At time of writing Cedar Woods Properties Ltd [ASX:CWP] is up marginally by 0.47% to trade at $6.80.

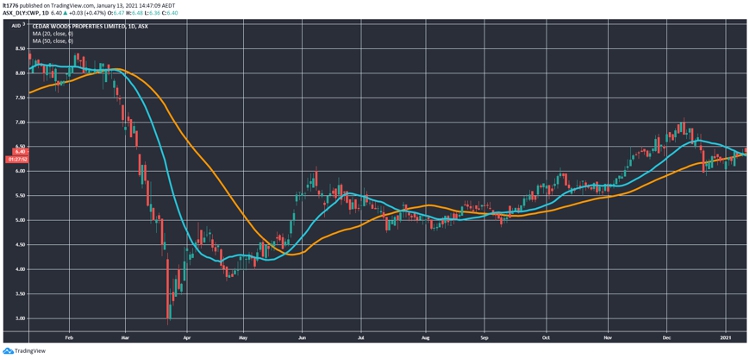

You can see the CWP share price building some momentum in the chart below:

Source: tradingview.com

Is this a sign that the Aussie property market is much healthier than people think? We look at the outlook for the CWP share price.

CWP share price up on acquisition in Melbourne’s north

Here are the key points from today’s announcement:

- The acquisition is a ‘7 hectare site in Melbourne’s north, immediately adjacent to the Company’s existing Mason Quarter project in Wollert’

- ‘The additional land was purchased for $30 million from a private land owner, with payment deferred until 2022. Cedar Woods expects this additional Wollert landholding to contribute to earnings by FY23’

- Which will ‘accommodate a masterplanned community of around 800 lots plus two school sites’

So, a sizeable outlay that is expected to contribute to earnings in a couple of years.

I think this is an excellent example of how the Australian property market is actually in a decent state after a prolonged lockdown.

Outlook for CWP share price

While there are certainly factors internal to the company that need to be considered, many outlets and commenters were bearish on the Australian property market, in particular Melbourne.

There’s the flight to the outer suburbs and regional Victoria to be sure, and vacancy rates are certainly high.

The rental market is also shifting to favour renters more so than landlords — not a complete reversal but there’s definitely been a shift.

But I think if you are looking for a good macro-based outlook for the CWP share price, you need to understand the underlying dynamics of the Australian property cycle.

The government and RBA were always going to plough money into the property market in response to the downturn such is the Australian obsession with property speculation.

You can find out when a serious downturn could materialise in the property market in this excellent free report by real estate expert Catherine Cashmore.

Hint: not anytime soon.

Reading it is a great way to learn how to drown out the noise and fear mongering coming from the major outlets in a level headed way.

Regards,

Lachlann Tierney

For The Daily Reckoning Australia