Approximately two months ago, I began writing to my subscribers that the lithium market could be approaching an important low.

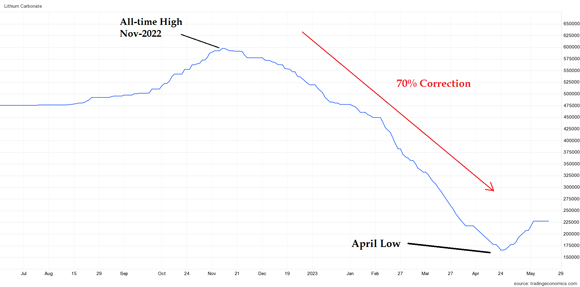

That was on the back of a 70% correction after it peaked in November 2022.

I relayed that message to readers of Fat Tail Commodities earlier this month too. You can read that update here.

That’s why throughout April, our focus for my two services, Diggers and Drillers, and Mining: Phase One, shifted toward buying-up lithium explorers and early producers.

While I believe it’s still early days for this recovery, identifying a low in the lithium sector has positioned us well ahead of returning sentiment.

After bottoming on 23 March, Australia’s lithium-producing giant Pilbara Minerals [ASX:PLS] has recovered by more than 40% in value and is now just 17% off its all-time highs.

IGO [ASX:IGO] bottomed on the same day and has since gained more than 25% in value and is now just 16% shy of its extreme top from late last year.

Some developers have gone one better. Liontown Resources [ASX:LTR] is now trading above its all-time highs — helped in part by a recent takeover bid from US chemical battery giant, Albemarle.

So, with gains like these, you’d expect the price of lithium to be soaring, right?

Well, not quite.

Carbonate spot prices have certainly bounced off their April lows and are now trading around 30% higher. Hydroxide has recovered around 20%.

It signals an emerging recovery, but in relative terms, it’s just a small blip in the overall price collapse that occurred in 2023. See for yourself below…

|

|

| Source: Trading Economics |

That’s why, after a strong rally over recent weeks, I believe lithium stocks could be bracing for a pause or a giving back of the gains that were reaped in the early recovery phase.

We’re already seeing a selling spike this week.

But despite short-term weakness, there’s still plenty of room for lithium to move higher from here.

It’s why I believe, if you are looking at the sector from a long-term perspective, any short-term pull-back from here could offer you an opportunity to add exposure.

But don’t expect the pull-back to last…

With falling lithium prices over the last six months, car manufacturers have been on hiatus or perhaps relieved that price shocks were behind them. Until recently, deals with the miners had dried up.

But the latest lithium surge has exposed major anxiety among car manufacturing executives.

The sharp turn-around has pushed some car companies into a frenzy of supply contracts.

In less than a week, Ford Motor Company has announced THREE major lithium deals.

On Monday, the company announced a deal with Albemarle to supply more than 100,000 metric tons of battery-grade lithium hydroxide for approximately 3 million future Ford EV batteries.

The five-year supply agreement starts in 2026 and continues through 2030.

It also signed deals with Chilean lithium giant, SQM, earlier this week. Ford also secured an 11-year contract with Nemaska Lithium for the supply of lithium hydroxide supplying around 13,000 tonnes per annum.

Vehicle CEO’s turn to mining

In the race to build EVs, manufacturing firms have become far more perceptive to the challenges of supply chains.

Like never before, executives are dealing directly with mining developers to ensure quality projects get over the line and enter production.

It’s why car manufacturers have been prominent participants in global mining forums.

The idea of these executives attending mining conferences would have been comical a decade ago. But today, it’s becoming the norm and perhaps one of the most important events on a CEO’s calendar.

Critical metals are the building blocks that lead to the development of EVs. Without a stable supply of key materials, manufacturing stops and revenue dries up.

But as I’ve highlighted many times in the past, the supply of these key metals looms as an enormous threat.

The mining industry has endured years of underinvestment, declining output, and a lack of new discoveries.

Miners have been sounding the alarm bell for years…

But now it’s the car manufacturers themselves who are calling out the looming shortage. In a recent interview, an executive at General Motors, Tanya Skilton, didn’t mix her words when it came to the impetus to secure supplies of raw materials, ‘We’re absolutely convinced that this is a race, a zero-sum game and resources are a finite limit.’

Skilton also forecasted that the industry will be divided into winners and losers based on which companies will have the minerals to fulfil their ‘electrified dreams’.

Indeed, this will be a race, and only manufacturers who are able to secure the vital raw ingredients will win.

In fact, moving too late on this critical issue could be the eventual undoing of companies that have held multi-decade dominance in the industry.

Surprisingly, one of those could be Toyota [NYSE:TM].

Japan’s largest vehicle manufacturer has been criticised by analysts for its slow EV uptake…meaning it has made relatively little attempt to secure exclusive critical metal supplies.

It’s the reason some believe long-standing CEO, Akio Toyoda, was ousted earlier this year.

Akio has vocally played down the rapid need to move to EV manufacturing, suggesting Western economies should be more cautious in their attempts to cut off traditional energy and transport.

In some regards, I do sympathise with the former CEO…

Securing the vast critical metals needed to eliminate a fleet of combustion vehicles has been undertaken with very little foresight or planning.

It’s setting up a desperate situation for car manufacturers as they embark on a corporate arm wrestle against competitors to secure finite resources.

Despite mining and car manufacturing executives voicing their concerns over critical metal supplies, political leaders continue to demonstrate they are hell-bent on rapidly ending fossil fuel reliance.

Don’t get me wrong — finding alternatives to fossil fuels is absolutely something we need to achieve.

But for some unknown reason, the political elite has tackled one of humanity’s biggest ever challenges with virtually no plan on how we’re supposed to achieve this outcome.

The key stakeholders who are intricately involved in understanding mineral supply have not been involved in net zero discussions.

In fact, several key academics have called into question whether we hold enough raw materials in the ground to make the transition work.

You see, calculating the volume of critical metals needed to eliminate fossil fuels versus what is available (mineral reserves) would be a logical first step in understanding whether we can achieve history’s greatest-ever energy transition.

Yet that was NEVER undertaken.

This is set to be a monumental miscalculation with severe consequences for the global economy.

It’s also highly inflationary.

It will take time to play out, but this is negligence on a colossal scale. The political hierarchy has overlooked this most basic, but fundamental calculation.

Next week I’ll detail the research that uncovers this major misstep. For those of you who are anticipating a smooth energy transition, this data may come as a shock!

But with a looming crisis on the horizon, there is a safe haven — resource stocks.

Until next time,

|

James Cooper,

Editor, Fat Tail Commodities

Comments