Do you know what time the sun rises tomorrow?

I’ll tell you…

Here in Adelaide, it rises at exactly 5.58 am.

Pretty precise, eh?

There are many cycles in life that we can predict fairly well. The changing of the seasons or the onset of puberty, to name two.

In markets, there are cycles, too.

Economic cycles of boom and bust, financial cycles of credit growth and credit contraction…and also commodity cycles.

As Australians living on a resource-rich continent, the commodity cycle is the big one we need to pay attention to.

But have you ever heard of it?

I’ll bet probably not…

But it’s a critical aspect of our investment strategy at Diggers & Drillers, my dedicated resource publication.

This predictable cycle underscores every aspect of the commodities market.

Participate on the right side of the cycle, accumulate quality stocks, and hold them through the upward leg — and there’s a good chance you should do well.

But invest on the wrong side, and you could be left holding stocks that decline for years.

As resource investors, knowledge of the commodity cycle is our compass.

Without it, we’re sailing blind through a market that constantly spins from bullish to bearish, confusing even the most steadfast investor.

While this is not an exact science, having some idea of where the cycle is heading can be incredibly valuable.

Imagine knowing when to take a position BEFORE conditions turn excessively bullish.

Or recognise that the market is close to a peak, allowing you to bank profits and exit BEFORE conditions turn sour.

That’s the knowledge we try to tap into at Diggers & Drillers.

So, how do we do that?

We look at past commodity boom and bust phases, key metrics (which I’ll touch on below) and anecdotal evidence from my time as a geologist in the industry.

But the first critical step toward understanding the cycle is this…

Phase One: Underinvestment

Lack of investment in new supply is the foundation for higher prices.

Every boom phase displays this key feature, and this cycle won’t be any different.

You see, in mining, supply depends on liquidity moving into exploration and developing new mines.

But as conditions turn bearish, mining firms pull investment from these growth projects into capital preservation.

However, that can only last for so long!

You see, mines are a shrinking asset.

Each year the deposit gets smaller as miners extract more ore.

And that usually accelerates in the down-cycle as producers try to offset falling prices by digging up more dirt.

These conditions existed for at least a decade during the last commodity downturn.

And that’s why I believe we’re at the precipice of a major ‘catch-up’ or growth phase.

To show you what I mean…

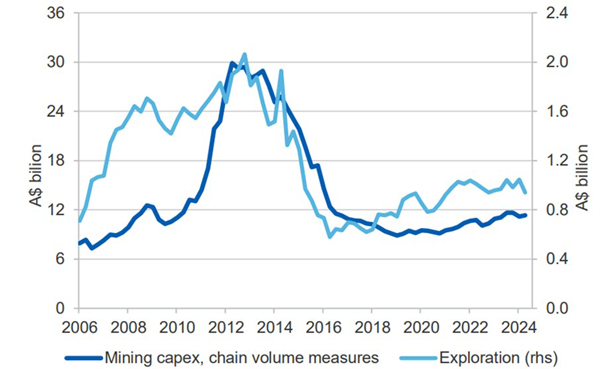

On the graph below, you can see growth in mining capitulated after the LAST mining boom peaked (in 2012):

| |

| Source: Department of Industry, Science and Resources |

Capex, a measure of investment in new mine development and exploration, fell precipitously before bottoming between 2016 and 2020.

Since then, investment has been in a phase of ‘consolidation’, gradually recovering from a phase of record underinvestment.

This is your first (and most important clue) on where we sit in this cycle!

Muted activity over the last decade has been a long-lasting response to the hyperbolic investment phase that culminated in 2012.

But the key point I highlight to my paid readership group is this…

The stage is set.

Underinvestment over the last decade has offered a floor (structural support) for higher commodity prices.

The foundation has been laid.

Knowledge of the Commodity Cycle in action

Markets have a short memory and tend to overreact to economic developments, either up or down.

Recall that in August 2024, authorities in China revised GDP growth below their long-term target of 5% per annum.

That drove a wave of panic across markets, especially those tied to commodities.

To make matters worse, steel producers in China responded with production cuts.

As a major buyer of Australia’s most important export, iron ore prices dived below the key support level of $US100 per tonne.

By September, several of Australia’s largest mining firms had hit multi-year lows.

Any thoughts of a looming commodity supercycle vanished!

The imminent collapse of China’s economy took over, and markets fell into a tailspin of worry.

If you bought into that panic, you would likely have sold out close to a major low.

As I explained to my paid readers, this was not a time to sell, and that came from our understanding of the commodity cycle.

But, it was also supported by other key metrics, like China’s imports of raw materials.

Despite deep pessimism over August and September and a wave of selling in commodity markets, imports of key commodities like iron ore remained robust.

Conditions were bleak, yet the Chinese Steel Association reported record volumes of iron ore imports into the country!

Up 6.7% in the first half of 2024 compared to the same period from 2023.

As most panicked, I told my paid readership group to hold firm.

We navigated that extreme anxiety and avoided selling mining stocks at a major low.

That’s an example of where you can hold firm if you understand where we sit in this cycle.

So, what happens next?

From here on, it’s pure speculation on what could happen next in the resource market.

As I’ve shown you, capex and exploration spending are building after years of underinvestment.

Meanwhile, China has clearly stated its intention to follow up on more stimulus in 2025.

The stage is set.

The inevitable turning of the cycle is underway.

But whether it’s China stimulus or something else…

Lack of investment in new supply, the great green energy transition, the thirst for more energy from AI data centres, or trade fragmentation limiting the stable supply of commodities.

The strengthening supply and demand fundamentals underpinning the resource market are diverse and immensely bullish over the long term.

In my mind, the cycle clearly favours sustained higher commodity prices in the years ahead.

And it’s the downtrodden mining and exploration stocks that could benefit the most!

If you’re as excited by that prospect as I am, join me here at Diggers & Drillers.

This is where I’ll explain the commodity cycle in detail, outline some of the best ways to play it and give you specific company recommendations.

If there’s one thing you should do in 2025, it’s to learn more about this important sector.

Have a great Christmas break, and tune in next week for our special Fat Tail editions, which will focus on the outlook for 2025.

Until then.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments