Commonwealth Bank of Australia [ASX:CBA] now has a BNPL product to compete with Afterpay Ltd [ASX:APT]. We analyse what this means for the CBA share price.

The Commonwealth Bank of Australia [ASX:CBA] share price is down 1.25% today at 3pm after announcing on Wednesday its own ‘buy now, pay later’ offering — CommBank BNPL.

A lot of ink has been spilt on the announcement’s ramifications for BNPL providers.

What does this mean for Afterpay? For Zip Co Ltd [ASX:Z1P]? And for Commonwealth Bank?

What will this mean, if anything, for the CBA share price?

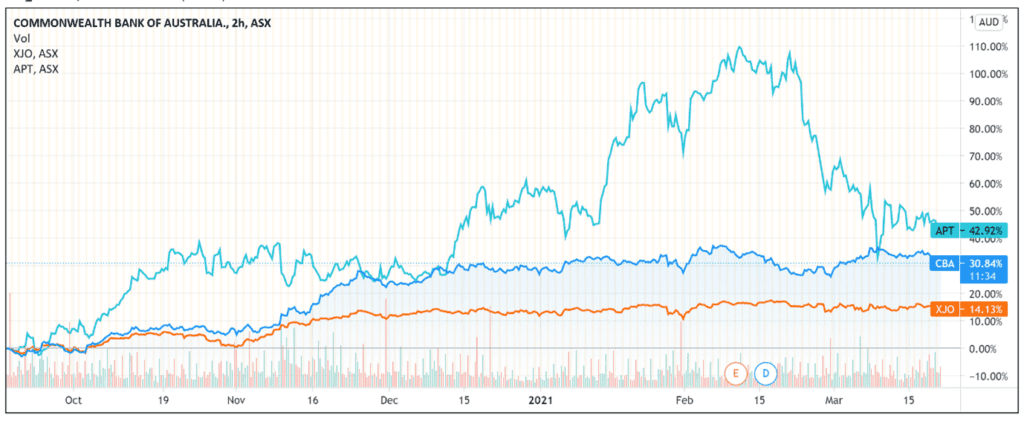

While the bank stock is trading slightly down today, it is up 3.1% YTD and up a healthy 38% over one year.

Source: Tradingview.com

Source: Tradingview.com

CommBank BNPL: merchants versus customers

As I’ve pointed out on Thursday, CBA’s BNPL option costs merchants nothing except their existing merchant services fees.

Speaking to ABC News, UBS analyst Tom Beadle pointed out that ‘with credit interchange [costs] being sub-1 per cent, the merchant fees and overall systemic cost of CBA’s offering are a fraction of APT’s (APT’s merchant fees range from around 3-7 per cent).’

Cost-wise, CommBank BNPL could be the more attractive option for merchants.

But is the BNPL sector a buyer’s market?

That is, can merchants stop offering Afterpay as a purchase order option if a significant chunk of their sales come from users buying only with Afterpay?

As Credit Suisse pointed out in an analyst note, cheaper fees for merchants are of no cost difference to the customer and would likely not prompt a switch to CommBank BNPL:

‘From the merchant’s perspective, CBA’s offering is cheaper, but with Afterpay having 15 per cent of the adult population … merchants probably can’t afford to not offer Afterpay in Australia.

‘And for many merchants, the additional sales that Afterpay brings (which CBA won’t) more than pays for the cost of the service.’

This was referring to Afterpay evolving into a marketplace for retailers.

As T Rowe Price’s Randal Jenneke told Livewire Markets:

‘Why the retailers like Afterpay is because when they think about their sales and marketing efforts, they can grow their business.

‘So the choice becomes, do I want to advertise on mainstream media, social media, or do I want to actually form a relationship with the buy now pay later company like in Afterpay, because they can help drive sales growth to my business?’

CBA, Afterpay, and demographics

Reflecting on CBA’s BNPL move, I had the following question.

Is CBA’s move reactive or proactive?

Hear me out.

Is CBA launching CommBank BNPL because it recognises massive potential in the BNPL space and envisions itself as a market leader?

Or is this a defensive move curbing BNPL providers’ encroachment on bank turf?

According to the Reserve Bank of Australia’s 2020 report on consumer payment behaviour in Australia, Australians are increasingly using debit cards over credit cards.

Importantly, ‘younger people tend to use debit cards the most intensively.’

According to RBA’s research, ‘respondents aged under 40 made around two thirds of their in-person payments with a debit card, compared with 36% for consumers in older age groups.’

This is why, according to ASIC’s 2020 BNPL industry update, the 18–44 age cohort accounted for 83% of all completed BNPL transactions in FY2018–19.

The 18–34 age cohort accounted for 61% of all completed transactions.

Most BNPL customers are young people who are disproportionately turning away from credit cards.

Banks may be desperate to stay relevant to capture this young demographic. CommBank BNPL is one way to lure some of that demographic back.

The idea is then to potentially upsell that young user base into mortgages and CBA’s other financial products.

CBA and BNPL: Is it that big a deal?

Ryan Dinse, whom I work with on the publications Exponential Stock Investor and Small-Cap Momentum Alert, shared his thoughts on CBA’s foray into BNPL:

‘My instinct says this won’t be as big deal as some people think.

‘Although some see this as a threat to BNPL pioneers like Afterpay, in my experience big institutions that try and copy innovation, usually fail to make too much of a dent.

‘There are a few reasons for this…

‘The main two are they don’t have the skillset or internal culture for the constant innovation needed to make new models succeed. As my old soccer coach would say, “they’re looking for where the ball is, not where it will be.”

‘And secondly, they’re making too much money in the short term from the status quo to really embrace disruptive models.

‘It’s a brave executive in a big bank that will willingly cannibalise guaranteed short-term profits in return for (uncertain) long-term ones.’

CBA, bond yields, and CBA share price outlook

CBA’s BNPL announcement received a lukewarm reception.

Investors likely to invest in blue chips like CBA may not care much about BNPL machinations and investors in BNPL providers may not be ready to jump ship just yet.

That said, CBA may do well in the near term with or without CommBank BNPL.

As John Authers argued in Bloomberg, ‘it is hard to bet against a steeper yield curve.’

The Fed will keep rates low for at least another two years and is aiming for a strong economy beyond that.

In Authers’ view, a ‘widening between short and longer-term yields seems almost inevitable.’

Consequently, banking stocks ‘directly benefited by a steeper curve, should continue to fare well.’

Not all BNPL providers are the same. We profile one niche BNPL stock in this free report, as well as two other small-cap fintechs that are still operating with market caps lower than $100 million. Definitely worth a read if these kinds of stocks interest you.

Regards,

Lachlann Tierney,

For Money Morning

Comments