I don’t know about you, but it seems like every time I go to the ABC News website, there’s another story about a young couple who borrowed to buy a house with a cheap, fixed-rate loan.

Now they’re sweating the day when the loan reverts to the higher variable rate. The Reserve Bank of Australia (RBA) screwed them over and the repercussions could be grim.

Investors are sweating too. This could send debts at the banks up, crush consumer spending, and spiral Australia into a recession.

Or will it?

Here’s something I remember. We had a similar fear roll around the housing market before, but with a twist.

Prior to COVID, a similar situation developed where billions of interest-only loans were going to revert to amortising loans. Cue the same mainstream media stories and financial market worries.

What happened?

Nothing…at least as far as crashing the housing market or banks or anything like that. I doubt anyone outside the banking industry even remembers it. Other than me, I suppose.

I distinctly recall chatting to a mate about it at the time. He was a housing investor. He brought it up and asked me if I was worried.

I said no because you rarely have to worry if a story is all over the mainstream media like that, and market players can see the problem coming.

Is this time ‘different’?

Right now, I’d argue no. We have a ‘known’ problem. But I’m not saying the issue isn’t important or relevant…

I was at a birthday party for a one-year-old yesterday.

Her Aunt Janet cornered me at one point and pressed me on what she should do with her mortgage.

Janet and her husband are recent house buyers. Her broker had encouraged them to take out a fixed and variable mortgage, split 80/20 from memory (mostly fixed, in other words).

Naturally, the cost of the variable loan was up in a heavy way.

‘Should I just fix all of it now?’ she wondered.

I’m no interest rate strategist, but right now, the market is pricing in a peak later next year at 3.6%, down from an earlier recent high of 3.9%.

Fixed-rate loans are nowhere near as good a deal as they once were.

My take: take your chance with variable rates. Who knows…maybe the RBA will end up cutting them sooner than expected?

That might not be crazy, by the way. Indeed, it was one scenario in Louis Christopher’s recent ‘Boom and Bust Report’ on housing.

What would need to happen for that to occur?

According to Louis and the team at SQM Research, first, we would need to see a pause in the recent rate hikes, if not now, from next year.

That means inflation needs to be peaking now and start dropping mighty fast. Economic growth comes off the boil, and unemployment ticks up a bit.

Then what?

Louis states:

‘In such a scenario, confidence returns to the housing market and buyers pounce on the falls of 2022. Especially first home buyers and quickly thereafter, investors, wishing to capitalize on the higher yields and tight rental market.’

Is this just wishful thinking?

Notable housing bear of recent times Christopher Joye would probably say so.

In fact, he put it like this in a recent column:

‘So right now there is really no good news on house prices. The pain is set to continue for many more months to come unless the RBA swings 180 degrees and starts cutting interest rates, which nobody expects in the very near-term.’

The RBA can’t be oblivious to the fact Australia has an astonishingly high rate of variable loans, and they are hammering borrowers. It’s not even clear this is appropriate, considering a lot of the current inflation is from external factors.

But Joye may not be correct in saying there is no good news at all.

My colleague Catherine Cashmore is a buyer’s agent and is on the ground every week. Catherine thinks housing is bottoming out now.

Clearance rates are rising. Household income is better than many presuppose.

Also note this comment from the Australian Prudential Regulation Authority, the bank regulator, in its latest update on credit statistics for October (released 30 November):

‘Credit growth continues to remain robust despite monetary policy tightening.’

Admittedly, my bias is to go with Catherine on this. However, my assessment is the stock market agrees with her. I’m watching housing stocks closely to see if they confirm this view in the next month or two.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

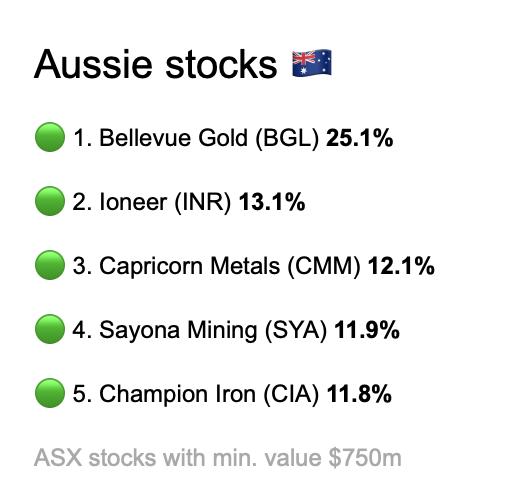

PS: Check out the best stocks on the ASX last week:

| |

Bellevue Gold was the November recommendation for my stock advisory Australian Small-Cap Investigator. At the start of every month, I release my ‘Top Five to Buy’. That went out last week. Check out the service here to grab those ideas…and five more!