Dear Reader,

The 80s were some interesting times for Argentina.

The country was transitioning from a military government to democracy. And, among many of the legacies left over from the old regime, there was a lot of debt…and inflation.

To start afresh, the new government replaced the currency, the Argentinean peso, with a brand-new one: the austral.

To make things easier — and lighter — they slashed three zeros. That is, one austral would equal 1,000 of the old Argentinean pesos.

After the government issued notes in smaller values (1, 5, 10, and 50) the austral started circulating in 1985.

But, let me show you something.

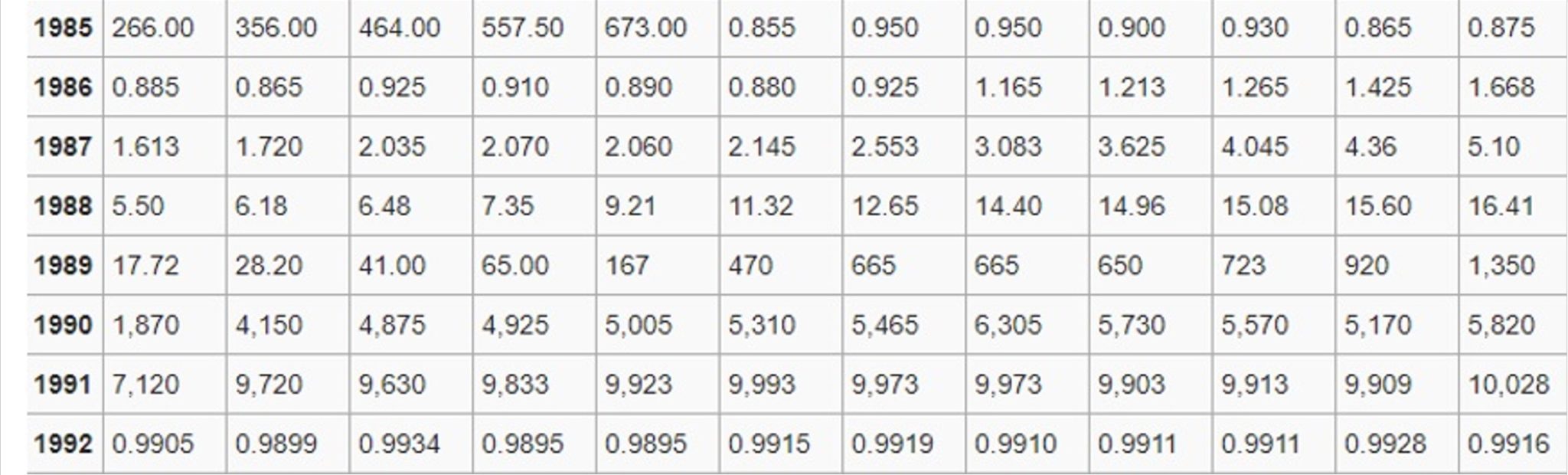

The chart below may look like a bunch of numbers, but it shows something quite interesting. This is the historical exchange rate between the Argentinean austral and the US dollar between 1985 and 1992.

|

|

|

Source: Wikipedia |

If you look at June 1985 you can see the change in currency. You see, before then one US dollar equalled 673 Argentinean pesos. Slashing three zeroes from the new austral meant now that one US dollar equalled about 85 cents of an austral.

Things for the austral worked well, for a while.

If you follow the timeline, you can see that the value held for over a year. But by the end of 1986, things started to get out of control.

[conversion type=”in_post”]

When Inflation Gets Out of Control

What happened then was inflation, or better said, hyperinflation.

The government had started the printing presses to pay off debt and the austral started to devalue against the US dollar.

You see, Argentina has quite an interesting relationship with the US dollar. At the first sign of inflation people flock to the US dollar to keep the value of their money.

It’s a vicious circle. The more people bought US dollars the more the austral devalued.

By 1988, inflation was completely out of control. I was living in Argentina back then and remember prices changing by the hour. The whole thing was crazy. Having no idea what things and your money are worth creates a huge sense of instability.

Soon those small one and five australes turned into 1,000, 5,000, and 10,000 notes. They even had to issue emergency notes in the value of 500,000 australes just to keep the country functioning.

By 1991, one US dollar was the same as 10,028 australes.

In 1992, the austral had lost all credibility so the government decided to get rid of it. After six short years the austral was gone. Replaced (once again) by the peso.

The austral wasn’t the only currency to self-destruct from hyperinflation. It’s likely it won’t be the last either. The German papiermark, the Zimbabwean dollar, even the US continental are some examples of currencies that succumbed from too much money printing.

It’s a basic economic law, the more money there is available, the less it’s worth.

Anyway, last week the US Federal Reserve had their annual meeting at Jackson Hole and as I wrote last week, the Fed tipped they would be making a major announcement on their inflation policy on Thursday night.

So they did…

Without much fanfare, the Fed said they will be keeping interest rates at near zero while allowing inflation to run higher than their 2% inflation target. This should make paying high debt easier.

The argument is that for some time now the Fed has been missing their 2% inflation target so they can make up for all that time they’ve missed having inflation running lower than the target.

The Fed may think they have a handle on inflation, but controlling inflation isn’t easy to do.

It’s always high debt and money printing that gets you in trouble.

And on that note, let me show you something else.

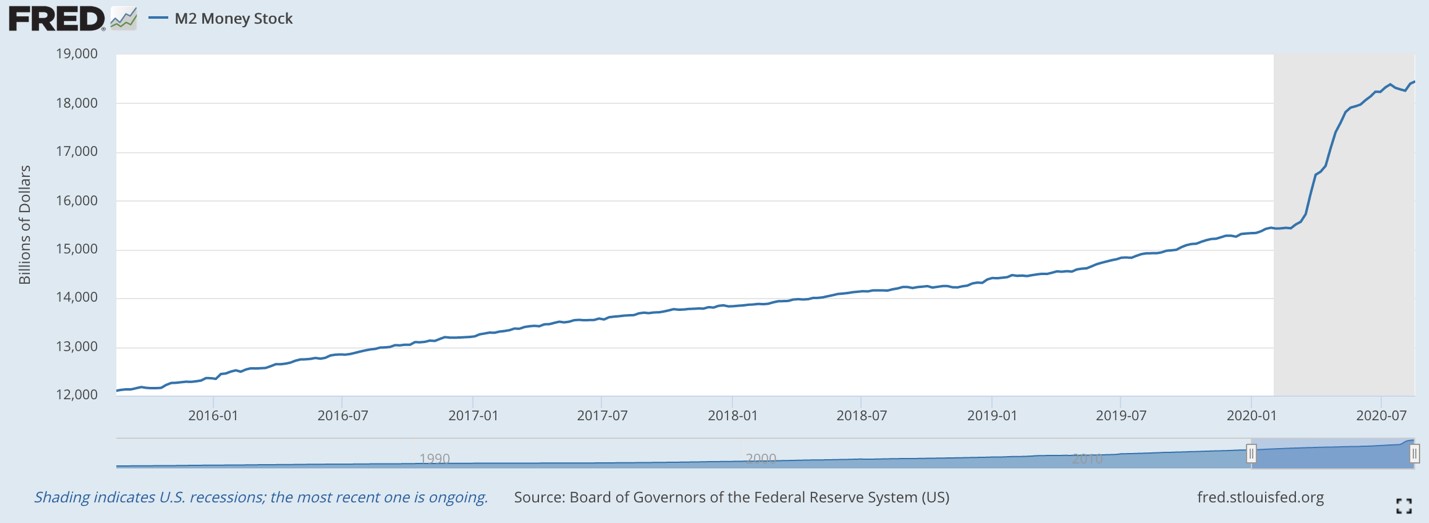

The chart below shows the US money supply in circulation for the last year along checking and savings accounts (with less than US$100,000) in banks and money market mutual funds.

|

|

|

Source: US FRED |

Money supply has shot up since the pandemic. It’s now at US$18.45 trillion. Only a year ago that amount was US$14.9 trillion. That’s a whopping 23.8% increase in only one year.

So far money velocity is staying low, people aren’t spending.

Our system is all based on confidence and this is an avalanche waiting for a trigger.

I’m not sure if we’ll see hyperinflation there yet.

The US dollar is a safe haven, widely used around the world and there’s not much of a replacement out there.

But as I said, the US dollar is where everyone in Argentina flew to for safety. It’ll be interesting if these policies erode that safe haven view.

It’s not surprising that the US dollar fell after the Fed’s speech though. And that the US dollar is already devaluing against gold.

Best,

|

Selva Freigedo,

For The Daily Reckoning Australia

PS: Aussie Gold Miner Stocks: Free report reveals why Australia is set to become the next ‘gold epicentre’ — which could result in a HUGE spike in Aussie gold stock prices. Click here to learn more.