You’ve probably heard of China’s One Belt One Road (OBOR) grand plan.

Perhaps you know it as the ‘The New Silk Road’ or the ‘Belt and Road Initiative’ (BRI).

It’s a Chinese vision to reshape the geography of the world — and the global power balance.

The Chinese think of it as the ‘great revival of the Chinese nation’, and enshrined it into their constitution.

China wants to create a ‘Eurasian land bridge’.

This will link Western China to Central Asia, before continuing on all the way to Western Europe.

It also includes a sea bridge. It will link Southern China across the Indian Ocean with Southeast Asia, South Asia, and even Africa to the Mediterranean.

There’s also a major pipeline from Central Asia and Pakistan to China.

The strategy revolves around building (and funding) mega amounts of infrastructure.

You name it, it’s on the table as an option across transport, energy, health, and technology. Think roads, bridges, gas pipelines, ports, railways, tall buildings, and power plants across countries and continents.

Around 130 countries have signed agreements to engage with it in one form or another.

It will allow raw materials to enter China via multiple paths altering the balance of trade around the world.

It’s also allowing China to expand its political and military dominance across country borders.

|

|

| Source: TheNewSilkRoad.com |

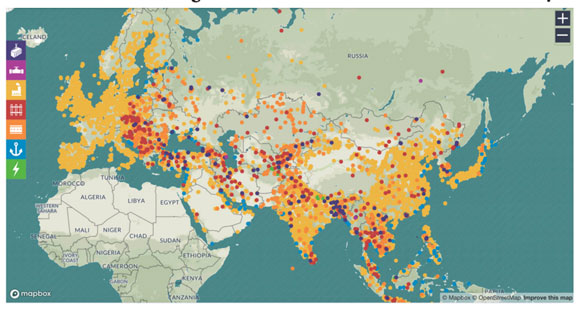

As you can see, OBOR is extremely ambitious.

It covers two thirds of the world’s population and a third of global GDP.

It’s also very expensive, ultimately costing trillions.

Here’s a map of the current and completed projects. It’s an almost unimaginable amount of construction activity:

|

|

| Source: https://reconasia.csis.org/map/ |

The motivation is to secure access to raw materials — the components of land — that history reveals is the fuel of empires.

China is the largest importer of commodities, such as iron, coal, and crude oil.

You already know Australia is uniquely dependant on this demand.

China appears both imperial and implacable.

But it does have a weakness. It suffers from…

The ‘Malacca Dilemma’

That’s a near total reliance on the 2.8-kilometre-wide Strait of Malacca, which accounts for 80% of China’s oil imports (and a quarter of global trade).

This is also why China’s foreign policy is so aggressive in the South China Sea. China’s economy depends on these trade routes.

It’s the world’s busiest commercial waterway.

China faces economic ruin if a naval blockade were to occur.

The British did this to Germany in the First World War. China cannot permit this scenario to play out…

There is an archipelago of reefs known as the Spratly Islands in the midst of the South China Sea.

Japan forcibly occupied some of the islands during the Second World War for the same reason.

The shipping lanes were nothing less than Tokyo’s energy and economic lifelines.

Today, Brunei, Malaysia, Taiwan, Philippines, and Vietnam each claim a portion of the Spratly archipelago.

But China claims it all!

And they’re prepared to defend their claim…

Chinese engineers went to work. Seven of the coral reefs now have runways, docks, radar, and other military facilities.

|

|

| Source: DigitalGlobe satellite imagery from 3 September 2015 and 15 Agust 2018, show the progress of development on the Fiery Cross Reef located in the South China Sea. |

Not surprisingly, these island defensive positions now also give access and protection to vast oil reserves and trillions of cubic feet of natural gas under the sea.

At some point, and it could be soon, China will be prompted to resolve ownership via military means. However, here’s what you need to know now…

The One Belt One Road project is vital for China.

It allows China to diversify their strategic supply lines.

It will allow them to grow their political and military dominance.

It also sets in place the potential for a global land boom.

Possibly the biggest in history.

Let me give you an example…

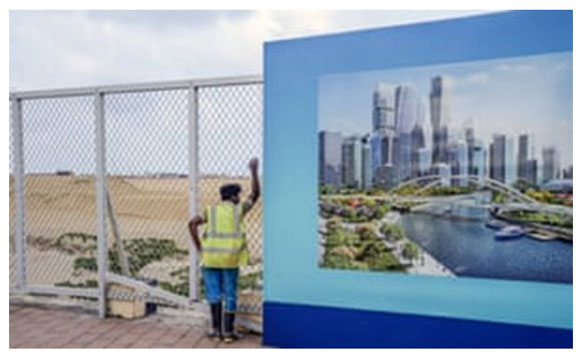

The ‘new’ Dubai — or Singapore!

The country of Sri Lanka sits between two economic powerhouses, Dubai and Singapore.

This island is directly in the path of major Indian Ocean sea lanes.

This makes Sri Lanka a strategic part of China’s OBOR.

China’s largest single direct investment was to expand the tiny Port of Colombo.

It was completed months ahead of schedule.

Colombo now has 173ha of marketable land.

Without anything on it, it was valued in excess of a whopping US$4.4 billion.

Workers are busy building five new commercial and residential centres, along with parks, tall buildings, transport systems, etc.

Think Dubai, London’s Canary Wharf, or even Singapore, and you’ll get a visual picture.

|

|

| Source: The Guardian |

Significantly, the whole area is going to have its own ‘business friendly’ economic and commercial tax laws to attract 80,000 new jobs.

No surprise that the new laws will lean in the direction of the Asian Tigers. Low productivity taxes in lieu of higher taxes on property. (As would be advocated by the economist Henry George.)

That means Sri Lanka’s status on the world stage is about to change dramatically. Described by economic analysts as ‘the biggest game changer in 100 years’.

Ultimately, with this type of investment, nothing is going to stop the biggest global escalation in land values into our projected peak of 2026.

But there’s a more direct investment case I can now reveal.

It’s the strategic resource I alluded to above…

A wonder material — under your feet!

China secured both the Spratly Island and the Port of Colombo with their growing mastery of the world’s most consumed natural building material.

How so?

They poured tonnes of sand onto the seabed. You may not believe me when I say the following…

This raw material is vital not just for OBOR, but also global infrastructure plans the world over…including here in Australia!

And we do not have enough of it…

I’m forecasting something I call the global ‘silica explosion’ over the next few years.

Here’s why…

Sri Lanka used 65 million cubic metres of sand to expand the shoreline.

It needs 100 million cubic metres for the work on top.

The average house uses an estimated 200 tonnes of it.

A hospital: 3,000 tonnes.

Each kilometre of highway: 30,000 tonnes.

And a large structure, such as a power plant, around 12 million tonnes.

Over the last 30 years, global demand for sand has increased over 360%. Some $50 billion tonnes trade annually.

This is not a new problem for Asian countries.

Singapore is the top importer of sand. It has none of its own.

It has used more than 500 million tonnes to expand its shoreline.

And now Singapore stockpiles sand — just like a strategic stock of oil…

And whilst the world is full of deserts and beaches, it’s no good!

To get some greater insight into this trend and find out how you can best advantage from knowledge of the 18.6-year real estate cycle, sign up to Cycles, Trends & Forecasts today!

Sincerely,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments