As inflation finally shows signs of easing in the US, it seems the Fed has blinked…

Powell tried his best to make it clear that more hikes are still coming, but the market seems to believe it may be a bluff. There is a chance that we may finally be at the end of the US tightening cycle.

Does that mean we should expect a similar reprieve from the RBA?

Probably not just yet.

Lowe, like Powell a few months ago, seems to be on the warpath.

But while this inflation battle rages in the West still, there is a far different problem in China.

Deflation, not inflation, is the plague of the Middle Kingdom.

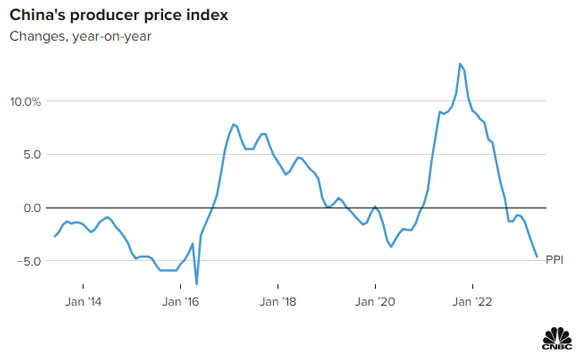

For the month of May, producer prices in the world’s second-largest economy fell by 4.6%. The biggest decline in seven years for the key metric.

As the following chart shows, things are now even worse than they were during the pandemic:

|

|

| Source: CNBC |

It begs the question as to whether we may finally be seeing the ‘Japanification’ of the Chinese economy. A scenario that would unwind the incredible growth that we have seen from China for more than two decades…

An end to the unsustainable

Honestly, while it is worth asking the question, I doubt China will repeat Japan’s mistakes. They would have to make some colossally bad decisions to repeat the ‘lost decades’ that Japan suffered from.

However, what does seem more likely is an end to the ‘supergrowth’ that many have come to expect.

The days of double-digit GDP gains are well behind China now.

They simply can’t rely on the easy growth of the past because their economy has finally caught up. As Harvard research fellow William Overholt wrote in Barron’s earlier this year:

‘The drivers of supergrowth have been property, infrastructure, and urbanization. By 2030, those will be largely exhausted, as will the easy technological catch-up. The service sector will dominate the economy.

‘But it is less competitive than Chinese manufacturing because it has been more protected from international competition. Amortizing the debt from property and infrastructure bubbles and from local governments’ excesses will take many years.

‘Meanwhile, the number of workers started declining in 2015, and the cost of an aging population will rise exponentially. And China still has a U.S.-size population not yet part of the modern world.’

In other words, the China boom is peaking.

There is no longer easy growth to be found by simply catching up to the rest of the world. Now China must find a way to maintain productivity growth by new means.

And as Western economies like the US and Australia are demonstrating right now, that isn’t easy.

Does that mean investors should write off any assets heavily tied to China’s success?

No, of course not.

It simply means you should be more mindful of what is at risk.

How the big money is responding

The most obvious concern of a China slowdown, for any investor, is commodities.

This headline from the Financial Times yesterday sums up the mood perfectly:

|

|

| Source: Financial Times |

It is certainly a logical conclusion to come to — whether it’s the right conclusion is another matter entirely.

For Australia in particular, this raises questions about mining stocks…

We’ve already seen a lot of volatility in this sector of late. Some of which led to big wins and some of which led to bigger losers.

Iron ore, for instance, is a perfect example of the latter. One of the hardest hit sectors as Chinese construction has stalled.

But as we’ve seen in markets, ‘critical minerals’ have picked up the slack. These commodity outliers are defying the Chinese slump narrative due to compelling global demand.

And that is the big takeaway from this entire situation in my view…

Because no matter what China’s economy does or where it goes, it is not the be-all and end-all. It may seem like that after more than 20 years of mining booms and busts, but it isn’t.

That’s why, when it comes to commodities, I’m not as worried as others.

In fact, this fixation on a Chinese slowdown may present a great buying opportunity. Because while the doomsayers are circling, this isn’t the first time they’ve singled out China.

That’s why I’d urge you to take a balanced perspective in all of this.

There is a distinct difference between the Middle Kingdom reaching a new plateau regarding GDP output and total collapse. Whether we’re likely to see one or the other is, of course, up for debate, but I wouldn’t be counting on the latter just yet.

China’s slowdown is certainly something to consider for your investments right now.

But because the mainstream is so worried about it, it may actually turn out to be a great time to buy…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning