political events in this copper-rich nation could play a hand in BHP’s motivation to grab Oz Minerals.

Recent employee strikes at the world’s largest copper mine, Escondida (majority owned by BHP), and a large hike in mining royalties indicate Chile is NOT the prime mining district it once was.

What is more alarming is the growing threat of nationalisation.

This is a dirty word in mining circles…essentially, it’s when operations come under State control.

When governments move toward a strong nationalistic agenda through punitive royalties or an outright takeover of the mine, the company invariably suffers.

There are many examples of this happening. In fact, I witnessed it firsthand while I was working in Zambia in 2010, just across the border from the Democratic Republic of the Congo (DRC).

The Canadian company First Quantum Minerals [TSE:FM] was operating the copper Kolwezi mine in the DRC.

But the government soon took control of FM’s prime copper deposit using military intervention, under the guise of ‘suspected widespread misconduct’.

Strategically, the government stepped in just after FM spent near $700 million setting up the project for production.

You can read more about that story from this Financial Times article, written in 2010 when the event took place, here.

As a resource investor, it’s important to understand the very real risk of nationalisation.

This is why Chile matters to the future supply of copper.

Chile has been here before…

You might be surprised to hear that the world’s most important copper producing country nationalised all its major copper mines back in the early 1970s.

The Marxist-led government, led by Salvador Allende, amended the country’s constitution, allowing it to take full control of its copper assets.

Typically, it did so without compensating to the international miners operating at the time.

The 1970s era become known as the ‘Chilenization of copper’.

Unsurprisingly, the world reacted with strong trade embargoes.

But these events were transpiring at the peak of US communist paranoia, during the Cold War era…it led to then US President Richard Nixon using his CIA henchmen to spark a military coup that toppled Chile’s democratically elected Allende government.

What followed was years of bloodshed across the nation.

But eventually, the country stabilised and regained confidence among multinational mining companies.

With vast reserves of copper sitting in the ground, Chile soon regained its title as the premier destination for the world’s largest copper producers.

It now hosts copper majors including Freeport-McMoRan [NYSE:FCX] and BHP.

For more than two decades, Chile has basked in strong growth, a stable political environment, and has been one of the leading economies across South and Central America.

Investors have since forgotten about Chile’s copper nationalisation program from the 1970s.

But changes are brewing

In what could be repeat of the past, Chile may be heading down this controversial path yet again.

It’s simply unthinkable for the likes of BHP, who have invested vast sums in developing the world’s largest copper mine, Escondida.

This is an excerpt from my article in The Insider, just last week:

‘In July 2022, Chile’s Finance Minister Mario Marcel introduced a tax reform bill that raised copper mining royalties on companies producing more than 50,000 tonnes a year.

‘It also increased revenue taxes on the largest mining producers.

‘But this is just the beginning.

‘As Reuters reports,Chile has set the constitutional groundwork that allows for the re-emergence of nationalisation of the country’s copper industry.

‘Unsurprisingly, it’s sparked an angry response from major mining firms, including Australia’s BHP.

‘You see, BHP has a lot at stake here. In partnership with Rio Tinto and Japanese-based JECO Corp, it operates the world’s largest copper mine, Escondida.

‘The mine, an enormous porphyry deposit in Northern Chile sitting in the Atacama Desert, provides around 6% of the world’s entire supply of copper!

‘It’s a HUGE cash cow for the company…but it’s also juicy low-hanging fruit for a government looking to reap more from its copper riches.

‘It forces BHP and other multinationals to rethink their long-term strategy in the country.

‘It means a severe pull-back on investment, including exploration, in the world’s most important copper province. Ultimately, the political landscape in Chile places even greater threats to the future supply of this important metal.’

So how does this tie into BHP’s offer for Oz Minerals?

OZL holds large reserves of high-grade, dependable copper deposits that have consistently delivered on production guidance for some of the lowest-cost production in the world.

Just as importantly however is the LOCATION of its assets — situated in the outback of South Australia.

For international mining majors, Australia offers a risk-free jurisdiction to grow their business.

With growing threats in the world’s largest copper-producing nation, Oz Minerals holds a prized asset.

It’s why I explained to readers of The Insider, just prior to the BHP revised offer, that OZL presented a prime opportunity for investors. This from the article dated 14 November 2022:

‘Demand continues to improve on the back of copper’s central role in decarbonising the world’s energy needs. But compounding the demand side is dwindling grades at existing mines and a lack of new discoveries.

‘It is all playing into a perfect storm for copper.

‘It means operators will try to unlock new frontiers for mining.

‘This brings added risk to what is already a risky investment class.

‘If you believe in the fundaments of this metal, finding a pure-play copper producer operating exclusively in a tier-one mining jurisdiction would be an excellent strategy for gaining maximum upside.

‘When it comes to LOCATION, then Oz Minerals [ASX:OZL] might be a great stock to consider.

‘Gold credits from its copper operations and project development into the nickel-rich Musgraves of Western Australia means the company is not entirely tied to copper, but it does come VERY close.

‘Assuming management can deliver on production forecasts, OZL could give you a strong upside as demand and critical supply shortages collide over the coming years.

‘Investing in copper is indeed an exciting space to be in, but you need to tread carefully!’

Now, I won’t be patting myself on the back for recommending Oz Minerals just two days prior to BHP’s offer, which caused a modest increase in the share price…why?

It falls well short of the enormous potential that investors MIGHT have gained if OZL’s management held out for the coming boom in copper.

Which brings me to my next point…if you’re not aware, we’ve just released a new investment advisory service called Diggers and Drillers.

It’s objective…find the very best small to mid-cap resource stocks listed on the ASX.

We’re off to a good start, with our five stock recommendations set to benefit from an enormous scarcity in critical minerals, including copper, over the coming years.

It’s still early days, so now is an excellent time to consider jumping onboard.

But I believe the most exciting idea for Diggers and Drillers subscribers is coming out next month.

With the scarcity of copper looming, projects situated in great locations will command a premium.

This is why copper will be the focus for our very first monthly edition of Diggers and Drillers, set to come out in December.

Oz Minerals was a rare species indeed.

Large, high-grade reserves of copper located in a prime location.

But with the BHP bid, it looks like this company is now off the table.

Major miners like BHP have an enormous appetite for copper. This is set to grow over the coming years.

You can find out more by signing up to Diggers and Drillers today, giving you instant access to our special reports and open buy recommendations.

You’ll also be first in line when I introduce our TWO Aussie copper plays next month.

Click here to get started.

Regards,

|

|

James Cooper,

Editor, The Daily Reckoning Australia