In today’s Money Morning…more exposure ≠ better value…an increasingly sweet honey pot…and more…

The talk of the financial world right now is Coinbase Global Inc [NASDAQ:COIN].

A cryptocurrency exchange that just wrapped up its direct public offering (DPO) overnight. Making headlines in what many are referring to as a ‘watershed moment’.

After all, it is hard to ignore the sheer amount of money involved…

With a US$87.4 billion market cap at the close of its first day of trading, Coinbase is officially the largest valued financial exchange in the world. Be it stocks or cryptocurrencies.

That in and of itself is a remarkable feat.

A factor that is certainly going to put crypto on even more investors’ radars if it wasn’t already, of course.

More importantly, this listing gives Coinbase an air of legitimacy, something that the crypto scene has always struggled with. Because to the cynics and skeptics of the world, crypto has always been this dirty underbelly of transactions or investing.

And while there are still some challenges to overcome, Coinbase’s listing certainly helps from a publicity standpoint. Providing inexperienced or unaware investors with a chance to get a glimpse at the inner-workings of a crypto exchange. As well as the kind of value and growth in transactions from crypto trading.

But, even as a diehard crypto advocate, you need to be aware that Coinbase is far from perfect.

More exposure ≠ better value

Again, like I said, Coinbase’s public debut will attract a lot of eyeballs. Bringing even more mainstream engagement to the crypto sector.

Who knows, maybe it has even piqued your interest in crypto?

Here’s the thing though, as far as crypto exchanges go, Coinbase isn’t all that great, at least, in my view.

I say this as someone who even used Coinbase when I began dipping my toes into cryptocurrency back in 2016. Favouring it for its relatively easy access, and uncomplicated user experience.

This is, without a doubt in my mind, the biggest advantage Coinbase has over competitors. Because with every new development in crypto, their goal has been to make it easy to buy and sell it.

A great introduction, and relatively safe way to start trading digital coins and tokens.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

The only issue is, you will pay through the nose for it…

Coinbase has always had some of the most egregious fees I’ve ever seen of any exchange. Be it stocks or crypto. Charging users far more for the luxury of easy access than many of its competitors. And for that reason, crypto enthusiasts largely avoid them.

For a little perspective, in the past 24 hours, Coinbase has handled just over US$5.25 billion worth of trading. A decent volume that has been steadily growing over recent years and months.

However, this volume is still just a fraction compared to leading competitor Binance. An exchange that has handled US$55.08 billion in trading volumes in the past 24 hours!

In other words, Binance has 10 times the volume of Coinbase.

Making it by far the biggest crypto exchange available right now.

More importantly, Binance offers investors access to more than 500 different coins and tokens. A much wider range of choice compared to Coinbase’s 44.

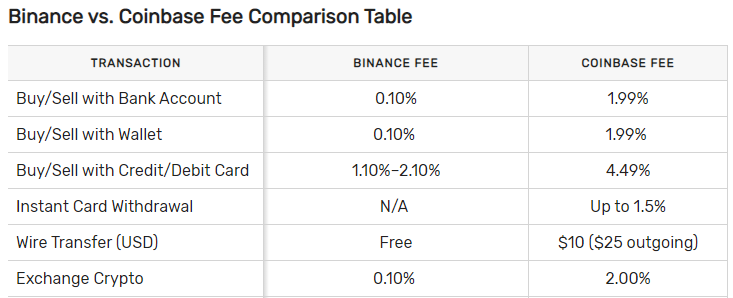

Oh, and when it comes to fees, it’s like night and day. With Binance offering some of the cheapest buying and selling around — which is precisely why it is so popular with regular crypto traders. Take a look at this direct comparison for yourself:

|

|

| Source: The Balance |

It is painfully clear that anyone who is even slightly interested in crypto should be using Binance.

But beyond the minor grievances of fees, usability, and token access — by far the biggest problem I have with Coinbase is its assets…

An increasingly sweet honey pot

As any crypto veteran will tell you, the worst event in bitcoin’s relatively short history was the collapse of Mt Gox. A popular exchange that once handled upwards of 80% of all bitcoin transactions in its heyday.

We’re talking way back around the early 2010s.

But the reason you don’t hear anyone talking about Mt Gox anymore is because they collapsed. Almost killing off bitcoin in the process during 2014.

It was the first major hack and theft that the crypto community ever saw. With an estimated 850,000 bitcoins lost or stolen over the course of the event. An amount that is worth trillions of dollars today.

So, how did it happen?

Well, the short story is that hackers gained access to Mt Gox’s backend systems. Enabling them to get into users e-wallets and slowly siphon off bitcoins. All of which occurred over the course of three years and eventually bankrupted the exchange.

To this day, the litigation and demands for recompense are ongoing. With many early crypto investors losing a lot of money.

And because of that, many have learnt a valuable lesson: ‘not your keys, not your coins’.

A phrase that reinforces the idea that keeping any amount of crypto on an exchange or in an e-wallet leaves users vulnerable to a potential breach. And this is by far my biggest concern with Coinbase — and most crypto exchanges for that matter.

Because while security has certainly improved from the Mt Gox era, far too many people still keep their crypto on an exchange or in an e-wallet.

Coinbase has even reported that it has US$90 billion of funds under management. Most of which I assume is floating on their exchange, or in their own ‘coinwallet’.

To me, that is a huge red flag. Because now, with this listing, they are putting a very large target on themselves. Opening up the possibility for another hack, or leak, or some other disastrous event to occur.

And while I certainly don’t wish it upon them, it is this centralised notion of a traditional exchange that is exactly what blockchain is trying to bring an end to. A fairly ironic development that isn’t lost on most crypto enthusiasts.

So, for the most part, Coinbase’s listing is a good thing for crypto.

From a publicity standpoint, it is fantastic.

Would I buy the stock though? Probably not.

Because while exchanges are a necessary evil when trading crypto. They are simply a means to an end.

And in that regard, I’d say you’re better off investing in the actual cryptocurrencies themselves. As well as making damn sure you are the one in control of it.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

P.S: Bitcoin vs Gold — Expert reveals how these assets stack up against each other as investments in 2021. Click here to learn more.

Comments