Things look like they may be slowing in China…but not when it comes to renewable energy.

Here is Gregor MacDonald from The Gregor Letter:

‘Damaged by the restrictive policies of Premier Xi, China’s economy continues to slow.

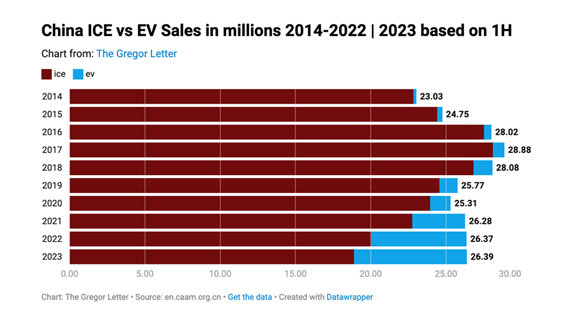

‘At the same time, China’s adoption of electric vehicles [EVs] and clean power is running at the very high rate we more typically associate with China’s historical growth. Forecasters now predict the country’s petrol demand will peak sooner than expected, by next year, as sales of internal-combustion engine (ICE) vehicles continue to be crushed by the EV tidal wave. China’s solar growth, in particular, is completely off the hook and the country is expected in 2023 to deploy more new capacity in one year (157 GW) than the total solar capacity of the US (113 GW at year end 2022).

‘If you are surprised to learn that China road fuel is near a peak, consider that China’s total mix of new EVs, aging ICE, and the year in which ICE sales peaked, is starting to line up with California — the first region in the US to actually experience a decline in gasoline demand after many years stuck on a plateau. California ICE sales peaked in 2015. In China, 2017. California EV sales are on pace to reach a 21% market share this year. In China, EVs are on pace to reach a 28% market share.’

|

|

| Source: The Gregor Letter |

There’s no doubt that when it comes to renewables, China has become a powerhouse. The country continues to invest in clean energy to diversify its energy choices and increase energy independence.

China is a leader in tomorrow’s energy market

China is not only the biggest EV market in the world, but also the largest EV maker.

The country is the largest investor in clean energy…

It’s the world’s main producer of solar panels and the largest manufacturing centre for wind components.

And China dominates when it comes to the lithium-ion battery supply chain with a whopping 77% of battery cell manufacturing capacity.

As the International Renewable Energy Agency put it in their report ‘A New World: The Geopolitics of the Energy Transformation’:

‘No country has put itself in a better position to become the world’s renewable energy superpower than China.’

Although we are starting to see more investment into clean energy manufacturing from both the US — with incentives like the Inflation Reduction Act — and Europe, most clean energy manufacturing still happens in China.

And the key to this is controlling critical minerals supply chains. Here China controls many of the raw minerals needed for the renewable energy supply chains like cobalt, graphite…and of course, lithium.

In fact, in the last couple of years, we’ve seen Chinese companies go into a buying frenzy to acquire lithium assets around the world.

And as competition to dominate clean energy supply chains and technology heats up, China is also looking at flexing some of its muscles when it comes to lithium futures.

Last month, the Guangzhou Futures Exchange launched lithium carbonate futures. As The Financial Times writes, there’s been a lot of interest in it (emphasis added):

‘China is making a push to dominate the trading of lithium carbonate futures, as it seeks to wrest the financial plumbing linked to metals vital to the clean energy revolution away from the Western dollar-based financial system.

‘Within three weeks open interest — a key measure of the size of the market — had risen to more than 20,000 lots and far outstripped activity at rivals London Metal Exchange, Singapore Exchange and the US’s CME Group, which had launched its own version just days earlier.

‘[T]he early lead established by Guangzhou has underscored how China is seeking to seize greater control over trading in what it sees as a group of metals critical for the 21st century. By establishing its own trading hubs and benchmarks priced in renminbi, the drive is part of Beijing’s efforts to lessen the commodities market’s reliance on the US dollar — which has intensified following the US sanctions imposed on Russia over the Ukraine war.’

It’s not the first time China looks at shifting attention away from the US dollar….

Our global energy system is changing…and so is our money

China is a heavyweight when it comes to renewable energy…but also oil.

And a few years back, the Shanghai International Energy Exchange launched a yuan-denominated oil futures contract.

Having commodities priced in yuan gives China more pricing power. But it also gives the country more influence on exporting countries that depend on commodity exports.

In a way, that’s how the US dollar became dominant.

In 1973, the US negotiated a deal with Saudi Arabia that marked the beginning of the petrodollar. Since then, global oil trade is mostly conducted in US dollars.

Any country that wants to buy oil needs to exchange its currency for US dollars first. This makes the US dollar the world’s currency for commodities, particularly oil.

And it strengthened the US dollar by increasing its demand around the world.

So, the fact that China wants the Yuan to become more prominent in international trade is a big deal.

The de-dollarisation of the world economy is a clear trend happening as we speak.

It may not happen overnight…but it looks like some countries are already preparing.

As I mentioned last week, central banks have been buying huge amounts of gold in recent years to diversify their assets from the US dollar.

And there’s been a lot of talk that the BRICS (Brazil, Russia, India, China and South Africa) could be developing a joint currency.

My colleague Brian Chu thinks that countries looking for alternatives to the US dollar bring ‘a huge opportunity’ for Australian investors today.

It’s why he’s created a game plan.

You can hear more about Brian’s plan of action here.

Best,

|

Selva Freigedo,

Editor, Fat Tail Commodities

Comments