Central bankers are scrambling to their monetary policy toolkits right now. This comes as they see inflation for much longer than they predicted a few months ago.

Initially, Aussie central bankers talked about cutting the supply of credit and potentially raising the interest rate in 2024.

Other central banks changed tone and said maybe they would move a little faster.

The Reserve Bank of New Zealand (RBNZ) moved first on 6 October 2021 by raising the interest rate from 0.25% to 0.5%.

Meanwhile, the US Federal Reserve revealed yesterday that they will begin to reduce their supply of credit by buying less mortgage-backed securities.

Big deal.

You can sense there’s nothing they can do that can fix this situation.

Society is falling apart fast from the ravages of the Wuhan virus and bad politics. Their last-ditch efforts to ‘fix the economy’ could achieve the opposite, and in fact bring on a societal crisis.

Is inflation here to stay?

Last Wednesday, the Australian Bureau of Statistics released their latest data on the Consumer Price Index (CPI). This data officially reflects the changes in price levels for various goods and services around the nation.

The September quarter saw the overall CPI rise by 2.91%, a slightly lower rate of inflation compared to the June quarter of 4.1%.

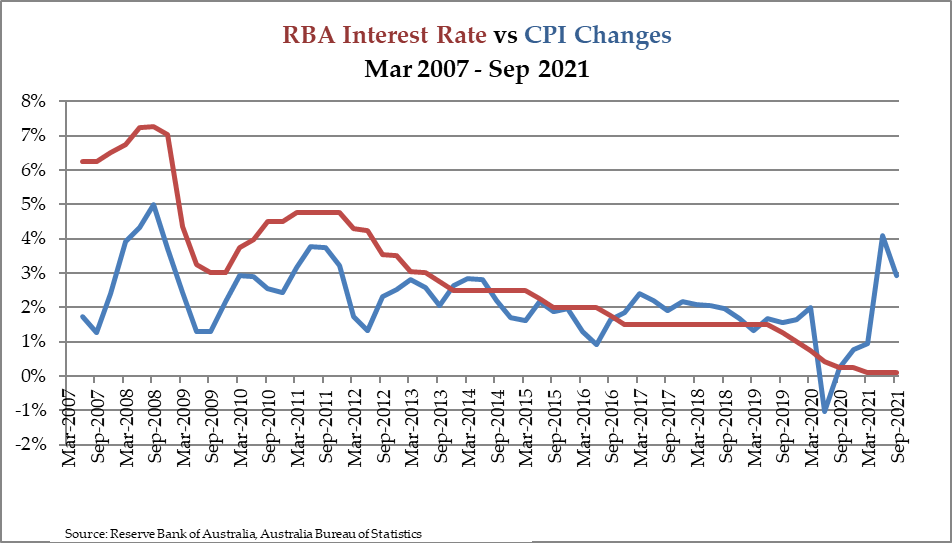

The graph below shows the CPI increase for each quarter compared to the RBA 24-hour cash rate from March 2007:

|

|

|

Source: RBA |

As you can see, the RBA has cut interest rates over the last 10 years. Since late 2016, interest rates have been less than the rate of inflation. Bank savings and deposit accounts pay virtually no interest, let alone help savers stay above inflation.

Mind you, these are official inflation rates. You may recall an article I wrote a few months ago where I explained how these official rates don’t reflect reality. They play with definitions and massage the data to give us the feeling that things are fine.

The jump in the inflation rate since the fourth quarter of 2020 suggests the RBA has been caught on the backfoot. If they’re that behind with official statistics, imagine how bad things really are.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Modern-day France in 1788?

This stagflation is clearly an economic blunder.

Worse still, politicians, health officials, and the mainstream media throw petrol on this dumpster fire.

Switch on the news and you’ll get a daily serving of government officials and experts acting in a way that will leave you speechless.

Take White House press secretary Jen Psaki talking about how the supply chain crisis is only problematic to households because they have to wait longer for the treadmill they ordered.

Or US Treasury secretary Janet Yellen saying that the way out of inflation is consumers spending more.

The insanity is no different here in Australia.

We hear terrifying threats from our prime minister, premiers, and health officials, who are urging people to get the vaccine or risk losing their jobs. Gone is the carrot-dangling of being vaccinated so you can dine out, resume flying on a plane, or go to the pub.

Meanwhile, video clips floating around social media show these same people flouting their own directives. There are clips of G20 summit leaders and White House press reporters only putting on masks when on camera and taking them off as soon as the cameras switched off (but caught seconds before this happened).

Or what about Queensland Premier Annastacia Palaszczuk, who locked down the state for months and refused entry for emergency treatment or seeing off dying family members? She then had the audacity to fly to Tokyo for the bid to host the 2032 Olympic Games.

There’s more…but you get the idea.

You can sense the ruling class and policymakers are like Marie Antoinette in the French Revolution. Their hypocrisy and contempt for the people make poor Queen Marie look like a spoilt brat who just deserved a good smacking instead of the guillotine.

Society braces for an un-merry Christmas

As the year draws to an end, many hope for a respite by the time Christmas arrives.

Many seek the economy reopening, border restrictions lifting, and life returning to normal.

However, we’re facing challenging times ahead.

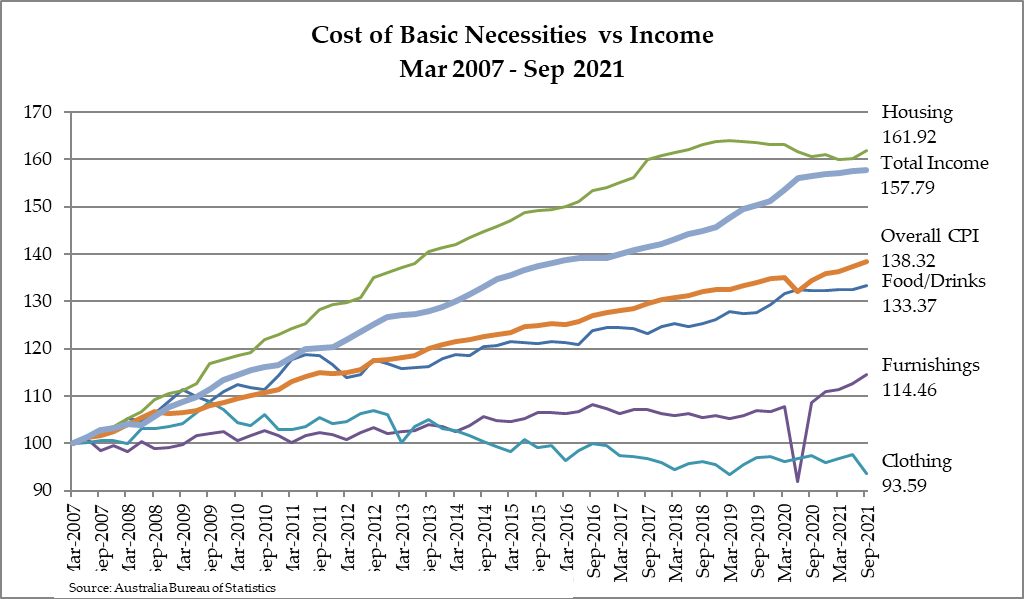

Look at this graph showing trends in the costs of essentials, based on official data:

|

|

|

Source: ABS |

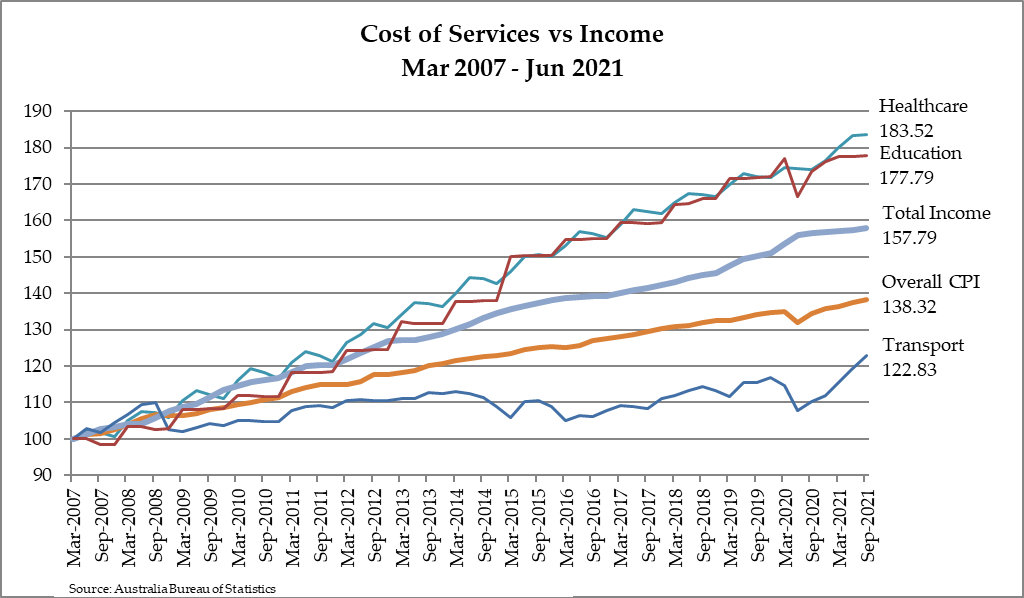

Or the cost of services:

|

|

|

Source: ABS |

These graphs sharply understate the reality — where we’re paying almost $40 per kg for sirloin steak (up from $27 per kg six months ago), $1.70 per litre for 91 octane petrol (up from $1.35 per litre) and have many takeaway stores adding $2–3 to a fish and chips order (upping it from $10 per serve).

I can imagine not many households are looking forward to a happy Christmas.

However, I hope you’re prepared for the time ahead.

Have your preferred hedge against inflation (I like mine in the form of precious metals), some assets with growth potential (gold mining stocks for me), and a prayer of protection.

And given it is Guy Fawkes Day, let’s hope the ruling class knows their own vulnerability in the face of our increasing dissatisfaction.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.