In a physical war, the key to defeating your enemy is to force them into a disadvantaged position.

It’s the same when nations fight a financial war.

For more than five decades, Western central banks dominated the financial system with their fiat currencies backed by the petrodollar.

The US dollar was the frontman in this system, acting as the reserve currency as nations agreed to trade the greenback for crude oil.

Gold took the backseat in the financial system, tied up and held as a ‘barbarous relic’. Bankers, financiers, and academics declared gold’s role as money a thing of the past, relegating it to just another currency.

The modern financial system was going to be glorious. Countries no longer needed to worry about monitoring their budget spending. Deficits could continue as long as the country finds a lender or taxpayers to foot the bill. And if you can’t, just sell some assets or take a loan from the International Monetary Fund (IMF). Or invade another country if you’re powerful enough.

You don’t need to worry too much about your gold reserves. Let it sit there and shimmer.

Everyone knows there’s a drastic price to pay for not playing along with this game. Take a look at what happened to Iraq and Libya, two countries that tried to sell their crude oil for another currency or gold.

Now, as the system celebrates its jubilee, the cracks arising from burgeoning debt, rising prices, and countries quietly sidestepping the system threaten its existence…

Russia’s financial nuclear bomb — a gold-backed ruble

Russia apparently holds the largest nuclear arsenal in the world. Many fear that in a hot war, Russia will adopt a ‘mutually assured destruction’ strategy and blow the Earth out of existence with its nuclear devices.

But there’s no need to worry about that, apparently.

Russia has a better plan and they acted on it by detonating a nuclear device against the fiat currency system last week.

On 28 March, the Russian central bank pegged the ruble to gold by declaring that a gram of gold would cost 5,000 rubles. This equated to around US$1,400 an ounce at the time the central bank made the announcement when the gold price was trading around US$1,940 an ounce.

It seemed strange at the time, since the Russian central bank was offering to buy gold from Russian local banks at a discount to the market price. Why would a local bank be willing to sell gold under that arrangement?

The difference is that the Russian central bank gets to set the currency’s value or interest rate. Therefore, what the Russian central bank actually achieved in this move was to reflate the Russian ruble, which had suffered a massive 35% drop after President Putin sent forces into Ukraine for a special military operation.

This benefits the Russian banks too, as it strengthens their trade position.

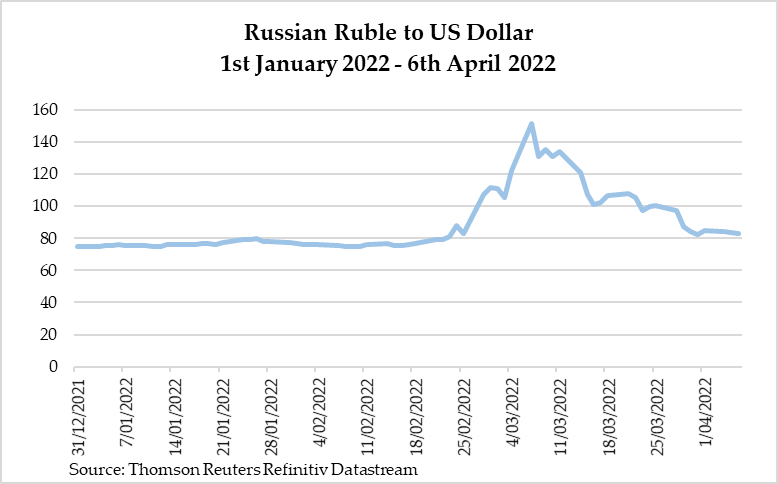

Have a look at the figure below showing the value of the ruble against the US dollar:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

The chart shows that the Russian central bank accomplished its mission.

As to whether Russia can hold this peg will depend on whether the world wants to use rubles for international trade.

President Putin thought this one through by signing a decree last Friday to impose a deadline for countries to open an account with a Russian bank if they wish to buy oil and gas. It’s a very risky play because it could backfire badly on Russia if many countries choose to buy oil and gas elsewhere.

Or it could end up in Russia’s favour.

Should this move succeed, it could drive a stake through the heart of the fiat currency system.

Especially given what the global economy is like right now.

Debt drowns the fiat currency system in the quicksand of inflation

Debt is a double-edged sword.

The central banks had tried to master debt for many decades. They seemed to have succeeded when they discovered inflation targeting whereby they would set the interest rate to keep inflation at a manageable level.

Over time, it began to spin out of control. Government deficits ballooned, corporations and households made the wrong investment decisions, and the markets tanked as bubbles burst. The central banks came to the rescue with more currency creation (via debt) to reflate the markets.

However, rising prices may not always be a good thing for the fiat currency system. This is because inflation causes the purchasing power to fall.

As much as central banks say they fear deflation, that’s not true. Their fiat currency has a greater purchasing power and hence regains its relevance. That’s why central banks raise rates to bring the markets back under control. They’re resetting the fiat currency.

But it’s a delicate process, raise the rates too much or too fast and markets come tumbling down.

Bit by bit, investors are realising this game and seek to cut loose from the system by holding other assets to preserve their wealth. This creates more inflation on the fiat currency, as there’s more fiat currency relative to these assets.

Think of gold, commodities, equity, property, and crypto.

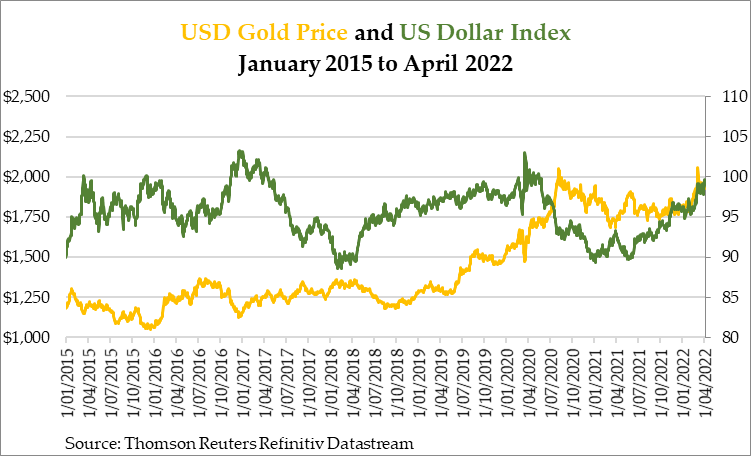

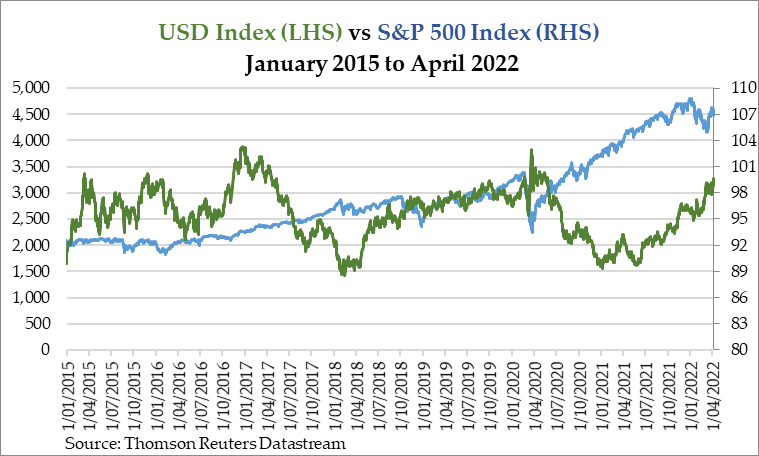

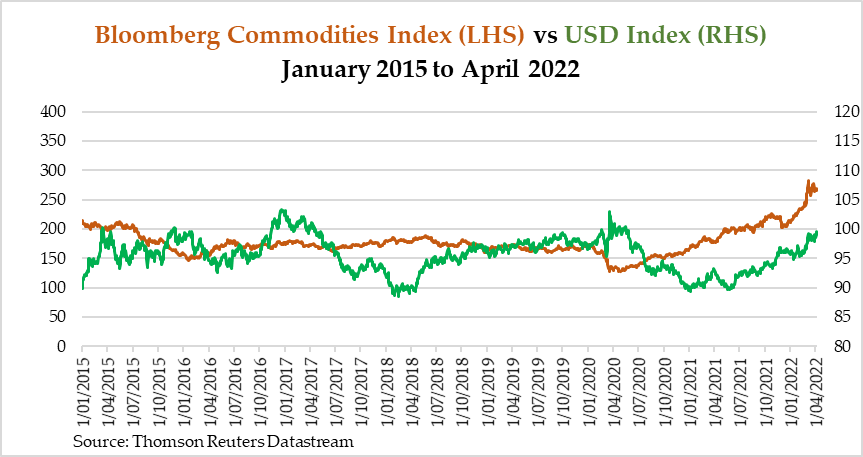

Here are some charts showing how gold, the S&P 500 Index [SPX], and the Bloomberg Commodities Accumulation Index [BCOM] have performed against the US Dollar Index [DXY] since 2015:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

|

|

| Source: Thomson Reuters Refinitiv Datastream |

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Recently, the US Dollar Index has been rising as the Federal Reserve has begun the tightening cycle. However, notice how gold, equities, and commodities are all rising?

The Federal Reserve is aware of this. It knows it is well behind the inflation curve. It’s stuck in the debt and inflation it created.

Therefore, it’s signalling its intention to raise rates at a more aggressive pace going forward.

But what’s different this time is that the Russian ruble is pegged to gold and may be a formidable candidate to be an alternative currency for oil/gas transactions.

So should the Federal Reserve botch the aggressive rate hikes and crash the markets, other countries may run to the gold-backed ruble or simply peg their currency to gold.

What does this all mean?

The fiat currency system appears to be stuck in hostile terrain while its enemy is watching it from a position of advantage.

What I foresee is potential pandemonium in the markets.

Amidst this chaos, gold is clearly the safe refuge. Russia has made a brilliant move in this financial war.

And you have a choice to be a winner or be slaughtered like the fiat currency system.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments