It’s an equation for forward-thinking investors.

In the last 24 hours, Trump made a speech before the UN.

This was followed less than an hour later by a speech from China’s Xi Jinping.

Trump threw some barbs China’s way, and Xi responded by claiming China would be carbon neutral by 2060.

EU negotiators pressured China over the last few months to make a firmer commitment on climate goals.

The EU likely thinks this is a major achievement — but it’s still four decades away.

How the China–US argument on climate change goes

I won’t try and settle the beef between the two countries, but here are two relevant charts from Bloomberg.

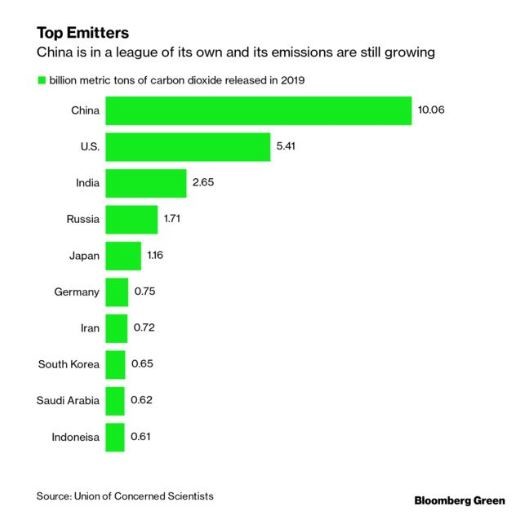

The first is CO2 emissions from 2019:

|

|

| Source: Bloomberg |

You can see China released almost double what the US did last year.

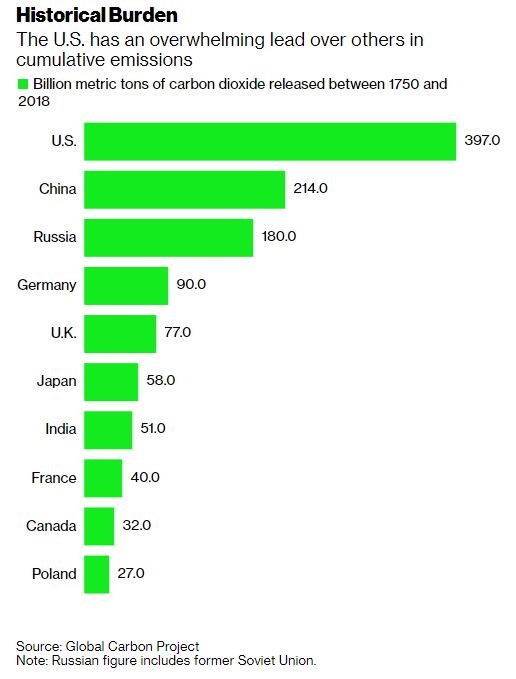

The second is CO2 emissions from 1750 through to 2018:

|

|

| Source: Bloomberg |

This is how the bickering between the countries goes:

US: You clearly don’t care China; you are blowing us out of the water on emissions.

China: But you did it first, and far more of it!

US: But we didn’t know it was bad! How were we meant to stop the industrial revolution in the early 1800s if we didn’t know?

China: We have a right to develop too you know, and we will do so as we see fit!

US: Grrrrrr

China: Grrrrrr

It goes around in circles like this, unfortunately.

I’d also note that even if China itself moves away from coal, it indirectly supports it through its Belt and Road initiative.

For instance, coal-fired power generation in Pakistan rose some 57% last fiscal year due in large part to Chinese investments.

Here’s how you could profit from China–US bickering on climate change

Europe is clearly leading the charge on greening their economy, but if China follows suit then you can expect a significant uplift in demand for battery metals.

EVs are the natural endpoint for these metals.

Tesla’s Battery Day is underway, and Elon Musk was quoted as saying:

‘We don’t have an affordable car. That’s something we will have in the future. But we’ve got to get the cost of batteries down.’

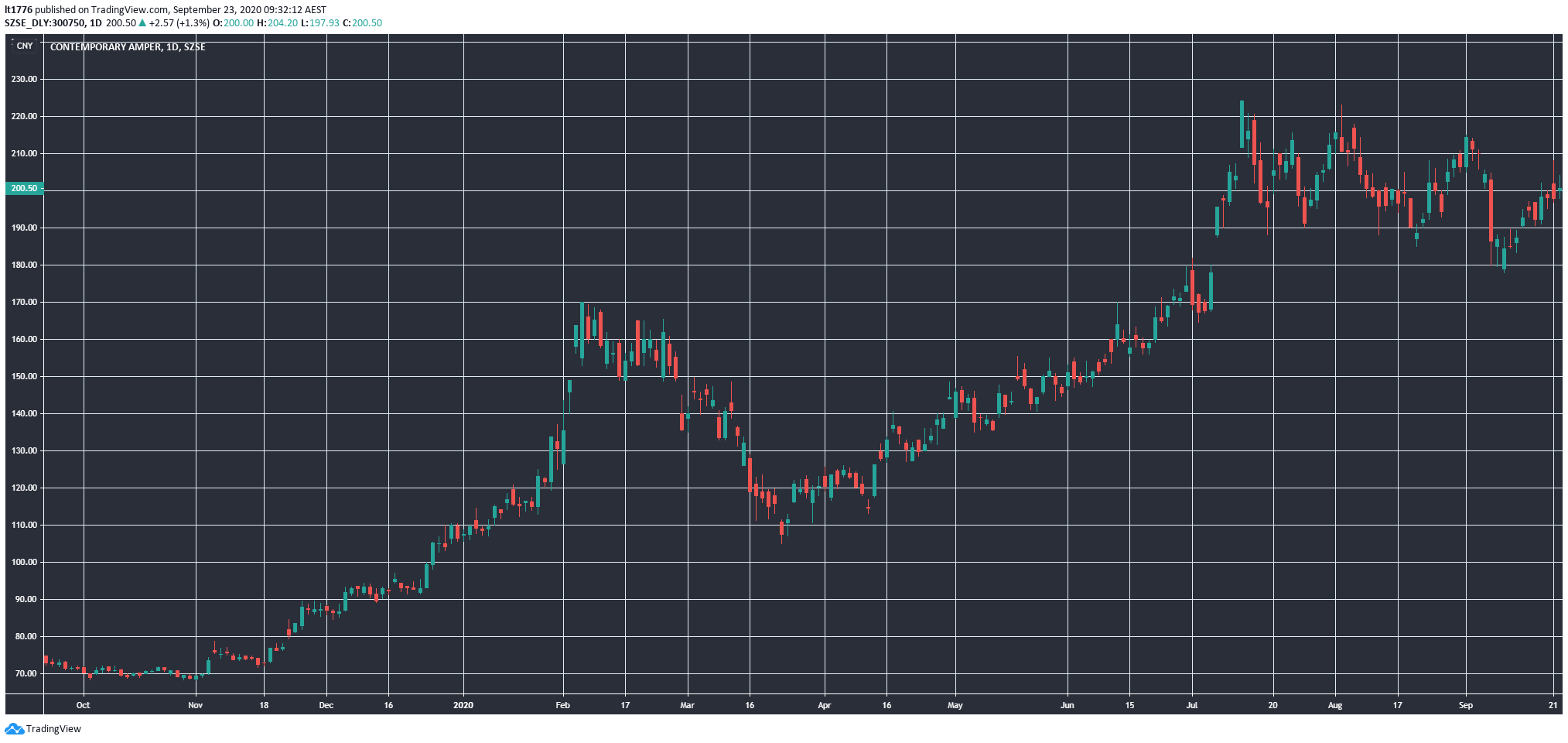

Check out the chart for Contemporary Amperex Technology Co Ltd [SZSE:300750]:

|

|

| Source: Tradingview.com |

CATL as its known in the battery world, is now an absolute giant.

They supply batteries to Tesla Inc [NASDAQ:TSLA] and other major automakers.

But don’t forget about the batteries necessary to store grid power as well.

For instance in Australia, the Genex Power Ltd [ASX:GNX] share price got a lift yesterday on a licence for their Queensland project.

Though their project is tiny when compared to this project profiled on RenewEconomy:

‘French renewable energy developer Neoen has filed its development application for the huge $3 billion Goyder South wind, solar and storage project in South Australia which includes a proposed big battery than it nearly 10 times bigger than the expanded “Tesla big battery” at Hornsdale.

‘The plan proposes a total of 1,200MW of wind energy, 600MW of solar PV, and 900MW/1800MWh of battery storage, an “extremely large” battery as Neoen describes it that will dwarf the 150MW/194MWh “Tesla” battery known officially as the Hornsdale Power Reserve.

‘Each stage would be delivered in three equal tranches of 400MW wind, 200MW solar and 300MW/600MWh of battery storage. Combined, they would generate around 4.8 terawatt hours of zero emissions power each year, nearly doubling the current output of wind and solar in the state, and taking South Australia close to the Liberal government’s net 100 per cent renewables target just on its own.’

It’s not just South Australia and Queensland that are getting big battery energy storage systems (BESS).

Victoria is getting one as well, as per PV Magazine:

‘The Australian city of Geelong, Victoria, has unveiled plans for a AUD 300 million ($185.5 million) battery system. French renewables developer Neoen submitted the application for a planning permit for the project, which has dubbed the “Victoria big battery.”

‘The 600 MW battery storage facility will provide fast frequency response services to the National Electricity Market (NEM)…

‘The Victoria big battery joins the ranks of numerous other grid-scale battery storage proposals across Australia, which are ushering in the next phase in the modernization of the country’s electricity network.’

Given these big projects, as an investor, it doesn’t matter whether you think renewables make sense or not.

The fact is, it’s happening, and it could be immensely profitable.

These resources are primed to benefit from the green push

The materials that go into these batteries are luckily found in great quantities in Australia’s fertile land.

This includes but is not limited to:

- Copper

- Cobalt (which has a projected increase in CAGR of 10% over the next two years)

- Nickel

- Lithium (of course)

- Even vanadium (which is often forgotten about)

The demand for these kinds of commodities driven by tech is part of our ‘Supercell’ thesis.

You can read all about that in this special report.

And no matter which way you look at it though, ASX resource companies are looking incredibly enticing given the green push discussed at the start.

China and the US sparring over climate goals could be the beginning of a huge uptick in demand for certain Aussie resources.

It’s all part of the equation.

Regards,

|

Lachlann Tierney,

For Money Morning

Comments