If you’re a long-term reader, you know I’m bullish on the set-up forming in commodity markets… This hasn’t been fleeting.

My opinion on where this market will shift over the coming years has been built from years of working inside the industry as a geologist.

That began when I left University in the early 2000s and started working for a tiny exploration company looking for copper, manganese, silver, zinc, and lead.

Mapping, trudging around old mine shafts and chasing drill rigs across South Australia’s outback.

Unfortunately, the Global Financial Crisis put the brakes on the industry in 2008… Tiny explorers were hit especially hard.

In the following years, I continued to work as a geologist, taking short contracts across SA and WA.

By 2010, an opportunity came up to head to Africa… A chance to ply my trade with Equinox Minerals in Zambia, an emerging ASX copper producer.

I stayed with Equinox, including the subsequent takeover from Barrick.

But after copper prices peaked in 2011 and M&A fervour reached its climax, along came the next bust—what I’d call the ‘real’ or secular downturn in the resource market.

The long-term demise of exploration

began in 2012

Barrick once held the industry’s most enviable exploration department… With teams of geologists scouring the globe from Australia, PNG, Africa, the Middle East and South and North America.

Like the best mining companies once did, Barrick drove growth from within, discovering and developing its own major deposits.

It took Barrick decades to assemble this industry-leading team.

Geologists were head-hunted from across the globe, and the company trained and sponsored individuals to take on PhDs… Anything that would give them an edge in finding new deposits.

It put the company on the path to becoming the world’s largest gold miner.

Yet, when metal prices began to tumble in 2012, management panicked.

In a matter of weeks, the company fired its entire global exploration department!

Hundreds of exploration staff across the globe were made redundant, myself included… Many left the industry permanently.

And this wasn’t just Barrick… Most major mining firms dismantled their exploration departments in the face of falling metal prices.

These teams had taken decades to assemble but just a few short weeks to dismantle.

How does this play into future

mineral shortages?

Now, this market has a lot of short-term noise, giving you every reason to feel pessimistic about the outlook for commodities… China’s growth statistics, global recession fears, and traders and institutional investors’ unwinding positions.

Every inch of the market has been measured, analysed, and scrutinised verbatim… Sentiment switches from bullish to bearish in a matter of hours.

Reacting to this obsessive news flow will leave you tired, confused, and fed up. Be aware of it, but don’t let it drive your investment decisions.

Instead, focus on the commodity cycle… This is where real wealth can be made.

I’ve experienced all the up-and-down phases of this cycle, from boom to bust.

As exploration geologists, we feel the extremities more than anyone else… We’re the first to be hired when conditions improve but the first to be fired when conditions deteriorate!

But as someone who has closely observed the industry over the last couple of decades, a few things stand out…

Over the last 15 years, major mining firms have been sitting on their hands, reluctant to spend cash on exploration or new mine development.

Now, there’s nothing unusual about this… Commodity cycles have always operated in this way.

As we witnessed in the early 2000s boom, periods of intense investment activity drove a wave of development activity and new capex.

Invariably, this sets up the market for surplus supply AND lower prices.

Consequently, new investment dries up, miners cut back, and development plans are abandoned… This took place on a monumental scale ten years ago.

Yet major mining firms still haven’t restored their exploration departments… They remain a fragment of their former glory.

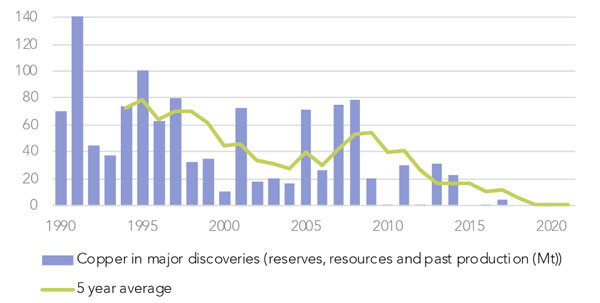

These conditions have now been in place for numerous years, and that’s having a major impact on new discoveries, as you can see below:

| |

| Source: S&P Global Wilsons Advisory |

Since the end of the last boom (in 2011), copper’s 5-year average discovery rates have fallen dramatically… The last 15 years have been utterly dismal.

It’s important to understand that this looming problem built on SUPPLY won’t appear instantly… Existing mines can temporarily maintain global demand.

But as ageing deposits deplete, problems begin to emerge.

I believe we’re already seeing flickers of that in today’s market…

The sudden closure of First Quantum’s Cobre Panama Mine in late 2023 pushed the copper market into deficits in early 2024.

Copper prices subsequently surged to all-time-new highs, rising above US$5 per pound for the first time in May 2024.

Yet, this mine supplied just 1% of global output… That indicates a market running on tight supply.

The big miners are hungry for ore

As the graph above clearly demonstrates, the rate of new mineral discovery over the last decade is amongst the worst in living memory.

Yet this couldn’t be happening at a worse time!

Sustained shortages across several commodities remain a very real threat.

However, it will also be a key catalyst in driving a new era of exploration and mine development, perhaps on a scale never before seen.

The world’s largest miners once played a critical role in mineral discovery… However, their enthusiasm eroded and never recovered after 2012.

While juniors continue to ply on and take on exploration risk, they don’t have the resources or liquidity to make meaningful impacts on global discovery… This explains the poor discovery rate over the last decade.

An opportunity beckons for the few who

have made discoveries

Despite the poor global discovery rates over the last 15 years, some explorers have uncovered major ore bodies.

These explorers hold assets desperately needed by major mining firms looking to resupply ageing mines.

In my mind, this represents the biggest opportunity in the resource market today: junior miners holding giant deposits – ripe for acquisition.

An opportunity built on limited supply, thanks to the dismantling of global exploration efforts by the world’s largest mining firms.

The biggest miners must buy their way out of a mess created over a decade ago… In other words, grabbing hold of juniors with prized assets.

So, which companies are under the crosshairs of the majors right now?

Well, that’s part of a comprehensive report I’ve put together on a looming M&A opportunity in the resource sector.

You can access all the details here.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments