In today’s Money Morning…extending your vision further down the track…minister becomes Twitter troll and these companies tumble…consequences of consequences…and more…

It’s something I am thinking deeply about at the moment.

Namely, what comes after the China/Australia schism we are seeing unfold before our eyes?

The immediate consequence is that we may see more tariffs and trade barriers erected as both sides seek retribution.

But the consequence of that consequence? I.e. the ‘second-order’ effect?

This is the real question.

Remember, thinking about second-order effects is not forecasting or anything like that.

It’s about extending your vision further down the track to identify the investment opportunities that others aren’t seeing.

This is how you get a leg up in a financial system that is pitted against your interests.

So, I’ll lay out what I think the real story behind this China/Australia conflict is in just a moment.

A bit of background is necessary first though.

You see, I’ve long held the view that China and the growth of their middle class was a sort of inexorable trend that would throw up great investment opportunities for Aussie investors.

In fact, it’s a theme in our Exponential Stock Investor service.

For the first time though, I’m having doubts.

Looking back a couple of months ago, I’ll readily admit I thought it was just bluster between the two sides — driven in part by the Trump administration’s hard-line stance.

And of course, our strategic alliance.

Now luckily, our picks in this area aren’t solely focused on China.

We have a fair bit of diversification in there.

However, it’s still a big risk and a risk we’re starting to take seriously.

Let’s take a quick look at why China and Australia have beef…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Minister becomes Twitter troll and these companies tumble

In this age of 280-character ‘new politics’ diplomacy, the China/Australia beef was naturally rekindled with a tweet.

From the Australian Financial Review:

‘Scott Morrison has appealed to China to reset the bilateral relationship after the Prime Minister condemned its Foreign Ministry for sharing a “repugnant” and fake image slurring Australian soldiers on social media.

‘The Prime Minister demanded the ministry take down and apologise for posting a doctored image of an Australian soldier slitting the throat of an Afghan boy, a reference to the Brereton inquiry into alleged war crimes committed by special forces troops.’

Called out, China then doubled down.

It was a pretty rogue move.

And it’s a shame that our relations are descending into a meme war (a meme is usually a comical image with a caption).

This was serious meme business though, many companies with exposure to China took a steep fall.

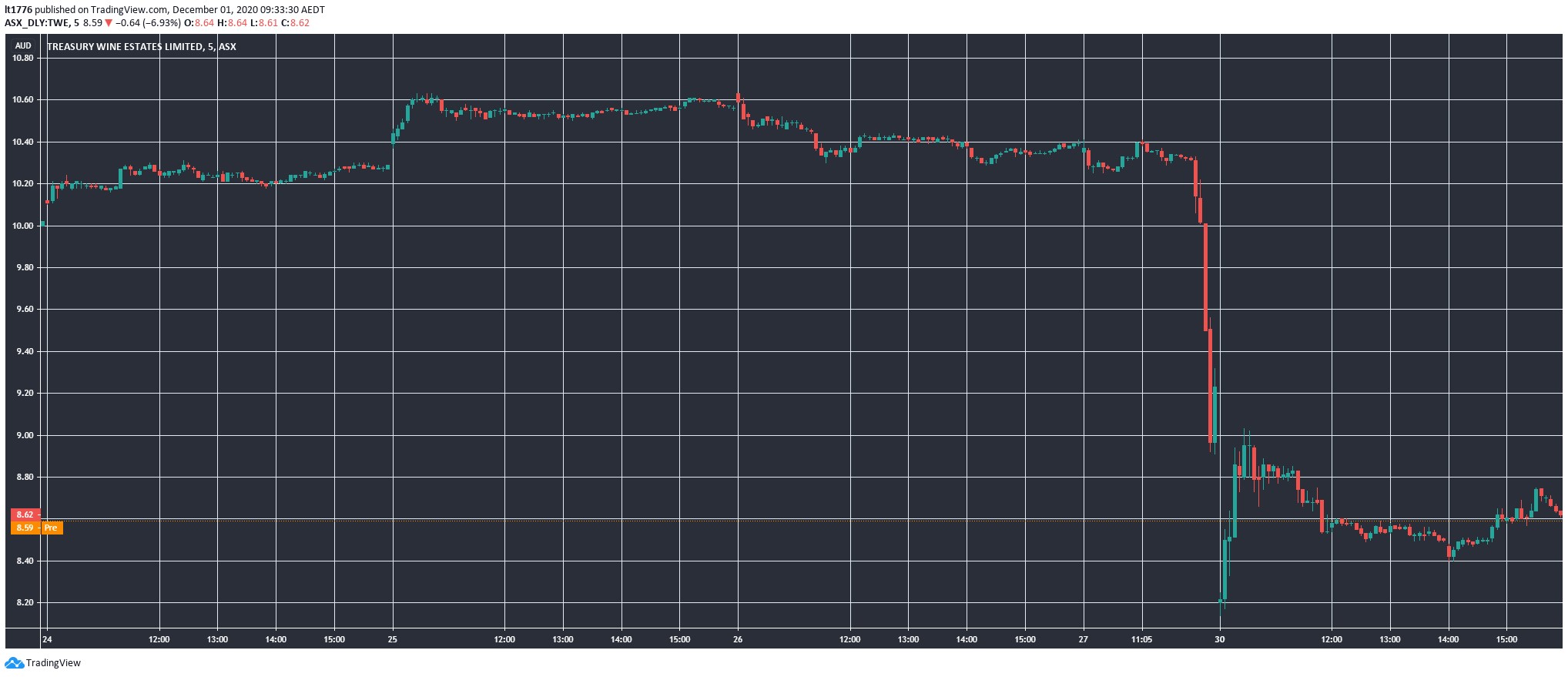

For instance, here’s the chart for Treasury Wine Estates Ltd [ASX:TWE] from the last five days:

|

|

| Source: Tradingview.com |

The TWE share price went off a cliff as you would expect, given their reliance on China sales.

In many ways, TWE is the ultimate play on the Chinese middle class, such is their penchant for our wine.

Also, iron ore heavyweights like BHP Group Ltd [ASX:BHP], Fortescue Metals Group Ltd [ASX:FMG], and Rio Tinto Ltd [ASX:RIO] all took a tumble as well.

Evidence of the market pricing in the risk of an iron ore supply chain shift.

Which leads me to where I think all of this is going.

Consequences of consequences

In a nutshell, if the first consequence of souring relations (via Twitter) is a tumble down the charts for companies with China exposure, then the second consequence is that certain resource companies may become a clever contrarian play.

As in, the old saying about being greedy when others are fearful and fearful when others are greedy.

I’m less interested in large-cap ASX-listed resource companies and more interested in the smaller, more speculative companies.

The kind of companies that might sell down on China headlines but could still be swept along by an even greater force.

Namely, the use of commodities as an inflation hedge, the push towards renewables, and most importantly — what comes after that.

I’m talking about the tech metals, industrial processes (actually super exciting), and technology that could drive us towards a clean energy future.

Regardless of what China does!

Keep your eyes peeled for our latest big idea, called ‘Australia’s Clean Energy Second Order’.

If you feel like you’ve missed the boat on renewables, this is your second chance to invest in what comes after the mad rush towards things like solar and EVs.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.

Comments