At the time of writing, the share price of Commonwealth Bank of Australia [ASX:CBA] is up a marginal 0.37%, trading at $94.93.

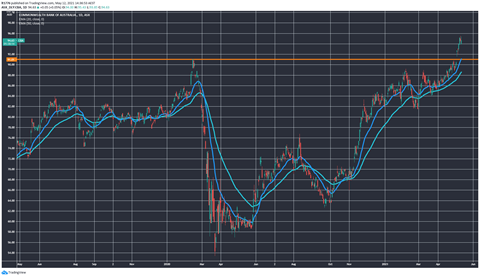

CBA share price is on a massive tear at the moment on economic recovery and a heap of stimulus running through the veins of the Aussie economy:

That’s some serious upward momentum, and CBA share price is even gapped up as it punched through resistance at the $91 dollar mark. So, today we ask — at this point for the ASX, are banks the only game in town? We take a look at the latest results out of CBA.

Highlights from CBA results

Here they are:

‘– Unaudited Statutory NPAT of ~$2.4bn2,3 in the quarter.

‘– Unaudited Cash NPAT from continuing operations of ~$2.4bn2,4 in the quarter, up 24% from the 1H21 quarterly average, mainly driven by lower loan impairment expenses.

‘– Income up 2%, with above system core volume growth, improved margins and higher non-interest income partly offset by the impact of two fewer days.

‘– Expenses up 1% excluding remediation costs (up 2% including remediation costs).

‘– Loan impairment expense was significantly lower in the quarter as an improved economic outlook resulted in a reduction in collective provisioning levels. Nevertheless, provision coverage remains strong and continues to reflect a cautious approach to managing risks as the economic recovery from COVID-19 continues.

‘– Strong balance sheet settings maintained, with a customer deposit funding ratio of 75%, NSFR of 124% and LCR of 125%.

‘– CET1 Ratio of 12.7%, up 10bpts in the quarter after payment of the 1H21 interim dividend to ~880,000 shareholders.’

And, as the Australian Financial Review’s Chanticleer column notes:

‘The CBA board can approach the question of capital management in August with great certainty about the bank’s future capital position because of the positive impact of divestments and the strong earnings momentum.

‘In the March quarter, CBA’s business lending was a standout, with $3 billion in additional loans, which was three times the system growth.’

Continuing:

‘The sale of a 55 per cent interest in Colonial First State will add 32 to 42 basis points to CBA’s capital although this will not be completed until the second half of the calendar year.

‘CBA’s capital strength is all the more remarkable when you consider it was forced by the Australian Prudential Regulation Authority to add an extra $1 billion to its capital following a review of its governance, culture and accountability.

‘CBA got half of that capital back in its interim results and it can expect to get back another $500 million when its remediation processes are complete and signed off by APRA.’

It’s the old banks are a ‘safe as houses’ narrative.

And there may be something to that.

I’ve noted before in a recent piece on CBA’s Big Four competitors that the share price movements are usually muted on results day.

That’s because there is a sea of analysts out there whose sole job is to have a grip on where these behemoths are headed.

There’s just too much money on the table for that to not be the case.

But here’s where you can get an edge on other investors and funds that benefitted from the CBA rally.

It’s by zooming out and looking at the macro picture, particularly the latest developments in technology.

Outlook for the CBA share price

To be honest, I’ve been bearish on the big banks for a long time.

And to degree that’s coloured my outlook for CBA share price and the other Big Four.

This is a long-term perspective though. The Aussie government and the superannuation industry/complex simply can’t afford for them to bite the dust.

So, it’s not surprising to see this huge of a rally across the board on the back of supposedly stellar earnings.

But my outlook remains unchanged in the 2–5 year timeframe.

Not only are there a range of super exciting small-cap fintechs, like these three, that are threatening to cut the banks’ lunch — there’s the crypto world too.

I’m talking specifically about the DeFi movement, which is quickly emerging, something I’ve profiled in a series of editorials.

There’s the first ‘real world’ loan development via MakerDAO.

Then there’s the fact that at a fundamental level, the DeFi movement could be the last great hope for reform of a broken financial system that will face the threat of CBDCs like the digital yuan.

I’d gently suggest you wrap your head around these things now, if CBA shares are on your mind.

Scrap that, I think this is urgent.

Check out our special briefing on what we call a ‘New Game’ here at work.

Grab a notepad, get the transcript and get ready to learn about this seismic shift in the world of finance.

It’s must watch stuff.

Regards,

Lachlann Tierney

For Money Morning

Comments