In today’s Money Morning…the fear of inflation is steadily growing in prevalence…no reaction sets an uneasy tone…no slowdown in earnings…and more…

It has been a very fascinating and peculiar week for markets.

The fear of inflation is steadily growing in prevalence. A narrative that has not only gripped the US but has now also spread to Australia and Europe.

As a result, central banks have been forced to take a stance.

The RBA confirmed this week that it has given up on its somewhat controversial ‘yield curve control’ policy. Conceding that it may need to raise rates by late 2023 — an earlier move than its previous 2024 forecast.

That hasn’t stopped Westpac from jumping the gun, though. The bank has already raised its fixed interest mortgage rate for a second time in under a month. And the other big banks may follow suit not long after.

Meanwhile, over in the US, the Fed finally pulled the ripcord on its taper talk, confirming that tapering will begin later this month. A decision that historically leads to a ‘taper tantrum’ from markets.

But that hasn’t happened at all.

Quite the opposite in fact. Both the NASDAQ and S&P 500 hit fresh all-time highs overnight.

So what the hell is going on?

No reaction sets an uneasy tone

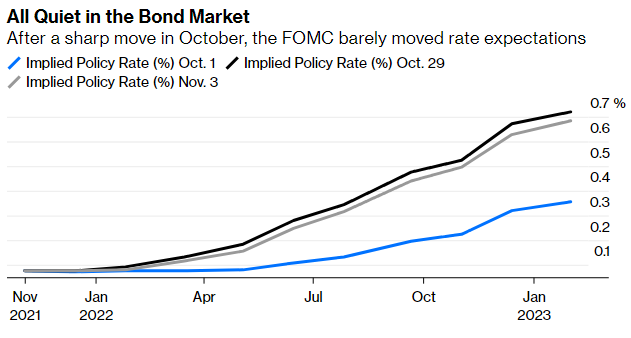

The reason this is all so surprising is because bringing an end to tapering, logically, should see at least some sort of reaction from US bonds. However, we have yet to see that unfold.

As John Authers shows in a recent Bloomberg article, the bond market is silent:

|

|

|

Source: Bloomberg |

Furthermore, real yields (which are adjusted for inflation) haven’t taken off either:

|

|

|

Source: Bloomberg |

So what should you as an investor make of this somewhat bizarre circumstance?

Well, the way I see it, it boils down to two scenarios.

In his article, John Authers points out that the sheer amount of liquidity sloshing around could be a factor. He suggests there is so much excess capital, that it could soak up any possibilities of a taper tantrum. And I agree that this seems like a plausible possibility.

The fact that there is still over US$1.34 trillion sitting in the Fed’s reverse repo facility is pretty indicative of that. It showcases how desperate a lot of excess money is for even the most modest of yields.

However, the other argument that could be made is that the US economy is in such a good spot that investors don’t need to flock to the safety of bonds. A narrative that the Fed itself is clearly trying to get people to buy into.

Surprisingly, though, they may be right…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

No slowdown in earnings

Given the lingering aftereffects of the pandemic, particularly the stubborn supply chain issues, growth seemed like it’d be hard to come by. US stocks, however, are disproving this theory emphatically.

As FactSet data reports, 80.9% of all S&P 500 stocks that have reported earnings so far have beat expectations. Meaning these companies are making more money than most analysts and market experts were expecting.

That is certainly music to the Fed’s ears. It leans into the possibility that things may really not be as bad as the media suggests. After all, if these businesses keep making money, despite the spectre of inflation, then stocks may have room to run a lot higher yet.

Back at home, the situation for local investors is only just starting to come into perspective. Quarterly results for September are finally starting to trickle in, and bar a few outliers, it has been mostly positive.

The only big concern to be aware of is the large slump in iron ore. A factor that is already weighing on some of the big miners.

But this is looking likely to be more than offset by gains across battery metal players, as well as a resurgence in oil and gas. Two examples that are helping prop up the ever-turbulent commodities sector.

So does that mean the RBA and Fed have dodged a monetary policy bullet?

Have they pulled off a miracle by saving us not only from a pandemic, but also inflation?

Hardly…

Central bankers have simply had the good fortune of a very unusual two years. A situation where business innovation and adaptation has done most of the heavy lifting.

Because while large parts of the economy — particularly service industries — have suffered, others have picked up the slack. It’s to prop up markets as a whole, even as some individual sectors have fallen by the wayside.

And for that reason, I think the real challenge for the RBA and the Fed is yet to come. Because while markets are jubilant right now, and could be for months or years to come, things look to be changing.

The end of their respective stimulus policies is proof of that. As well as the possibility of earlier than expected rate rises. All of which will have to come to a head eventually.

Luckily, though, if the past two years have proved anything, it is that good businesses will find a way to survive no matter what. Even if the central bankers look to be fighting against all reason more often than not.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here