Australian financial administration company Computershare [ASX:CPU] has agreed to sell its US mortgage services business to Washington DC-based Rithm Capital [NYSE:RITM] for an estimated AU$1.13 billion. The sale comes after a cost-out program helped the division return to profitability following a difficult few years.

News of the divestment has pleased investors, with early spikes in the share price this morning, and finishing the day as one of the few companies trading positively, up by 0.85% at $26 per share.

Computershare’s US mortgage services business, known as CLS was severely hit during the pandemic, seeing revenue squeezed in its highly competitive market as refinancing and mortgage volumes dropped.

Despite these US challenges, the company maintained profitability in its other global lending sectors and has also moved to acquire a smaller UK-based mortgage services business with about one-third of CLS’s annual revenue.

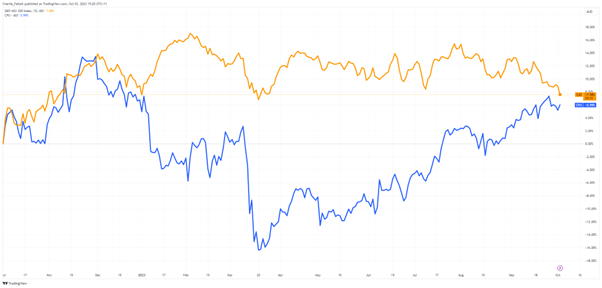

The company has surfed the turbulent macroeconomic environment, rebounding from share price losses seen after its 1HFY23 results to gain 6% in the past 12 months.

So whats next for the company?

Source: TradingView

Computershare simplifies

The US home mortgage servicing sector has posed challenges for Computershare in recent years.

In FY22, the division posted a negative EBIT of $6.3 million, making it Computershare’s only loss-making segment.

The company’s foray into the US market in 2000 had significantly contributed to its earnings in the past, constituting 64% of Computershare’s total earnings in the last financial year.

However, its share registry business faced challenges due to a weak global market for initial public offerings over the past year.

Computershare had undertaken an aggressive cost-cutting program to improve CLS’s profitability, which delivered $23 million in savings for FY23.

CLS’s revenue for the last financial year dipped to US$351 million from US$423 million, resulting in a $3.7 million loss in earnings before interest and tax in the 12 months ending 30 June.

As part of the cost-cutting, CPU also embarked on a new strategy to deliver consistency to the business and shareholders.

Computershare CEO Stuart Irving said the company had completed a detailed review of its US mortgage services business and determined that a full divestment was in the best interests of shareholders.

‘We have completed a detailed review of our US Mortgage Services business and determined that a full divestment of the business via a competitive process would be in the best interests of shareholders.’

‘Today’s announcement represents an important milestone in executing Computershare’s simplification strategy and drive to increase the quality and consistency of earnings.’

‘The divestment of US Mortgage Services allows us to focus our efforts on our core businesses, which have high levels of recurring revenues, long-term growth runways, low capital intensity and attractive returns through the cycle.’

The sale of Computershare’s mortgage services arm to Rithm is anticipated to result in a one-time, pre-tax loss ranging between US$150–180 million.

Despite this, the company said the transaction is not expected to have a material impact on FY24 EPS guidance and kept its forecast of 116 cents per share, assuming the deal closes before March 2024.

Looking ahead, Computershare has strategically shifted to mortgage services business in the UK. This was highlighted by its recent acquisition of Morgan Stanley’s UK & European Employee Share Plan business.

This mouthful will be simplified to Solium UK once the deal is complete this quarter, subject to regulatory approval.

So what will the new business mean for the company’s future?

Computershare’s Strategy

The sale of the US mortgage services business is part of Computershare’s simplification strategy, which focuses on core businesses with high recurring revenues, long-term growth runways, low capital intensity, and attractive returns.

While this would sound like any company’s ideal situation, the execution of the strategy has so far pleased shareholders.

The proceeds from the sale of CLS will enhance Computershare’s flexibility to pursue strategic investments and consider other capital management opportunities.

The Solium UK is a good example of this. While its revenues are modest — at only $28 million annually — the low costs and structural growth appear exciting.

Here Computershare is betting on the growing trend of companies issuing equity to attract, retain and incentivise employees. As labour markets remain tight, the managerial tool has moved from the C suite to the main street, as more organisations offer stocks.

It will also be a significant shift away from the US market for CPU, which previously pulled 64% of its revenue from America.

Source: Computershare FY23 Report

Whether this bet pays off remains to be seen, but it’s a smart play towards a structural trend.

Today’s announcement could be seen as the capstone to the simplification strategy Computershare set out to accomplish. It allows CPU to refocus on its core strengths and navigate a tricky financial landscape with a leaner ship.

Dividends back on the menu

The ASX has had another troubled day in the red. The ASX 200 is now near a six-month low and is down -1.13% in 2023.

With the new clarion call of ‘higher for longer’ being shared by all central banks and fuel prices rising, equity markets are shaking.

Investors are moving into defensive positions, focusing on quality stocks that can provide safety and pay dividends.

But blindly buying the ‘best dividend-payers’ could be a fruitless move beyond the short term.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding a better option.

He calls it the Royal Dividend Portfolio, and it’s the sweet spot between growth and dividends.

You may want to consider a different strategy if you think you’re overexposed in uncertain times or simply too defensive.

Click here to learn more about what that looks like.

Regards,

Charles Ormond,

For Money Morning