The Cettire Ltd [ASX:CTT] recorded ‘strong trading momentum’ in its latest trading update as gross revenue jumped 184%.

Despite reporting solid growth across key trading metrics, the Cettire share price was nonetheless somewhat flat in afternoon trade, down 2%.

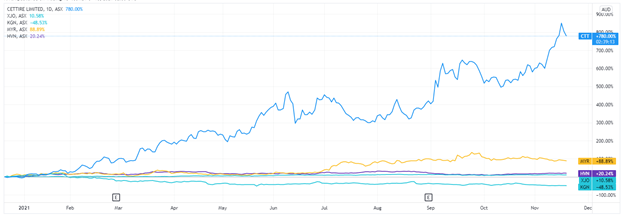

The luxury online retailer has been an ASX bolter of late, notching 780% gains in the last 12 months.

Having listed on the ASX at an IPO price of 50 cents a share in December 2020, the CTT stock is now trading for $4.41 a share, with a market cap of more than $1.68 billion.

Cettire’s trading update — growth in key metrics

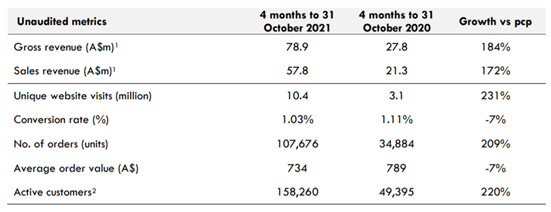

CTT today released results covering the four months to 31 October.

During the period, CTT’s gross revenue rose from $27.8 million to $78.9 million, an increase of 184%.

Sales revenue rose 172% from $21.3 million to $57.8 million.

Why the discrepancy?

Cettire calculates sales revenue as gross revenue net of allowances and returns from customers.

As a percentage of gross revenue, CTT’s sales revenue dropped from 77% in the four months to 31 October 2020 to 73% in the four months to 31 October 2021.

Cettire reported that unique website visits spiked 231% to 10.4 million.

Cettire founder and CEO Dean Mintz also noted that CTT’s October monthly traffic rose 379% year-on-year.

But the increased eyeballs saw a drop in conversion. The conversion rate fell 7% to 1.03%.

The big jump in website visits led to a 209% jump in the number of orders, rising from 34,884 to 107,676.

Active customers rose, too, up 220% from 49,395 to 158,260. Cettire classifies someone an active customer if they made a purchase in the last 12 months.

Maybe as a result of the growing customer base, the average order value fell 7%.

The most recent average order value is now $734, down from $789.

Cettire’s Founder and CEO, Dean Mintz, offered his take on the latest performance figures:

‘As offline stores reopen with COVID-19 restrictions easing, Cettire’s growth trajectory continues unabated with gross revenue up 184%, the number of orders more than tripling and active customers growing very strongly.

‘The focused investment to further enhance Cettire’s solid foundations is delivering results. Having invested in customer acquisition and executed strongly, October monthly traffic increased 379% year-on-year.

‘In addition, we are seeing very positive early signs from the migration to our proprietary storefont, with sales growth in “migrated” markets outpacing the Company.’

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Cettire signs direct brand partnership with Staff International

The trading update coincided with news Cettire signed an agreement with Staff International to integrate products from its licensed brand portfolio into Cettire’s platform.

Staff International is a subsidiary of the international fashion group OTB S.p.A and acts as OTB’s industrial platform for a selection of OTB’s labels such as Maison Margiela, Marni, and Diesel.

Cettire customers will now have direct access to products within Staff International’s portfolio of brands.

In turn, Staff International gets access to CTT’s customer base.

The two companies further said they will work together to offer part of Staff International’s collection exclusively on Cettire’s platform.

Cettire Founder and CEO Dean Mintz said:

‘We are delighted to welcome Staff International’s brands to Cettire’s online luxury platform, marking a continuation of our previously announced direct brand partnerships.

‘Staff International has a reputation for utilizing innovative techniques to push traditional boundaries. Partnering with Cettire enables their products to be directly available to a new and fast-growing digital audience of luxury goods customers.’

As the Australian Financial Review noted, this marks Cettire’s first direct relationship with a brand owner outlined to the public.

Some brands had previously voiced concerns to the Review about products appearing on CTT’s site and coming via third-party suppliers.

But with the growing customer base and website traffic, some brands — like Staff International — may be reassessing the potential of leveraging Cettire’s customers to their advantage.

The surge in CTT’s share price since its IPO highlights the great potential of the small-caps sector.

Unheralded stocks can be rerated by the wider analyst community…and send their share prices flying.

Here at Money Morning, we have two great analyst minds focusing on small-caps — Murray Dawes and Ryan Clarkson-Ledward.

Both Murray and Ryan run the Australian Small-Cap Investigator.

If you’re interested in their latest small-caps research, you can find out more info here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here